After oil broke below $70 per barrel many energy investors declared the energy bull market over. But that flip to bearish sentiment may have just marked the low price in oil.

After breaking down from a three-month consolidation, oil prices have reversed higher, and are trading back into the range. This is a bullish indication, as the market seemed to immediately find buyers as soon as things were looking down.

Furthermore, OPEC+ has committed to lowering oil production thus cutting supply through the end of the year. The group is meeting again on Friday, where they are expected to reaffirm their stance of reducing oil output.

Using the Zacks Rank, I have identified three stocks with upward trending earnings revisions, indicating near-term bullish expectations. Additionally, all the stocks are in the Refining and Marketing industry which currently ranks in the top 22% of the Zacks Industry Rank.

Image Source: TradingView

Par Pacific

Par Pacific PARR manages and maintains interests in energy and infrastructure businesses. The company’s operating segment consists of refining, retail, and logistics. It also markets and distributes crude oil from the Western United States and Canada to refining hubs in the Midwest, Gulf Coast, East Coast and to Hawaii.

PARR boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Current quarter sales are expected to grow 11.8% to $1.5 billion, while earnings are expected to climb 473% to $1.98 per share.

Sales and earnings expectations for the following few reporting periods are not expected to come in very strong. Next quarter and current year sales and earnings are expecting negative growth.

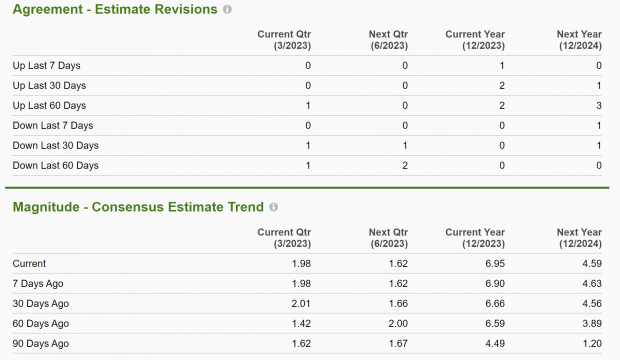

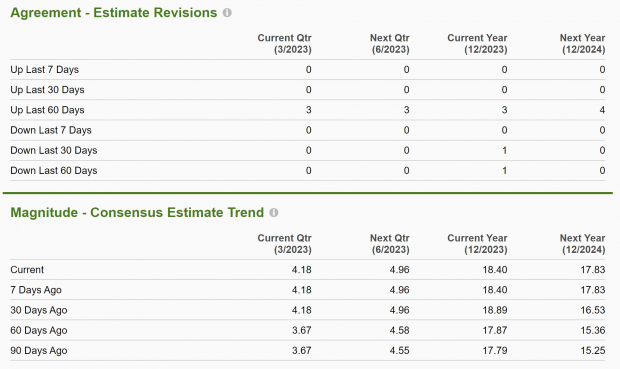

However, as you will see in the other stocks as well, future projection became extremely weak when analysts started to expect a recession. But the economic slowdown hasn’t materialized, and many are now having their earnings revised higher as seen here.

Current quarter and next quarter estimates are a bit mixed, although mostly higher, while current year and next year have had huge upgrades. Over the last 90 days next year earnings have been revised higher by 300%.

Image Source: Zacks Investment Research

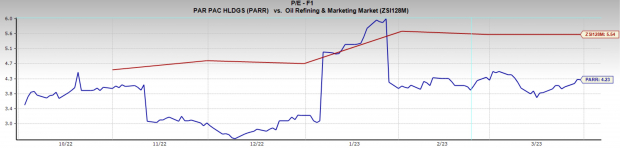

Par Pacific is trading at a one-year forward earnings multiple of 4x, which is considerably below it eight-year median of 15x, and below the industry average 6x.

Image Source: Zacks Investment Research

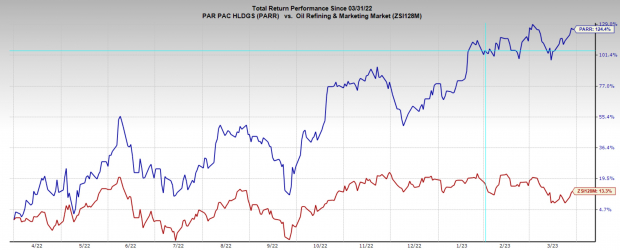

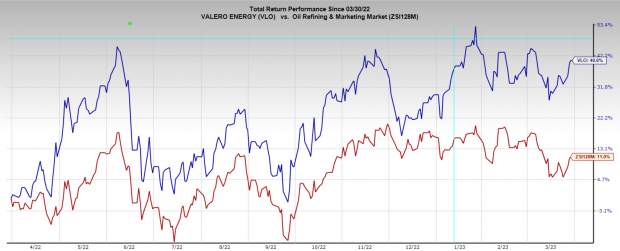

PARR is one of the best performing stocks in its industry. Over the last year it has rallied 124% vs the industry’s 13%.

