The Industrial Products sector is often a good area of the economy to find growth and innovation with these prospects harder to come across amid high inflation.

With that being said, here are two Industrial Products stocks that have soared this year as their growth prospects remain intriguing.

Altair Engineering (ALTR)

Among the Industrial Products sector, Altair Engineering stock stands out sporting a Zacks Rank #1 (Strong Buy) and its Engineering R and D Services Industry in the top 17% of over 250 Zacks industries.

Altair is focused on the development and broad application of simulation technology to synthesize and optimize designs, processes, and decisions for business performance.

Altair’s earnings estimate revisions have continued to trend higher over the last 30 days. Fiscal 2023 EPS estimates have now gone up 12% throughout the quarter with FY24 estimates up 9%. Altair’s earnings are expected to rise 11% this year and jump another 13% in FY24 at $1.12 per share. On the top line, sales are forecasted to be up 8% in FY23 and rise another 6% next year to $654.63 million.

Image Source: Zacks Investment Research

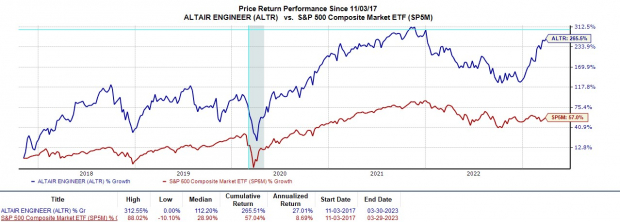

Trading around $70 a share, Altair’s growth in recent years is starting to justify the premium being paid for the stock after going public in 2017. To that point, Altair stock is up a stellar +56% year to date to largely outperform the S&P 500’s +5% and the Engineering/R&D Services Markets +7%.

More impressive, Altair stock has now climbed +265% since its 2017 IPO to crush the benchmark and its Zacks Subindustry’s +53% during this period.

Image Source: Zacks Investment Research

The Manitowoc Company (MTW)

The growth of The Manitowoc Company is intriguing as well. Manitowoc stock also sports a Zacks Rank #1 (Strong Buy) with the Manufacturing-Construction and Mining Industry in the top 7% of all Zacks industries.

Manitowoc is a leading provider of engineered lifting solutions, including lattice-boom cranes and boom trucks. Notably, earnings estimate revisions have soared 66% for FY23 over the last 90 days with FY24 estimates jumping 50%.

Fiscal 2023 earnings are now projected to decline -20% after a very solid year that saw EPS at $1.06 in FY22. However, fiscal 2024 earnings are expected to rebound and grow 35% at $1.14 per share. Sales are forecasted to be up 1% this year and rise another 2% in FY24 to $2.10 billion.

Image Source: Zacks Investment Research

Trading at $16 a share, Manitowoc stock has soared +82% this year to largely outperform the S&P 500 and the Machinery-Construction/Mining Markets -6%. More impressive, over the last three years, Manitowoc stock is now up +96% to easily beat the benchmark and slightly top its Zacks Subindustry’s +92%.

Image Source: Zacks Investment Research

Bottom Line

The rising earnings estimate revisions are a great sign that the strong performances in Altair and Manitowoc stock could continue along with their rapid growth over the last few years. Furthermore, both stocks look like viable investments to consider for 2023 and beyond.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

See Stocks Now

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.