The Zacks Medical sector has struggled in 2023, down roughly 5% YTD and underperforming relative to the S&P 500.

One stock residing in the realm, Pfizer PFE, has seen its near-term outlook shift negative over the last several months, pushing the stock down into a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine. How does the company currently stack up? Let’s take a closer look.

Share Performance

PFE shares have been in a downward trend throughout 2023, losing more than 20% in value and widely underperforming relative to the S&P 500.

Image Source: Zacks Investment Research

And over the last six months, PFE shares have again lagged behind the general market, losing 6% in value compared to the S&P 500’s 9% gain. The adverse price action indicates that sellers have been in control with no meaningful buying yet to step up.

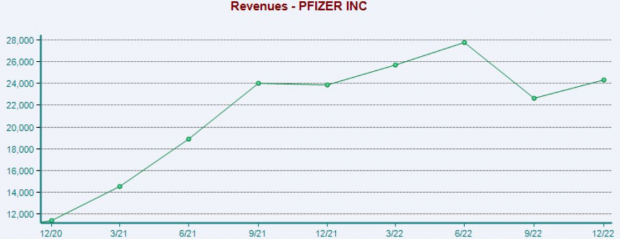

Quarterly Performance

Pfizer has consistently posted better-than-expected results recently, exceeding earnings and revenue estimates in three consecutive quarters. Just in its latest release, the pharmaceutical titan penciled in a 10% bottom line beat and reported sales marginally above expectations.

Image Source: Zacks Investment Research

However, the market wasn’t impressed with the recent double-beat, sending shares downward post-earnings. This is illustrated by the green arrow circled in the chart below.

Image Source: Zacks Investment Research

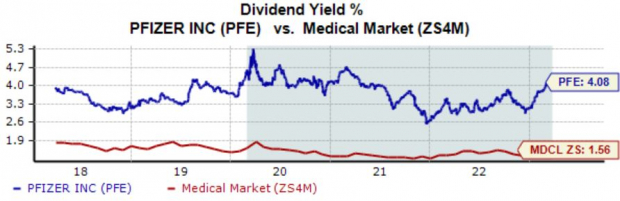

Dividends

Pfizer shares do pay a solid dividend, currently yielding 4.1% annually. As we can see, the current yield is more than double the average of the Zacks Medical sector.

Over the last five years, PFE’s payout has grown by roughly 4%.

Image Source: Zacks Investment Research

Bottom Line

Weak share performance and negative earnings estimate revisions from analysts paint a challenging picture for the company’s shares in the near term.

Pfizer PFE is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Just Released: Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for 2023?

From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%. Our Director of Research has now combed through 4,000 companies covered by the Zacks Rank and handpicked the best 10 tickers to buy and hold in 2023. Don’t miss your chance to still be among the first to get in on these just-released stocks.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.