The recent rally of physical gold has served as a reminder of the challenge in trying to time the market.

While gold has not served as a great inflation hedge in the recent economic environment, history has demonstrated that its best performance is generally later in the economic cycle. The price of gold, for the first time in five years, recently went above $2,000 — a surprise for many investors.

As investors recognize the challenge in timing the market and risks in not maintaining an allocation to commodities, the Harbor Commodity All-Weather Strategy ETF (HGER) is worth consideration as a long-term component in investment portfolios.

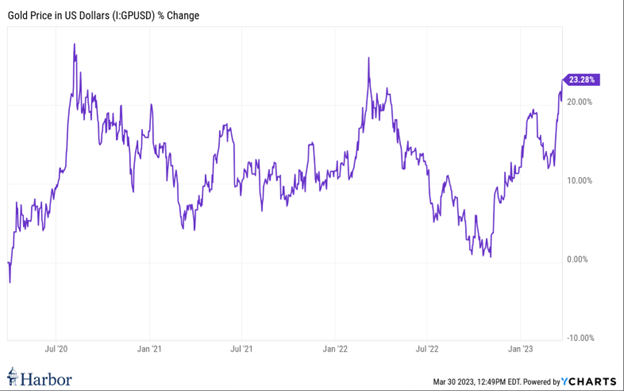

HGER’s dynamic increased allocation to gold this year appears to be advantageous, as gold has rallied from its October 2022 bottom. In addition, over the last three years, gold has rallied 23.28% on a cumulative basis.1

As demonstrated in the chart below, HGER is outpacing the Bloomberg Commodity Index by 1465 basis points since October 1, 2022.

HGER’s underlying index, the Quantix Commodities Index, places more weight on those commodities which have a higher pass-through cost to inflation, such as gasoline, and a lower weighting to those with lower pass-through costs, such as cotton or cocoa.

The QCI also includes a scarcity debasement indicator to indicate what the source of inflation is; in a debasement regime, where inflation is coming from a weaker USD, the QCI will tilt toward gold, and in a scarcity regime, where inflation is coming from demand outstripping supply, the QCI will tilt toward consumable commodities such as oil.

We believe there are strong reasons why gaining exposure to precious metals (physical gold, in particular) via physical holdings or futures is advantageous compared to investing in a derivative of the metal’s price by owning gold miners equities.

While gold miners are likely to benefit from an earnings standpoint from higher gold prices, they also face additional pressures that physical gold does not, such as higher input and labor costs due to the current inflationary environment as well as market beta/valuation risk given that they are owned as equities, according to Harbor.

For more news, information, and analysis, visit the Market Insights Channel.

1 Source: YCharts, 3-year cumulative return as of March 29, 2023.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks. For standardized performance, fees, and important information: HGER

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

The Quantix Commodities Index is calculated on a total return basis, which combines the returns of the futures contracts with the returns on cash collateral invested in 13-week U.S. Treasury Bills. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Quantix Commodities Index was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC.

The Bloomberg Commodity Index is a broadly diversified commodity price index distributed by Bloomberg Index Services Limited. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

A basis point is one hundredth of 1 percentage point.

Debasement refers to lowering the value of a currency.

USD (United States dollar) is the official currency of the United States of America.

Beta is a measure of systematic risk, or the sensitivity of a fund to movements in the benchmark. A beta of 1 implies that the expected movement of a fund’s return would match that of the benchmark used to measure beta.

Valuation risk is the financial risk that an asset is overvalued and is worth less than expected when it matures or is sold.

Quantix Commodities, LP is the subadvisor for the Harbor Commodity All-Weather Strategy ETF (HGER).

This article was prepared as Harbor Funds paid sponsorship with VettaFI.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2819060

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.