Murphy Oil said on April 5, 2023 that its board of directors declared a regular

quarterly dividend of $0.28 per share ($1.10 annualized).

Previously, the company paid $0.28 per share.

Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend.

Shareholders of record as of May 15, 2023

will receive the payment on June 1, 2023.

At the current share price of $39.00 / share,

the stock’s dividend yield is 2.82%.

Looking back five years and taking a sample every week, the average dividend yield has been

3.48%,

the lowest has been 1.37%,

and the highest has been 18.87%.

The standard deviation of yields is 2.01 (n=237).

The current dividend yield is

0.33 standard deviations

below

the historical average.

Additionally, the company’s dividend payout ratio is 0.18.

The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0)

means 100% of the company’s income is paid in a dividend.

A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend – not a

healthy situation.

Companies with few growth prospects are expected to pay out most of their income in dividends, which typically

means a payout ratio between 0.5 and 1.0.

Companies with good growth prospects are expected to retain some earnings in order to invest

in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 1.20%,

demonstrating that it has increased its dividend over time.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can

do it easily with Fintel’s Dividend Capture Calendar.

What is the Fund Sentiment?

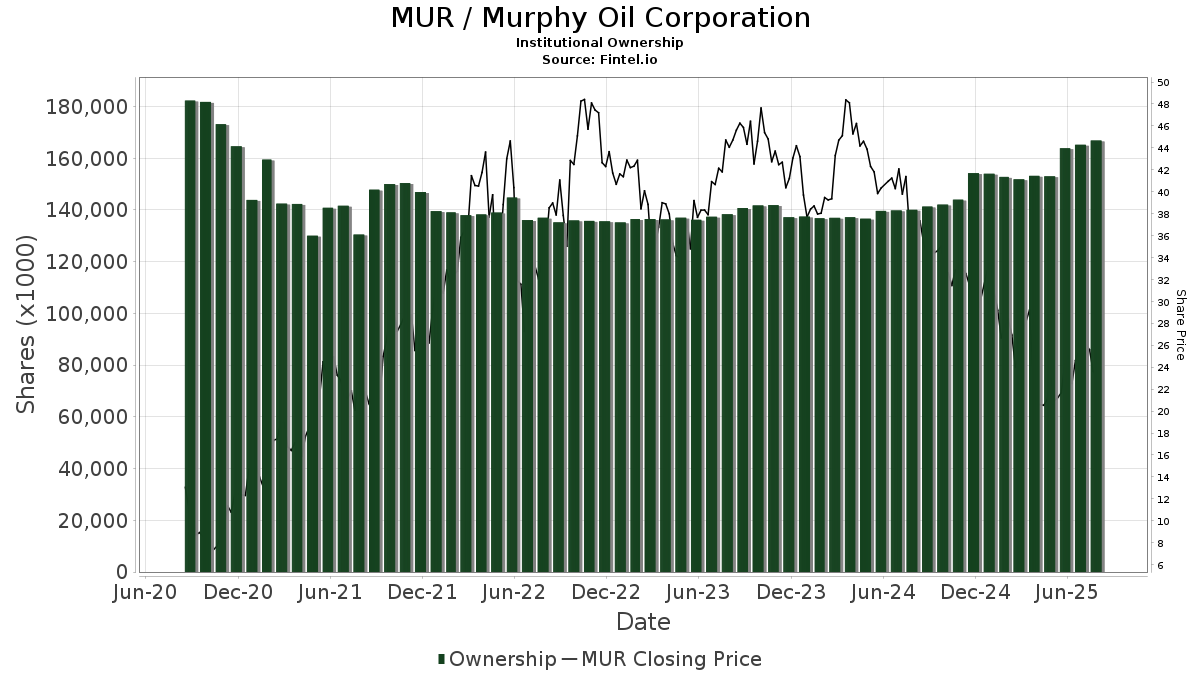

There are 796 funds or institutions reporting positions in Murphy Oil.

This is an increase

of

49

owner(s) or 6.56% in the last quarter.

Average portfolio weight of all funds dedicated to MUR is 0.26%,

an increase

of 7.87%.

Total shares owned by institutions increased

in the last three months by 1.44% to 137,130K shares.

The put/call ratio of MUR is 1.00, indicating a

bullish

outlook.

Analyst Price Forecast Suggests 27.22% Upside

As of April 6, 2023,

the average one-year price target for Murphy Oil is $49.62.

The forecasts range from a low of $34.34 to a high of $64.05.

The average price target represents an increase of 27.22% from its latest reported closing price of $39.00.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Murphy Oil

is $4,198MM, an increase of 7.65%.

The projected annual non-GAAP EPS

is $7.78.

What are Other Shareholders Doing?

QSMLX – AQR Small Cap Multi-Style Fund Class I

holds 8K shares

representing 0.01% ownership of the company.

No change in the last quarter.

Profunds – Profund Vp Mid-cap Growth

holds 2K shares

representing 0.00% ownership of the company.

In it’s prior filing, the firm reported owning 2K shares, representing

an increase

of 1.73%.

The firm

increased

its portfolio allocation in MUR by 16.55% over the last quarter.

BBVSX – Bridge Builder Small

holds 24K shares

representing 0.02% ownership of the company.

In it’s prior filing, the firm reported owning 32K shares, representing

a decrease

of 35.42%.

The firm

decreased

its portfolio allocation in MUR by 13.64% over the last quarter.

NORTHWESTERN MUTUAL SERIES FUND INC – Index 400 Stock Portfolio

holds 80K shares

representing 0.05% ownership of the company.

In it’s prior filing, the firm reported owning 79K shares, representing

an increase

of 0.61%.

The firm

increased

its portfolio allocation in MUR by 12.34% over the last quarter.

PMAIX – Pioneer Multi-Asset Income Fund :

holds 43K shares

representing 0.03% ownership of the company.

No change in the last quarter.

Murphy Oil Background Information

(This description is provided by the company.)

As an independent oil and natural gas exploration and production company, Murphy Oil Corporation believes in providing energy that empowers people by doing right always, staying with it and thinking beyond possible. Murphy challenges the norm, taps into its strong legacy and uses its foresight and financial discipline to deliver inspired energy solutions. The company sees a future where it is an industry leader who is positively impacting lives for the next 100 years and beyond.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.