Investment bank and financial services firm Jefferies Financial Group Inc (NYSE:JEF) has posted its SEC report for the quarter to end-February 2023.

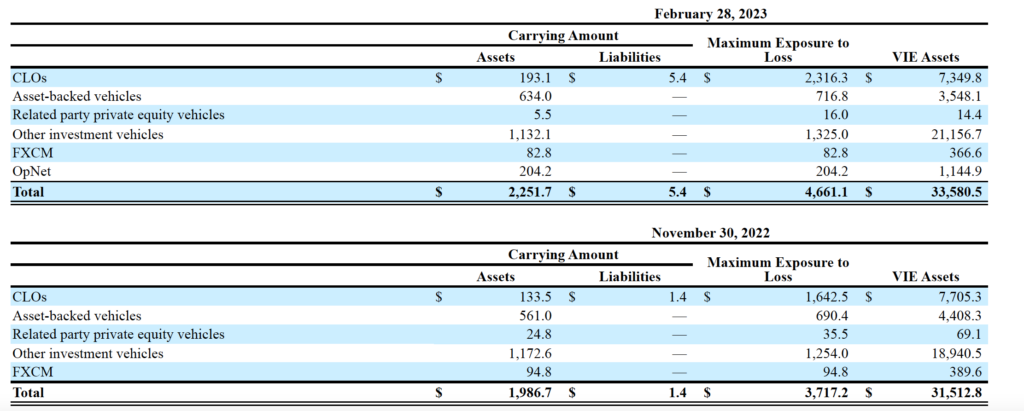

The data reveals that Jefferies’ maximum exposure to loss due to its involvement with FXCM was $82.8 million at February 28, 2023. This compares with $94.8 million at the end of the preceding quarter.

Jefferies notes that its maximum exposure to loss often differs from the carrying value of the variable interests. The maximum exposure to loss is dependent on the nature of the variable interests in the VIEs and is limited to the notional amounts of certain loan and equity commitments and guarantees. The maximum exposure to loss does not include the offsetting benefit of any financial instruments that may be utilized to hedge the risks associated with Jefferies’ variable interests and is not reduced by the amount of collateral held as part of a transaction with a VIE.

Jefferies has equity interests in FXCM of $46.7 million and $59.7 million at February 28, 2023 and November 30, 2022, respectively, consisting of a 50% voting interest in FXCM and rights to a majority of all distributions in respect of the equity of FXCM.

Jefferies also has a senior secured term loan to FXCM due May 6, 2023, which is accounted for at a fair value of $36.1 million and $35.1 million, at February 28, 2023 and November 30, 2022, respectively.

FXCM is considered a VIE and Jefferies’ term loan and equity interest are variable interests. The assets of FXCM primarily consist of brokerage receivables and other financial instruments and operating assets as part of FXCM’s foreign exchange trading business.