Retail investors bought the dip in banking shares whilst ditching airlines and autos in the first quarter of 2023, according to the latest quarterly stocks data from social trading and investing platform eToro.

Retail investors also benefited from their continued loyalty to big tech, with the sector staging a partial recovery in 2023.

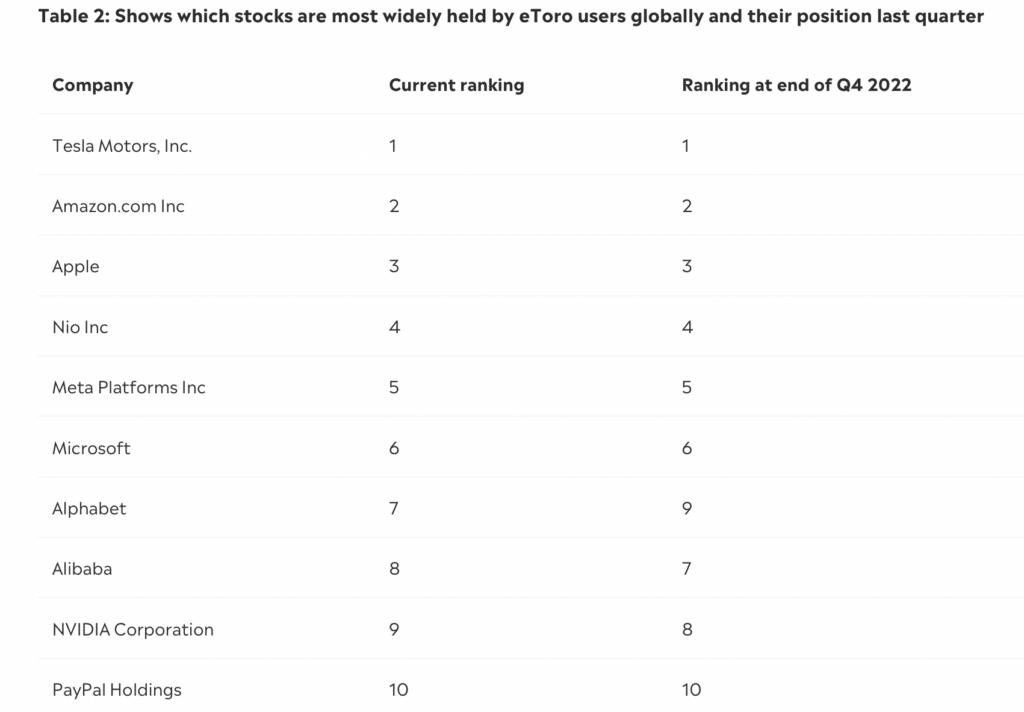

eToro looked at which companies saw the biggest proportionate change in holders at the end of Q1 2023 versus the end of Q4 2022, while also looking at the 10 most widely held stocks on the platform.

The most widely held stocks were led by Tesla, Amazon and Apple, all of which have seen significant share price improvements this year, with Tesla’s share price up 68% year-to-date. Others in this list include NVIDIA (+90% share price ytd), Meta (+76% share price ytd), which along with Tesla, have been the three best performing stocks in the entire S&P 500 in 2023.

Amongst the 10 ‘biggest risers’, several banks feature on the list, indicating that investors have been attempting to buy the dip following the recent turmoil in the banking sector. The number of global eToro users holding Credit Suisse stock is up 242%, whilst BNP Paribas SA (+36%) and Bank of America (+38%) also saw large increases. Several health-related stocks – a traditional defensive play – also made the list including CVS Health Corp (+68%) and UnitedHealth (+39%).

Commenting on the data, eToro’s Global Market Strategist Ben Laidler, said:

“The banking sector has been in turmoil in recent weeks and share prices have been hit, but ultimately we see any lasting impact being limited to a few individual banks rather than the broader system. With this in mind, buying the recent dip in bank share prices may prove to be a good long term play. Even those who jumped into Credit Suisse may ultimately make good, as they now receive UBS shares in the takeover.

“Retail investors have also been rewarded for their loyalty to the big tech titans this year, with share prices starting to recover across the sector, though in many cases still well off previous highs. These tech giants have huge profit margins and strong balance sheets and remain well placed to weather economic difficulties ahead.”

At the other end of the spectrum, airlines and car-makers featured prominently on the list of the 10 most sold stocks in Q1, with Rolls Royce (-14%), Porsche AG (-9%), Lufthansa (-9%), Renault (-8%) and United Airlines (-8%) all included.

Laidler adds:

“The airline industry has made up some ground since it was battered by Covid but the recovery has been slow and inconsistent and some investors are possibly deciding that their money can work harder for them elsewhere. Car makers may also be losing their appeal as investors take heed from the wider consumer squeeze happening globally.”