Marex Group today announced record full-year results for the period to 31 December 2022.

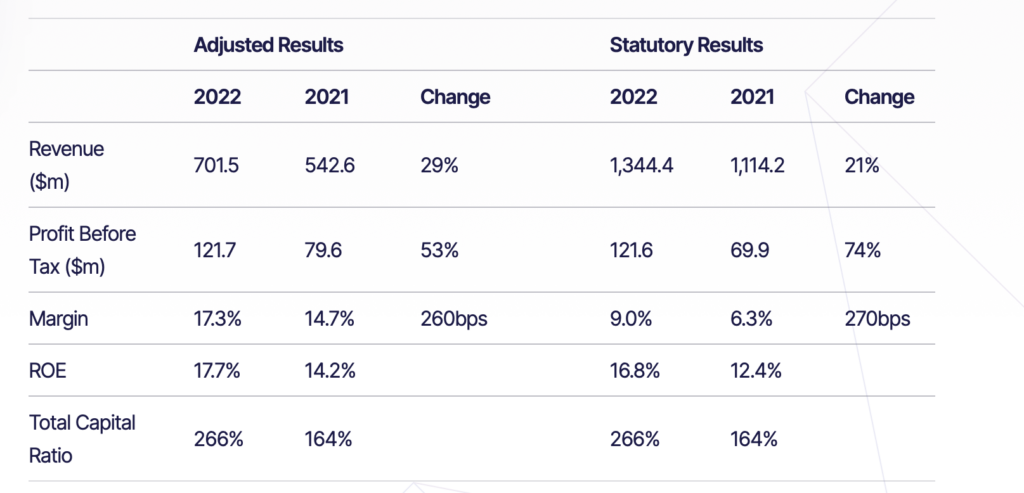

Group net revenue for 2022 increased by 29% to $701.5 million and Adjusted operating PBT was up 53% to $121.7 million.

The strong performance was driven primarily by organic growth from increased client activity across the global franchise and strong commercial execution in Marex’s core energy and commodity markets.

The acquisition and consolidation of ED&F Man Capital Markets also contributed to performance in the final quarter of the year. Segregated client monies increased significantly to $12.9 billion as at the end of 2022 (2021: $5.4 billion).

Robust revenue generation and the increasing scale of the business resulted in Adjusted operating PBT margins increasing to 17.3% (2021: 14.7%), delivering improved return on equity of 17.7% (2021: 14.2%).

Across segments, Market Making revenues increased 23% to $161.3 million (2021: $131.1 million) as Metals and Agricultural franchises benefited from rising market volatility and improving market conditions, combined with strong performance particularly in our energy market making franchise.

Clearing revenues increased 58% to $214.4 million (2021: $136.1 million) due to increased client activity resulting in higher number of contracts cleared during 2022, combined with the benefit of higher interest income of client balances.

Hedging and Investment Solutions delivered 14% revenue growth to $99.8 million, as strong demand for Marex’s bespoke commodity hedging solutions more than offset subdued investor appetite for its investment solutions (structured notes).

Agency and Execution revenues increased 21% to $226.0 million (2021: $187.3 million). This reflected positive market conditions, particularly in the first quarter of the year, with higher volatility driving higher levels of client activity across the energy markets, and the inclusion of ED&F Man Capital Markets securities revenues in the last quarter of the year.

Ian Lowitt, Marex CEO, commented:

“We are delighted with these record results. The strong revenue growth reflects the increasing demand from our clients, who recognise our deep expertise and ability to deliver quality service and solutions.

“We remain focused on our strategic growth initiatives, which are diversifying our business by adding products to our service segments and expanding geographically. A particular highlight this year has been the acquisition of the ED&F Man Capital Markets business, which materially expands our footprint, expertise and clients across the world.

“This is a very exciting time for Marex, and I’d like to thank our people for their commitment to delivering excellent service for clients through a volatile year. The outlook for Marex is very positive, we have had a strong start to 2023 and I am confident that we can continue to deliver sustainable growth and build an even more diversified, resilient and dynamic firm.”