UK neobroker Freetrade has released it financial results for 2022 (fiscal year end September 30), indicating modest growth on the top line while continuing to lose big money on the bottom line.

Freetrade reported Revenues of £15.6 million in 2022, up by 23% from £12.47 million in 2021. However Freetrade’s net loss grew substantially, from £17.1 million last year to £39.8 million in 2022. We reported last month that Freetrade is about to launch a crowdfunding round, to help shore up the company’s finances, at a significant discount to its previous valuation of £650 million when it raised capital in late 2021 and again in mid 2022.

Freetrade is an app-based stockbroker, providing an execution-only trading platform to retail customers. Customers are able to purchase instruments listed on exchanges in the United Kingdom, United States and Europe without paying commission fees. Customers can choose one of Freetrade’s simple subscription pricing plans that is best suited to their investment needs, and hold their investments in either a General Investment Account (GIA), a stocks and shares Individual Savings Account (ISA) or a Self-Invested Personal Pension (SIPP).

Freetrade did state that throughout the financial year, customer numbers and net inflows of customer assets have continued to grow strongly. Its number of registered users increased significantly during the year. Total users increased by 51% reaching 1,336,760 by the end of the financial year (2021: 886,743). This growth reflects the impact of a strategic investment in marketing activity with Freetrade’s first large-scale out-of-home marketing campaign as well as continued investment in a highly efficient ‘free share’ referral scheme.

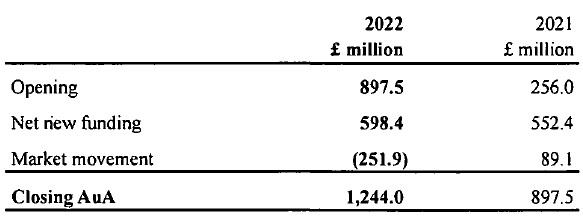

Assets under Administration (AuA) increased by 39% in the financial year with this growth occurring despite challenging market conditions that contributed to an adverse market movement of £0.3 billion in customer AuA. This movement partially offsets the sustained growth of net new funding, which was consistent with the prior financial year as detailed below:

Despite challenging macroeconomic conditions, Freetrade reported that trading volumes have overall remained resilient, increasing by 9% to £3.6 billion (2021: £3.3 billion), leading to the aforementioned increase in Revenue for the year.

During the financial year, Freetrade onboarded its first European customers following the granting of a regulatory licence from the Swedish Finansinspektionen to Freetrade Europa AB, a direct subsidiary of Freetrade Limited. Having launched in Sweden shortly following the financial year end, Freetrade plans to expand across Europe early in 2023.

The Group’s loss for the financial year of £39.7 million (2021: £17.1 million) is attributable to an increased level of costs in the financial year. The most significant increase was in staff costs. Following the Series B financing in early 2021 there was also a strategic investment in marketing activity in the first quarter of the financial year, including a significant brand awareness campaign.

As the market conditions began to change during the year, the Company introduced prudent cost saving measures. In addition to raising funds from existing and new investors , steps were taken to make the cost base more resilient to the market conditions. Initially, this meant a focus on operational costs and third party contracts as well as freezing hiring and significantly reducing marketing expenditure. As the market downturn continued, it became clear to the Board of Directors that further action was required.

The Board and Executive team, therefore, made the difficult decision to make company-wide redundancies – these were all completed by the end of the financial year with minimal financial cost. A reduction in staff costs from their peak during the financial year has significantly reduced Freetrade’s monthly operating costs and has strengthened the forward looking capital and liquidity position.

Fretrade’s headcount grew substantially through the first half of the financial year as a result of hiring activities undertaken in the final quarter of 2021 and to a lesser degree in the first quarter of 2022. Headcount reached a high of just over 300 employees in March 2022. As a consequence of this headcount growth in the first half of the financial year and the previously noted actions subsequently taken to reduce headcount in the second half of the financial year, total headcount across all locations decreased by 17 to a total headcount of 184 at 30 September 2022 (2021: 201), despite a higher average headcount over the financial year of 264 (2021: 118). The overall level of staff costs in the business at the end of the 2022 financial year is much closer to the level at the end of the 2021 financial year.

Looking ahead to the next financial year, Freetrade said it continues towards its mission to get everyone investing. The Freetrade app officially launched in the Swedish App Store in November 2022 and work is underway for a pan-European launch early in 2023. Meanwhile, teams remain dedicated to developing new features and products for UK and European customers that will further enhance Freetrade’s value proposition and add potential revenue streams in a competitive market.