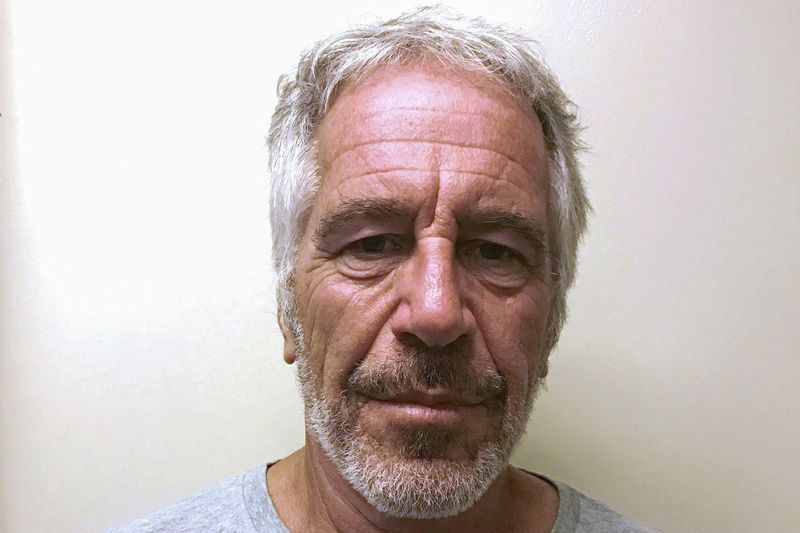

© Reuters. FILE PHOTO: U.S. financier Jeffrey Epstein appears in a photograph taken for the New York State Division of Criminal Justice Services’ sex offender registry March 28, 2017 and obtained by Reuters July 10, 2019. New York State Division of Criminal Justice

By Jonathan Stempel

NEW YORK (Reuters) – Jamie Dimon and Jes Staley do not agree on who to blame for JPMorgan Chase (NYSE:)’s relationship with former client Jeffrey Epstein, but agree that a shareholder lawsuit over their alleged failure to police the disgraced financier should be thrown out.

Lawyers for Dimon, the bank’s chief executive, and Staley, a former private banking and investment banking chief, urged a dismissal in filings late Thursday in Manhattan federal court.

Shareholders led by pension funds in Miami and Pittsburgh have said Dimon, seven other JPMorgan directors and Staley “put their heads in the sand” and ignored internal warnings as Epstein used his accounts to further abuses of young women and girls.

Lawyers for Dimon and the directors said there was no showing that either knowingly ignored red flags about Epstein, or that Dimon was involved in keeping Epstein as a client.

“The claims against Mr. Dimon are based on nothing more than pure speculation and innuendo,” the lawyers said.

Staley’s lawyers, meanwhile, said the shareholders made “no showing whatsoever” that compliance was his job, and that unlike Dimon, “whose writ, as CEO, presumably ran the gamut – Mr. Staley served in discrete roles lower in the corporate hierarchy.”

The so-called derivative lawsuit seeks to have the defendants or their insurers pay damages to JPMorgan, benefiting shareholders.

Lawyers for the two pension funds did not immediately respond on Friday to requests for comment.

JPMorgan agreed last month to pay $290 million to settle claims by dozens of Epstein victims.

It is also defending against a lawsuit by the U.S. Virgin Islands, where Epstein owned two neighboring private islands.

The New York-based bank is suing Staley to cover its losses in both lawsuits, and return eight years of pay.

Staley has expressed regret for his friendship with Epstein and denied knowing about his sex trafficking. He also served as Barclays (LON:)’ chief executive from 2015 to 2021.

Epstein committed suicide at age 66 in August 2019 in a Manhattan jail cell while awaiting trial for sex trafficking.

The case is City of Miami General Employees & Sanitation Employees Retirement Trust et al v Dimon et al, U.S. District Court, Southern District of New York, No. 23-03903.