Here’s something we have only seen once in 20 years

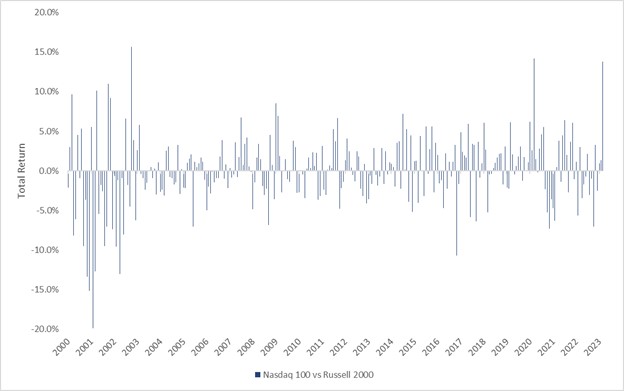

In a true study of contrasts, the tech-heavy Nasdaq 100 index has soared 6.3% during March while the Russell 2000 index of small-cap stocks has tumbled 7.5%.

That’s left the performance gap (known as the spread) between these two indices at nearly 14 percentage points—the widest monthly difference since March 2020, the early days of the pandemic.

Source: Blomberg, as of 03/28/2023

Source: Blomberg, as of 03/28/2023

Why the extreme divergence? A few key drivers include:

Banking. Fears about the financial sector due to the recent failure of some regional and mid-size banks have hit the Russell 2000 Index—which has a 10% allocation to bank stocks—particularly hard. In contrast, the Nasdaq 100 currently has no bank exposure at all.

Funding. The smaller companies that make up the Russell 2000 typically require greater ongoing access to bank funding than the larger, more financially stable firms in the Nasdaq 100. Banks’ willingness to lend is likely to decrease going forward. Issuance of debt has also declined sharply this year due to market volatility and other factors, potentially crimping small-caps’ growth prospects.

Fed Chair Powell addressed these issues in his comments last week, noting that “events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would, in turn, affect economic outcomes.”

Clearly, investors have decided that large technology companies will be better able to weather such headwinds. We believe mega-cap tech stocks are an attractive asset class and have increased our exposure to the sector.

That said, the wide spread that now exists may present opportunities among beaten-down and overlooked small-caps. Unless we see a full-blown banking crisis that causes access to credit to evaporate—an unlikely outcome, in our view—it’s possible that small-caps’ relative performance could improve as fears about the banking system and companies’ access to credit subside.

The upshot: When markets hit extremes, it could be a good time to look for investment opportunities.

For more news, information, and analysis, visit the ETF Strategist Channel.

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The Russell 2000 Index tracks the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Nasdaq-100 Index comprises 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. You cannot invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.