By Andrew Okrongly, CFA

Director, Model Portfolios

The turmoil within the U.S. banking system, started by the sudden failure of Silicon Valley Bank and Signature Bank, appears far from over.

While regulators have taken extreme measures to contain the upheaval, uncertainties remain for regional banks in the United States.

Where do we go from here?

Thinking about the range of possible outcomes, it may be helpful to examine another crisis that made headlines across the pond a few months ago.

Rising Rates, Market Losses and the Need for Cash

Last September, unprecedented volatility in the UK government bond (gilt) market led to a liquidity crisis within the country’s pension system.

These liquidity issues were caused by margin calls within liability-driven investment (LDI) programs.

LDI is a strategy designed to match the market sensitivity of pension assets with their long-dated liabilities. This typically necessitates using leverage via repurchase agreements (repo) and/or interest rate and inflation swaps.

The rapid spike in yields, due initially to concerns with the UK government’s fiscal position, led to steep losses on these leveraged positions. To cover the ensuing margin calls, pensions were forced to realize losses and sell their beleaguered bonds, kicking off a vicious downward price spiral.

Sound familiar?

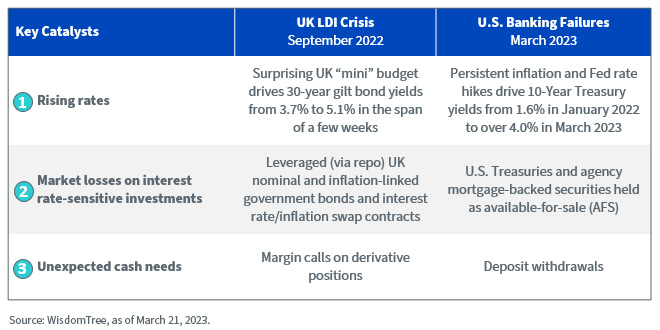

As we see it, there were three key catalysts driving both the UK LDI crisis and the current banking failures seen in the U.S.:

- Rising rates

- Market losses on interest rate-sensitive investments

- Unexpected cash needs

Not Entirely “Apples to Apples”

While parallels abound, there are several critical differences between the UK LDI crisis and the current stress on the U.S. banking system.

Most notable is the type of institutions involved.

Pension plan assets are invested with the objective of meeting long-dated liabilities far out into the future. Short-term cash flow needs are limited to ongoing benefit payments and any margin or capital calls from the investment portfolio.

So long as cash flow needs are met and the value of the pension plan’s assets and liabilities move in conjunction with one another, the plan’s solvency is maintained.

Commercial banks and savings institutions operate in different tax and regulatory regimes, earning a profit on the spread (known as the net interest margin, or NIM) between the return on assets (loans, securities) and short-term liabilities (deposits). These deposit liabilities, while traditionally sticky, are much less predictable than those of pension plans.

Additionally, a notable characteristic of the UK LDI crisis was the explicit use of leverage within pension plan investment portfolios. While utilized primarily for liability hedging and risk management purposes, this leveraged exposure to interest rate risk was certainly a contributing factor to the ensuing liquidity crisis that ensnared the UK last fall.

Conclusion

It seems clear that neither one of these dramatic market events would have occurred without the rapid rise of interest rates in developed markets over the past year. Two additional features linking both examples are mark-to-market losses on high-quality investments and an unexpected short-term liquidity need.

What became clear in the UK crisis last year was that the root cause of the market upheaval was a liquidity problem and not a credit problem. This made it very different from the issues plaguing the financial system in the global financial crisis of 2007–2008.

Given the nature of the investments (U.S. Treasuries and agency MBS) that are now crystallizing losses on U.S. bank balance sheets, it seems fair to say the same could be true in this case.

But a key difference might be on the liability side: long-duration UK pension liabilities couldn’t be withdrawn and experienced large decreases in value (in line with assets) as yields surged.

The same can’t be said for the liabilities (deposits) on banks’ balance sheets.

In fact, the sudden awareness of credit risk on bank deposits seems to have drawn attention to the even more glaring fact that banks have been very slow to pass on the increase in short-term market yields to their depositors.

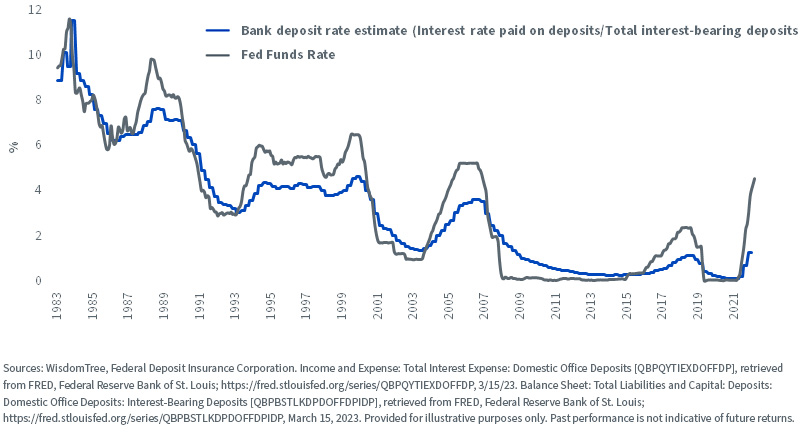

Bank Deposit Rate Estimate vs. Fed Funds Rate

This gap between market rates (Fed Funds Rate) and what commercial banks pay on deposits is now at its widest level since the data began in 1984.

Bank customers seem to be waking up to this fact. In the last year, more than $400 billion of assets have flowed into money market funds, including more than $100 billion in this past week alone.

Total Assets in Money Market Funds ($ Billion)

The key question now may be, what will regulators need to do to solve this deposit flight?

Ultimately, the Bank of England was able to stabilize the UK pension system and broader gilt market by stepping in to purchase government bonds and provide liquidity to affected market participants.

U.S. regulators have already taken significant steps to calm markets and inject liquidity. It remains to be seen if these measures (and potentially more in the future) will be sufficient to restore confidence across the banking system.

Find out More Information on Both Topics with the Behind the Markets Podcast

In the March 17 episode of the Behind the Markets podcast, WisdomTree’s Global Chief Investment Officer Jeremy Schwartz interviewed Trevor Greetham, Head of Multi Asset at Royal London Asset Management, on a wide range of topics, including the recent stress on the banking sector.

Additionally, in November 2022, Jeremy discussed the LDI crisis with Ben Clissold, Head of Fixed Income & Treasury at Universities Superannuation Scheme Limited (USS), the largest private pension scheme in the UK.

Listen to both conversations below:

Originally published by WisdomTree on March 23, 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.