Treasury bonds have been a silent hero for investors so far this year, as the combination of attractive yields and trust in the government’s ability to make good on its commitments has made them an appealing shelter in a storm. Amid their widespread popularity, savvy investors and advisors may want to get a second opinion on Treasuries risk and what may make this safe haven dangerous.

That’s the premise of recent insight from Richard Bernstein Advisors (RBA). While Treasuries have a reputation for safety that – rightly – has its merits, markets may be overlooking a serious tail risk to the much-vaunted government debt offering: the risk of U.S. government default.

See more: “Q&A With RBA’s Director of Research, Lisa Kirschner”

Certainly, markets have seen this all before, and while much ink is spilled over the impact of elections on markets, it would be fair for market watchers to be skeptical that the U.S. government would actually default. Yet, without ascribing blame to either party, RBA’s research asks an urgent question – and underlines a political situation that is more precariously balanced than it seems.

With one party holding the slightest majority in the House, with enough members dead set on cuts that the President staunchly opposes, a redux of the days-long Speaker vote may be a prelude to a brutal default fight.

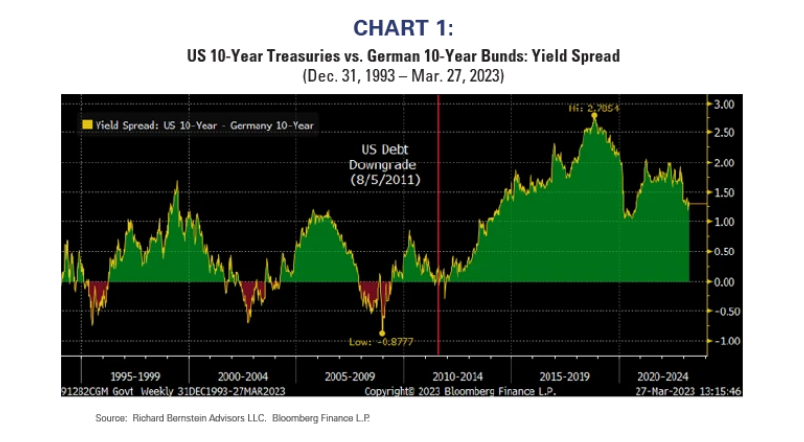

One doesn’t need to look too far back to note the impact of the last debacle over the debt ceiling, either, as the U.S. government has still paid between 100 to 200 basis points more in yield relative to German government debt since the U.S. debt downgrade in 2011. Combine that with news that the one-year credit default swap (CDS) spread, which helps indicate default risk, is higher now than it was in 2011, and the need to consider the risk of default grows.

A second look opinion on Treasuries risk doesn’t necessarily ignore the benefits they can offer, but it does take into account risks that may be overlooked in the market as a whole. RBA’s investment process looks to profit cycles, considering top-down, fundamentals-based factors like liquidity, sentiment, and profits to assess which sectors are the best fit for the period in which the market cycle is operating.

While RBA remains overweight long-term Treasuries in recognition of slowing nominal growth and as a hedge against vulnerable equities, the firm is also recognizing how a U.S. government default may not only jeopardize Treasuries’ role in the global economy but further increase interest rate pain.

For more news, information, and analysis, visit the Richard Bernstein Advisors Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.