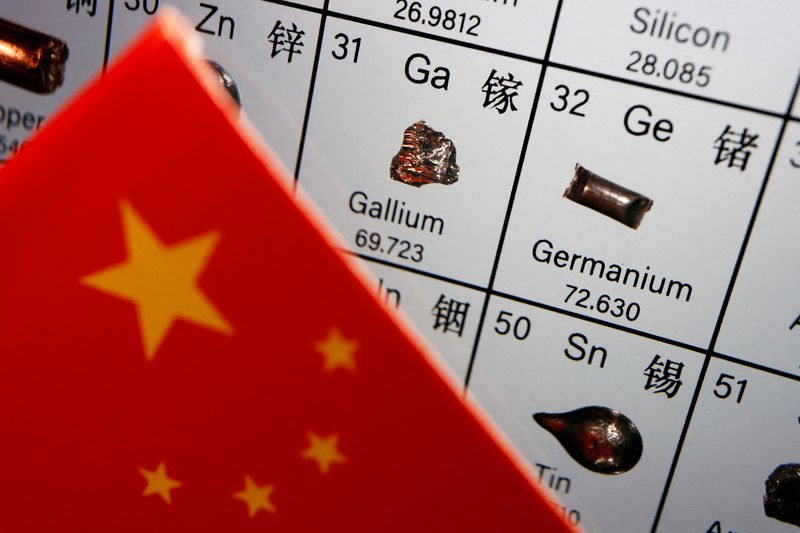

© Reuters. FILE PHOTO: The flag of China is placed next to the elements of Gallium and Germanium on a periodic table, in this illustration picture taken on July 6, 2023. REUTERS/Florence Lo/File Photo

By Nick Carey

LONDON (Reuters) – China’s looming gallium export controls leave automakers with a dilemma over whether they can continue to rely on a metal which had been seen as a game changer for electric vehicles.

Gallium is currently used in a wide variety of applications, from LEDs to smaller mobile phone adaptors. Little known to most people, gallium in pure form can melt in your hand – but in a couple of compounds has become sought after for semiconductors.

Automakers are hungry for anything that boosts EV efficiency and reduces weight, helping them to cut costs. Gallium Nitride does both and is far cheaper than other semiconductor materials like platinum or palladium.

Gallium is found in trace amounts in zinc ores and in bauxite, and gallium metal is produced when processing bauxite to make aluminium. Around 80% is produced in China, according to the European industry association Critical Raw Materials Alliance (CRMA).

For EVs, the compound gallium nitride can handle a lot of power without generating heat – making it ideal for on-board chargers and possibly inverters, which help control the flow of electricity to and from the battery pack.

“Gallium nitride is a huge game multiplier,” said Umesh Mishra, co-founder at Goleta, California-based Transphorm, which is developing chips using the compound.

Transphorm uses ultra thin layers of gallium nitride that are a micron, or one thousandth of a millimetre thick, on its semiconductors.

“You can either charge faster with the same footprint or if you want to charge at the same rate, you can do it in a much smaller point,” Mishra said.

Transphorm is working with automakers in the design phase for on-board chargers on a wide range of EV models – which should hit the market around 2026 – and is in conversations with others for using them in inverters, Mishra said.

But some mineral experts say China’s decision last week to impose export controls on gallium, along with another semiconductor material germanium, starting next month could force automakers to think again.

The auto industry is only now recovering from a pandemic-fueled global semiconductor shortage that forced automakers to halt production of some models and in some cases to leave unfinished vehicles standing waiting for a single chip.

Alastair Neill, a director at the Critical Minerals Institute, said that automakers who are in the early stages of designing their next generation of EVs could opt for silicon carbide, even though gallium nitride performs about 30% better, rather than risk a fresh supply chain headache.

“If you are already banking on gallium nitride and designing it into your platform, then you’re in trouble,” he said.

Automakers have responded cautiously to China’s announcement, with many saying they are monitoring the situation.

A source at a Japanese automotive supplier told Reuters the company was weighing up whether to use gallium nitride or silicon carbide for future power semiconductors.

“Of course this factor (China’s export controls) would be an issue if we’d use a large quantity of these devices in the future,” said the source, who was not authorized to speak on the record.

Some chipmakers have also been reticent to speak.

Germany’s Infineon (OTC:) announced in March it was acquiring Canada’s GaN Systems for $830 million, citing the anticipated rapid growth in gallium nitride chips.

The company said it does not comment on specific materials.

Transphorm’s Mishra said that, as gallium metal is produced when processing bauxite to make aluminium, he is confident other countries will step in to replace the China supply.

“If China completely locks it down, there will be a blip, there will be an uptick in prices and people will just fire up their plants in other countries,” Mishra said.

Others are less confident.

“People have to look for other options, but gallium nitride is hard to replace, said the CMI’s Neill. “Coming up with an alternative would take a lot of time.”