Alibaba BABA has soared over the past two days after announcing a radical transformation into six different companies. The Chinese e-commerce giant is splitting up into six separate business groups: Cloud Intelligence, Cloud Commerce, Local Services, Smart Logistics, Global Digital Commerce, and Digital Media & Entertainment. Each group will have the ability to raise outside funds, operate independently, and potentially go public via initial public offerings.

The company stated that the move is “designed to unlock shareholder value and foster market competitiveness.” Shares surged more than 14% on Tuesday, and are currently up another 1.5% in early trading during Wednesday’s session.

Perhaps uncoincidentally, the news arrived just one day following the return of BABA founder Jack Ma to China after a year-long exile. Ma’s original departure overlapped with Chinese government efforts to crackdown on tech monopolies.

The regulatory environment in China has been a major obstacle for companies over the years. Assertive regulations are very much par for the course for the Chinese economy. Part of this arises from the fact that Chinese industries developed so fast in the last few years that government regulators are often left to catch up. Regulatory frameworks often become out of date as these industries and companies develop, and consequently the regulations themselves have to be changed in a hurry after businesses raced ahead and grew to large sizes.

The most recent regulatory crackdown that targeted Chinese tech companies made sweeping changes to the way these companies operate, including a crackdown on the use of data and antitrust laws. The move included major fines for some of the largest tech players, including a $2.8 billion fine for Alibaba related to anti-competitive business practices.

Over the past few years, there have been talks that Chinese firms would be delisted from U.S. stock exchanges due to a lack of transparency regarding Chinese accounting practices. But last year, American and Chinese regulators reached an agreement to allow accounting firms in China to share more information about the companies listed on U.S. exchanges. The agreement marked a turning point in resolving a major conflict that had originally pointed to a departure of China’s largest companies from domestic exchanges.

It now appears that government officials are reversing course on stringent regulations in order to stimulate the economy. Ma’s return to China has investors pleased amid speculation that Chinese regulators will continue easing up on the overly burdensome policies. Alibaba’s reorganization will likely draw support from Chinese regulators who have been concerned with high levels of concentration in the technology sector. As the Chinese economy opens up following severe Covid restrictions, the future looks bright for Chinese stocks that were decimated in the past few years.

Emerging market valuations are very attractive. In particular, many Chinese companies (and their stocks) were hit hard due to extensive COVID-19 related measures, along with the aforementioned regulatory and technology crackdowns in recent years. This has created great value propositions, with emerging market stocks becoming appealing once again.

Alibaba management stated in a letter to staff that each new division resulting from the reorganization will be run by a separate board of directions and chief executive. Current CEO Daniel Zhang will continue to serve in his role while also heading the cloud intelligence division.

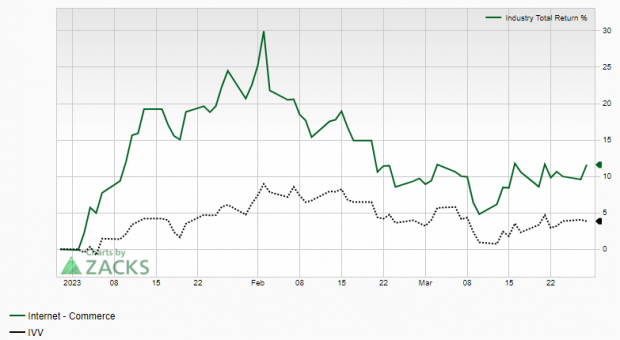

Alibaba is part of the Zacks Internet – Commerce industry group, which ranks in the top 37% out of approximately 250 Zacks Ranked Industries. Historical research studies suggest that about half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

Because this group is ranked in the top half of all Zacks Ranked Industries, we expect it to outperform the market over the next 3 to 6 months. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market.

By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success. This group has widely outperformed the market to kick off the new year:

Image Source: Zacks Investment Research

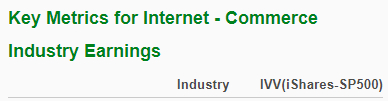

Also note the promising metrics for this industry group below:

Image Source: Zacks Investment Research

Alibaba is ranked favorably by our Zacks Style Scores, with best-possible ‘A’ ratings in each of our Growth and Value categories. This indicates BABA is likely to experience further upside on favorable earnings, sales, and valuation metrics.

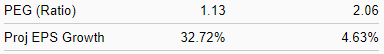

BABA, currently a Zacks Rank #3 (Hold), has surpassed earnings estimates in each of the past four quarters. Alibaba most recently reported fiscal third-quarter earnings back in February of $2.79/share, a 21.83% surprise over the $2.29 Zacks Consensus Estimate. Sales of $35.92 billion also exceeded projections. BABA has delivered a trailing four-quarter average earnings surprise of 16.35%.

Image Source: Zacks Investment Research

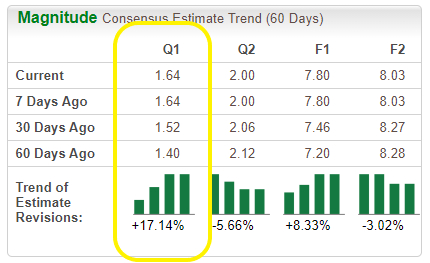

Analysts have been raising earnings estimates for the current quarter as of late. The fiscal Q4 EPS estimate has increased 17.14% over the past 60 days. The Zacks Consensus Estimate now stands at $1.64/share, reflecting potential growth of 31.2% relative to the same quarter in the prior year.

Image Source: Zacks Investment Research

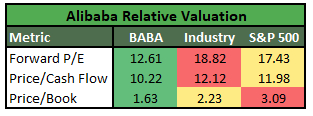

Alibaba stock is also relatively undervalued, irrespective of the metric used:

Image Source: Zacks Investment Research

After surging in January, BABA crashed back down and was lower on the year just a few weeks ago amid wider concerns in the Chinese tech sector. Calls for loosening regulations sparked concerns over a potential price war that would bring down operating margins. But the recent restructuring has BABA investors bullish once again. The stock is currently up 13% year-to-date.

Make sure to keep an eye on BABA shares heading into the Q4 earnings announcement slated for May 25th.

Free Report: Must-See Hydrogen Stocks

Hydrogen fuel cells are already used to provide efficient, ultra-clean energy to buses, ships and even hospitals. This technology is on the verge of a massive breakthrough, one that could make hydrogen a major source of America’s power. It could even totally revolutionize the EV industry.

Zacks has released a special report revealing the 4 stocks experts believe will deliver the biggest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.