Stocks stand to benefit if the Fed eases up on the brakes

Continued concerns about the health of the U.S. banking system and economy have some investors convinced that the Fed would soon end its campaign of inflation-fighting interest rate hikes in an effort to support overall financial conditions.

Expectations about Fed policy have shifted drastically in the wake of Silicon Valley Bank’s collapse, as we recently noted, and the market increasingly thinks we may be close to peak rates for this current cycle.

[wce_code id=192]

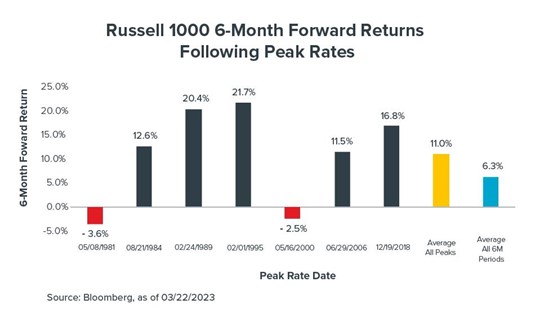

If they’re right, equities could benefit. To see why, consider the Russell 1000 Index’s historical returns during the six-month period after the federal funds rate peaked, going back to 1981 (see the chart).

A few key takeaways:

- Stocks, on average, gained 11% during the six months following the peak federal funds rate.

- Typically, stocks return far less—just 6.3% on average over all six-month periods.

- Stocks’ six-month returns were positive following peak rates during five of the past seven rate cycles.

- The losses were relatively small in the two periods when stocks were negative (-3.6% and -2.5%).

Notably, when the Fed raised the fed funds rate earlier this week, it indicated it expects to increase rates just once more in 2023. Both the Fed and investors now see rates peaking at approximately the same level. Of course, there’s no guarantee that stocks will post gains if the Fed halts its recent rate hikes—particularly if financial conditions worsen significantly or current banking woes turn into a serious crisis.

It’s also unclear whether the Fed will actually dial back on its earlier commitment to “ongoing increases” to combat inflation. Future data on inflation, job growth, and wage growth—all of which have been surprisingly strong so far this year—will likely paint a clearer picture of the Fed’s next steps. As always, we will closely monitor those developments along with the performance of various asset classes.

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The Russell 1000 Index tracks the highest-ranking 1,000 stocks in the Russell 3000 Index. You cannot invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC

For more news, information, and analysis, visit the ETF Strategist Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.