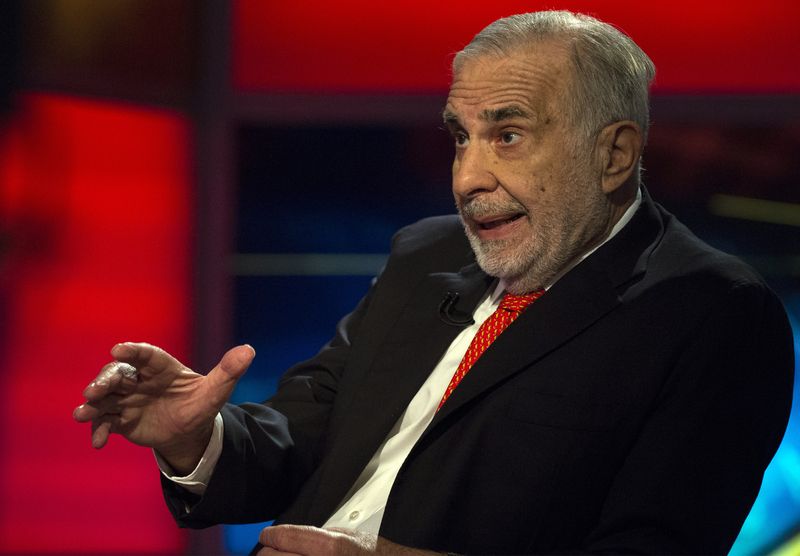

© Reuters. Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network’s Neil Cavuto show in New York, U.S. on February 11, 2014. REUTERS/Brendan McDermid/File Photo

(Reuters) – Carl Icahn and banks have finalized amended loan agreements that untie Icahn’s personal loans from the trading price of Icahn Enterprises, after a short-seller report in May flagged concerns, the Wall Street Journal reported on Monday.

Icahn has agreed to increase his collateral and set up a plan to fully repay the loans in three years, the report said, citing people familiar with the matter.

Icahn’s company became the target of short-seller Hindenburg Research in May.

Among other concerns, Hindenburg flagged that Icahn had pledged more than 65% of his IEP stake as collateral for margin loans for “unspecified purposes.”