A Nudists’ Beach?

Warren Buffett famously said, “Only when the tide goes out do you learn who has been swimming naked,” which seems appropriate right now. With the period of easy and plentiful money in the rearview mirror, we see cracks within some banks agitating the investment markets. At first, it was one bank tied to the crypto ecosystem. Next, it was a bank that catered to the start-up ecosystem. Another was a chronically ill international bank. Each is explained as unique. And they were, but unique does not necessarily mean alone.

Silicon Valley Bank—When Success Fails

Over the past ten days (which feels much longer), we have seen three bank failures, another teetering on edge, and a forced merger. Let’s look at Silicon Valley Bank (SVB), the largest of the three failures and the sixteenth largest U.S. bank, as well as the envy of the industry, given its growth and pedigree in the technology and venture world. That changed a little after 5:00 PM on Wednesday, March 8. Many articles discuss it, and we will add our thoughts.

What Happened?

In short, a lot of quick success, several very poor decisions, and an overall lack of risk controls. (We are aided by hindsight).

[wce_code id=192]

The longer story is that SVB was one of the primary benefactors of the funding boom that hit the technology sector over the last few years. They catered to every need of technology companies, the executives that ran them, and the venture funds that invested in them. Over the last three years, their deposits more than doubled.

The longer story is that SVB was one of the primary benefactors of the funding boom that hit the technology sector over the last few years. They catered to every need of technology companies, the executives that ran them, and the venture funds that invested in them. Over the last three years, their deposits more than doubled.

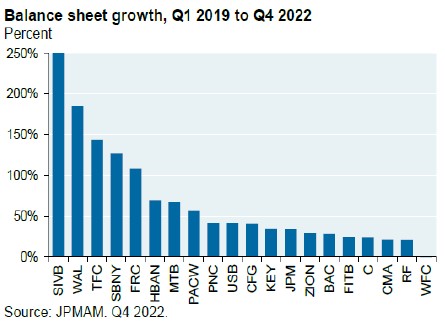

SVB wasn’t the only one that experienced a gush of new deposits. As shown in the chart, Western Alliance, Truist, Signature Bank, and First Republic were included in the top five, with SVB taking first place.

Oversimplifying, when a bank has a large influx of new deposits, they need to do something with them. Now, since banks typically pay their clients low-interest rates for on-demand deposits (i.e., checking accounts), those funds are a cheap and sticky source of funds for the bank’s investments. That is a good thing… unless you, the bank, don’t have good investment opportunities.

To earn something better than zero, SVB decided to purchase long-term U.S. Treasuries (at the time yielding 1.5%-ish) and mortgages (also at historically low-interest rates). Sounds good, right? You take money with low or no cost (the money within checking accounts) and buy a high-quality bond that will produce 1.5%. What could go wrong?

A lot. Everything can go wrong if interest rates rise dramatically over a short period, as they did in 2022 (and now we’re getting to the poor decision part). As rates rise, bond prices fall. If rates rise quickly, bond prices also fall quickly. The bonds SVB purchased before 2022 with all those new deposits became less valuable. Sure, SVB could theoretically hold them to maturity, generating that suboptimal return. But what if deposit growth slows and withdrawals increase? Well, the bank must sell those low-interest rate bonds before maturity, at unfavorable prices, to generate cash to provide money for the withdrawals. And that is exactly what happened to SVB, leading to their collapse. Would the situation have been a controlled sell if the withdrawal demand were slow? Yes, but it wasn’t slow.

The rapid decline experienced by the bank over 30 hours was spurred by individuals and companies that owned those deposits fleeing the bank, fearing that they would lose access to their funds or, even worse, lose the funds entirely, as most of those deposits were above the FDIC insurance limit of $250,000. A small group of people (it might have been most venture capitalists, but that is still a relatively small group) advised their portfolio companies to protect their newly raised money by moving it to safer havens—large banks or U.S. Treasury bills. As your grandparents (or great-grandparents for some!) could tell you, in the old days, it took long lines of people stretching around the corner to cause a bank run. Not anymore. In the case of SVB, a few people shouting, “Fire!” in a crowded theater caused more than $40 billion out of $200 billion in deposits to run for the exit on Thursday, March 9. SVB was not adequately covered or set up to weather such a storm. (Now we get to the poor risk controls).

First Republic Bank appears to be experiencing the same bank run by its high-end depositors (many of whom also banked with SVB). Only a few days ago, major banks attempted to infuse $30 billion of new deposits into First Republic to stem the outflow, which doesn’t appear to have eased the fear surrounding the bank as withdrawals have been over $70 billion. We have no idea what it takes to bolster confidence in the bank, but the enviable position the bank recently had as a one-stop shop for the wealthy is rapidly losing its luster.

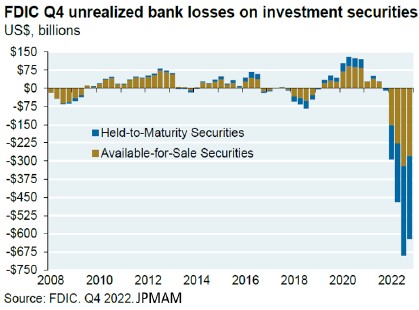

The public’s growing distrust of banks can be attributed to the rapid move off zero interest rates and the impact on bond prices experienced by all as the Federal Reserve has raised rates. We have spent much time discussing the 2022 bond market, which experienced the worst performance since the founding of the United States. The banks did not dodge that bullet. The graph to the right shows that the U.S. banking industry had unrealized losses totaling more than $600 billion for the bonds they held as assets.