Image Source: Zacks Investment Research

Murphy USA

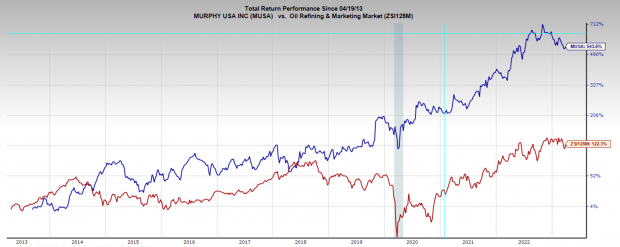

Murphy USA MUSA is a leading retail gas station and convenience store based in the U.S. MUSA was spun out of Murphy Oil Corporation’s downstream business into its own separate publicly traded company in 2013. The company has more than 1,700 retail fuel stations covering 27 states.

Murphy USA stock has been a stellar performer over the last ten years. It more than 5x’d investors’ money over that time and compounded at an annual rate of 21%. Additionally, over the last 12 months the stock is up 26%, outperforming the industry and broad market.

MUSA is a Zacks Rank #2 (Buy) stock, indicating upward trending earnings revisions.

Image Source: Zacks Investment Research

MUSA, like PARR, is expecting reduced growth in sales and earnings over the next few reporting periods. But earnings expectations are on the rise. Analysts are in near unanimous agreement in upgrading earnings expectations across all time frames. Over the last 60 days, current quarter earnings estimates have been revised higher by 14%.

Image Source: Zacks Investment Research

Murphy USA is trading at a one-year forward earnings multiple of 14x, which is below its five-year median of 16x and above the industry average 6x. It is worth noting that MUSA has spent the majority of its history trading at a premium to the industry, reflecting its quality as a brand.

Image Source: Zacks Investment Research

Valero Energy

Valero Energy VLO is a deeply diversified oil refinery company with 15 plants across the U.S., Canada, and the Caribbean and capacity to refine 3.2 million barrels a day. The majority of VLO’s refinery plants are located in the Gulf Coast with easy access to export facilities, boosting margins. Last quarter Valero reported strong fourth-quarter results with a 13% upside surprise on EPS.

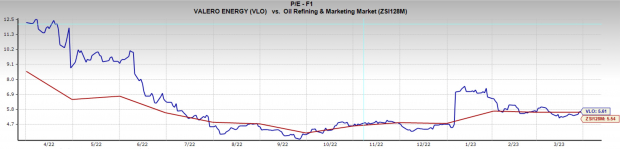

VLO stock has been a very strong performer over the last year. The stock has quadrupled the returns of its respective industry and trounced the returns of the broad market.

Image Source: Zacks Investment Research

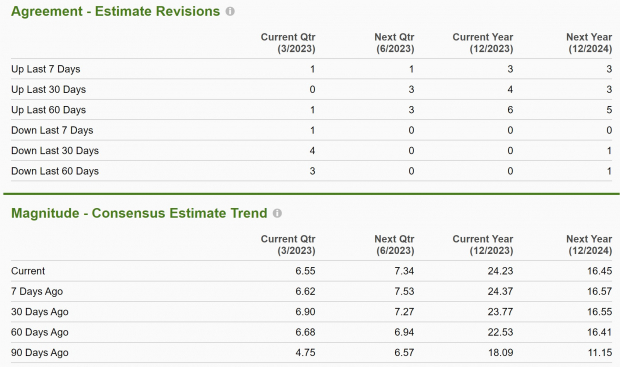

Valero Energy earns a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Current quarter earnings are expected to climb 186% YoY to $6.62 per share, while current quarter sales are expected to drop -13% to $33.5 billion.

Although there have been some slight revisions lower in the current quarter recently, earnings have still been revised considerably higher over the last three months. Furthermore, all other earnings periods have been revised considerably higher, with current year earnings being upgraded by 36%.

Image Source: Zacks Investment Research

VLO is trading at a very reasonable 6x one-year forward earnings, which is in line with the industry and well below its five-year median of 13x. VLO also offers a dividend yield of 3.2%, which has been raised by an average of 4.8% annually over the last five years.

Image Source: Zacks Investment Research

Conclusion

As we can see there are several very appealing stocks in the energy sector at the moment. Because of the widely forecasted recession many oil companies had their sales and earnings expectations cut significantly. The thing is, the recession hasn’t come, and now analysts are raising expectations again. This, along with the OPEC+ supply cuts leaves the energy sector with bullish catalysts on the horizon.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

See Stocks Now

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.