On March 28, 2023,

Erste Group

upgraded

their outlook for NextEra Energy (NYSE:NEE) from Hold to Buy.

Analyst Price Forecast Suggests 28.25% Upside

As of March 28, 2023,

the average one-year price target for NextEra Energy is $96.75.

The forecasts range from a low of $80.80 to a high of $113.40.

The average price target represents an increase of 28.25% from its latest reported closing price of $75.44.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for NextEra Energy

is $24,362MM, an increase of 16.25%.

The projected annual non-GAAP EPS

is $3.11.

What are Large Shareholders Doing?

Jpmorgan Chase &

holds 68,723K shares

representing 3.46% ownership of the company.

In it’s prior filing, the firm reported owning 62,726K shares, representing

an increase

of 8.73%.

The firm

increased

its portfolio allocation in NEE by 7.24% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares

holds 60,407K shares

representing 3.04% ownership of the company.

In it’s prior filing, the firm reported owning 59,264K shares, representing

an increase

of 1.89%.

The firm

increased

its portfolio allocation in NEE by 0.36% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares

holds 45,938K shares

representing 2.31% ownership of the company.

In it’s prior filing, the firm reported owning 44,539K shares, representing

an increase

of 3.04%.

The firm

increased

its portfolio allocation in NEE by 1.31% over the last quarter.

Bank Of America

holds 45,658K shares

representing 2.30% ownership of the company.

In it’s prior filing, the firm reported owning 44,706K shares, representing

an increase

of 2.09%.

The firm

decreased

its portfolio allocation in NEE by 99.90% over the last quarter.

Geode Capital Management

holds 34,484K shares

representing 1.74% ownership of the company.

In it’s prior filing, the firm reported owning 33,396K shares, representing

an increase

of 3.16%.

The firm

increased

its portfolio allocation in NEE by 1.78% over the last quarter.

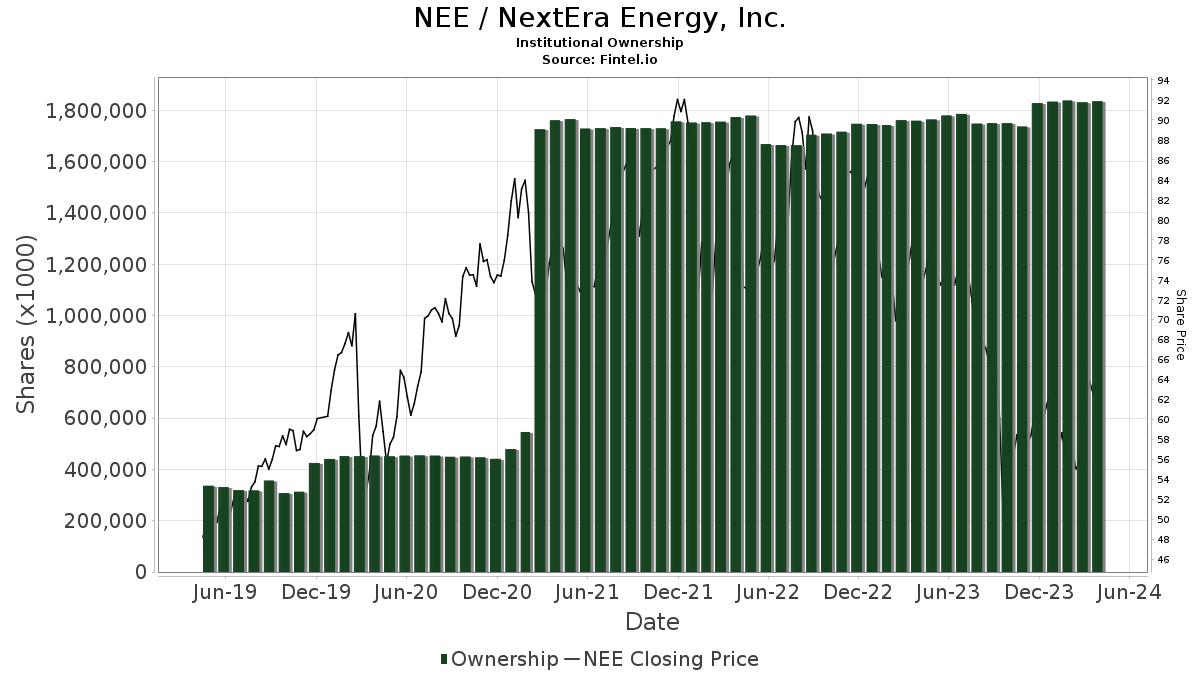

What is the Fund Sentiment?

There are 3659 funds or institutions reporting positions in NextEra Energy.

This is an increase

of

127

owner(s) or 3.60% in the last quarter.

Average portfolio weight of all funds dedicated to NEE is 0.75%,

a decrease

of 5.17%.

Total shares owned by institutions increased

in the last three months by 0.75% to 1,762,244K shares.

The put/call ratio of NEE is 0.81, indicating a

bullish

outlook.

NextEra Energy Background Information

(This description is provided by the company.)

NextEra Energy, Inc. is a leading clean energy company headquartered in Juno Beach, Florida. NextEra Energy owns Florida Power & Light Company, which is the largest rate-regulated electric utility in the United States as measured by retail electricity produced and sold, and serves more than 5.6 million customer accounts, supporting more than 11 million residents across Florida with clean, reliable and affordable electricity. NextEra Energy also owns a competitive clean energy business, NextEra Energy Resources, LLC, which, together with its affiliated entities, is the world’s largest generator of renewable energy from the wind and sun and a world leader in battery storage. Through its subsidiaries, NextEra Energy generates clean, emissions-free electricity from seven commercial nuclear power units in Florida, New Hampshire and Wisconsin. A Fortune 200 company and included in the S&P 100 index, NextEra Energy has been recognized often by third parties for its efforts in sustainability, corporate responsibility, ethics and compliance, and diversity. NextEra Energy is ranked No. 1 in the electric and gas utilities industry on Fortune’s 2020 list of ‘World’s Most Admired Companies’ and received the S&P Global Platts 2020 Energy Transition Award for leadership in environmental, social and governance.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.