The public’s growing distrust of banks can be attributed to the rapid move off zero interest rates and the impact on bond prices experienced by all as the Federal Reserve has raised rates. We have spent much time discussing the 2022 bond market, which experienced the worst performance since the founding of the United States. The banks did not dodge that bullet. The graph to the right shows that the U.S. banking industry had unrealized losses totaling more than $600 billion for the bonds they held as assets.

Simplistically, the assets of a bank can be split into three buckets. The first is on-demand, cash-like instruments meant to meet the day-to-day needs of clients’ cash needs. The second bucket is available-for-sale securities. Banks can sell these high-quality, tradable bonds when they want. For the luxury of having that ability, they need to reflect the current market price of those bonds on their balance sheet. The longer-term bucket is called held-to-maturity securities. These are the bonds or loans they have made that the banks expect to hold until the bond or loan’s term expires. In these cases, banks get to show them on their balance sheet at the same value as when they made the loan or bought the bond; the price, in other words, is not adjusted for market volatility.

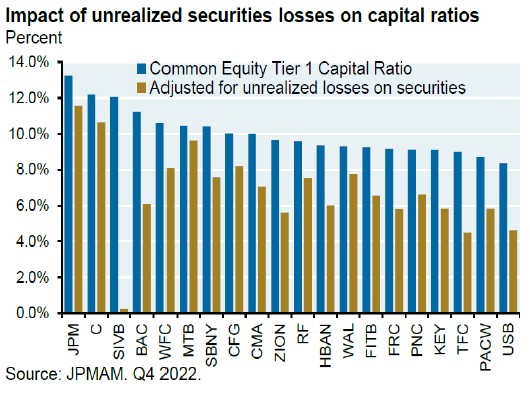

And this is where the current distrust in banks is focused. The primary measure of a bank’s health is its capital (the amount of assets greater than its liabilities). The higher its capital level, the healthier it is. Regulators want to see that a bank’s capital is at least 6% of assets. (This percentage refers to Tier 1 capital and is only one component, but we want to keep it simple for this discussion). Concerns grow if the ratio goes below that level, and the bank’s management likely needs to take action. The chart shows the impact on Tier 1 capital if the held-to-maturity bucket had to reflect the current market prices.

The blue bars highlight the Tier 1 level for various banks. The gold bars show how the Tier 1 levels would look if adjusted for the banks’ unrealized losses. Silicon Valley Bank was unique because its capital would evaporate upon realizing all expected losses. Is this the only component that goes into the equation? No. Signature Bank (SBNY) was taken over two days after SVB even though the above graph shows ample capital, so the graph alone can’t be relied on for culling the weak from the strong. Rather, it as an illustration of one aspect of the current situation.

The blue bars highlight the Tier 1 level for various banks. The gold bars show how the Tier 1 levels would look if adjusted for the banks’ unrealized losses. Silicon Valley Bank was unique because its capital would evaporate upon realizing all expected losses. Is this the only component that goes into the equation? No. Signature Bank (SBNY) was taken over two days after SVB even though the above graph shows ample capital, so the graph alone can’t be relied on for culling the weak from the strong. Rather, it as an illustration of one aspect of the current situation.

The current prices on the held-to-maturity securities are not an issue in most cases as the bank will suffer the lower return and see the return of loan proceeds upon maturity. It only becomes an issue if a bank needs to sell those securities before that time, as was the case for SVB. The Federal Reserve has created a new funding facility for banks to prevent this from happening at other banks. This should allow the current nervous environment to settle down to a simmer rather than boil over to the entire financial system.

Lessons Learned—Be Paranoid, Not Scared

We have long worried about complacency within the investment world. We have advised caution regarding sky-high equity valuations, weakening credit markets, and the impact of high inflation. However, we did not think uncertainty would show itself in a bank run, especially on three banks among our top 20 largest banking institutions.

The Fed, the Treasury, and the FDIC’s swift actions have prevented these bank failures from incurring high costs on the public and the clients that rely on those banks, thankfully. We do not think that depositors at banks are at risk because the Fed knows that the result of not insuring all deposits would be disastrous. But, as shown, the investors in the banks can be wiped out overnight. So, we do not see a need to be scared by the headlines, but we do advocate for being paranoid. The situation is fluid, and we do not know what we may see as the tide goes out.

There are a few takeaways for us from the last few weeks:

- This is not the Global Financial Crisis. That was about bad assets sitting on overleveraged bank balance sheets. This is about high-quality assets needing to be liquidated at a speed that looks like a going-out-of-business sale. Historically, banks could look at their client deposits as inexpensive and long-duration funding to match it with long-duration assets. Now, trust is weak, and those deposits are no longer long-duration and not likely to be cheap in the future. This is bad for investors in banks but is not necessarily bad for the economy.

- The idea of relationship banking and relying on one bank—a single point of failure—is over. The fiduciary duty we all take seriously is meant to put clients first. A wealth manager that worked for the bank and placed the client into all bank products has likely not worked as a fiduciary for their clients. Many smaller banks have figured this out and have worked to partner with outside wealth managers. SVB, First Republic, and most of the largest firms have not, potentially putting clients at risk.

- Now is not the time to be complacent about where your cash and investments reside. The surprise of SVB required many to shoot first and ask questions later. Positioning conservatively can reduce the chance of the sleepless nights some experienced when their funds were at risk.

- Before the SVB news, inflation was perking up again, and the markets were bracing for a material move up in rates. That has changed now with fear centering around the fragility of the banking system and a potential need to lower rates. This complicates the Fed’s fight against inflation.

We will need to see how the adjustment of bank deposits impacts the economy. At the moment, there are signs that financial conditions are tightening. It is unclear if those conditions continue or subside as the situation normalizes. We are monitoring credit markets for any indication that the current fear eases. Until then, we continue to wait for better opportunities to place dry powder to work.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.