(Bloomberg) — BlackRock Inc (NYSE:). increased its overweight call on inflation-linked debt on the view that price pressures will remain well above the Federal Reserve’s 2% target.

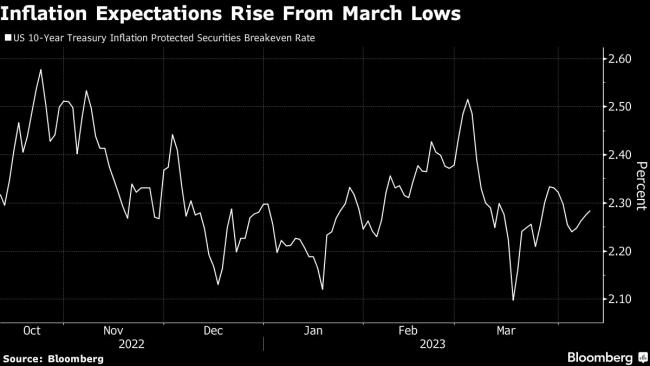

The firm has been overweight the securities strategically for a few years, noting structural trends are likely to sustain price pressures, and added to the position last month when market measures of inflation expectations fell, strategists at the BlackRock Investment Institute wrote in an April 10 note. Wednesday’s release of consumer-price data will confirm inflation’s stickiness, they wrote.

“We are going to be living with inflation,” strategists including Jean Boivin and Wei Li said in the note. “We do see inflation cooling as spending patterns normalize and energy prices relent, but we see it persisting above policy targets in coming years.”

For the past year, global central banks have been hiking rates to tame inflation, fueling speculation that monetary authorities will ultimately push economies into recession as part of that effort. The lurch lower in Treasury yields last month signaled to some that a recession is on the horizon as the Fed tightens.

“The Fed is sticking to hiking rates to get inflation down to target, even as financial cracks start to appear,” the strategists wrote. “The Fed will eventually stop hiking when the damage becomes more apparent. That means it won’t have done enough to create the deep recession needed to achieve its inflation goal.”

US consumer prices likely rose at a 5.1% annual rate in March, down from 6% the prior month, according to the median estimate of economists surveyed by Bloomberg ahead of the release Wednesday. Excluding food and energy prices, the pace is expected to increase to 5.6% from 5.5%.

Meanwhile, traders have raised the odds of another quarter-point Fed rate increase in May in the wake of strong employment data released last week. Swap contracts referencing Fed meeting dates repriced to levels indicating more than 80% odds of the central bank raising its policy rate range to 5%-5.25% on May 3. Traders are still bracing for rate cuts later in 2023.

“The market pricing in repeated rate cuts suggests investors are underestimating inflation’s persistence and expecting central banks to come to the rescue,” the BlackRock strategists wrote. “We see sticky inflation preventing cuts in 2023.”

(Adds chart.)

©2023 Bloomberg L.P.