Direct indexing is one way a high-net-worth investor can lighten their tax drag. But is it the right move? How can an investor decide if direct indexing or index ETFs is the best way to improve their after-tax alpha more effectively?

A direct indexing portfolio is a separately managed account based on a benchmark index. But unlike a traditional SMA, direct indexing offers scalable, automatic tax-loss harvesting. Direct indexing with daily scans for tax-loss harvesting opportunities — like Vanguard Personalized Indexing — can increase after-tax alpha by from 20 basis points to well over 100 bps for an investor with extensive recurring capital gains.

Direct indexing can help boost after-tax alpha for some investors, but not all. Some may be better served by traditional strategies like index ETFs. According to Vanguard, the following factors should help determine whether implementing a direct indexing strategy is the right move:

- The frequency and size of recurring capital gains in the portfolio.

- The extent to which those gains can be offset by harvesting losses on assets held in taxable accounts.

- The expected alpha to be generated from holding preferred tax-inefficient investments (such as actively managed equities and private equity) in taxable accounts.

- The client’s capital gains tax rate and the relative cost difference between a direct indexing strategy and index mutual funds or ETFs.

See more: “Ideal Factors For Direct Indexing to Reduce Taxes”

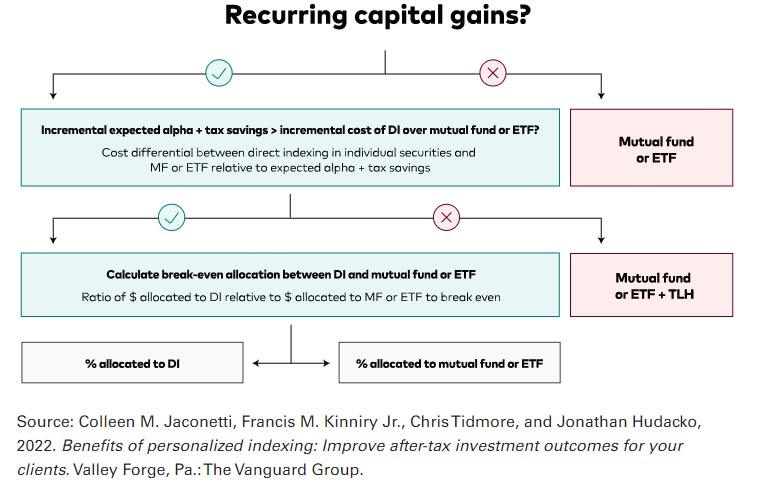

Vanguard’s researchers created the following flowchart to outline the key decision points to determine what percentage of a client’s portfolio to allocate to each strategy.

There’s no one-size-fits-all allocation to direct indexing. How much to allocate depends on such factors as the expected size and frequency of capital gains and the current market environment. As a general rule, the larger the expected alpha and the amount of gains to be offset, the greater the portion of the equity portfolio that could benefit from Vanguard Personalized Indexing.

For more news, information, and analysis, visit the Direct Indexing Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.