Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the second quarter of 2023.

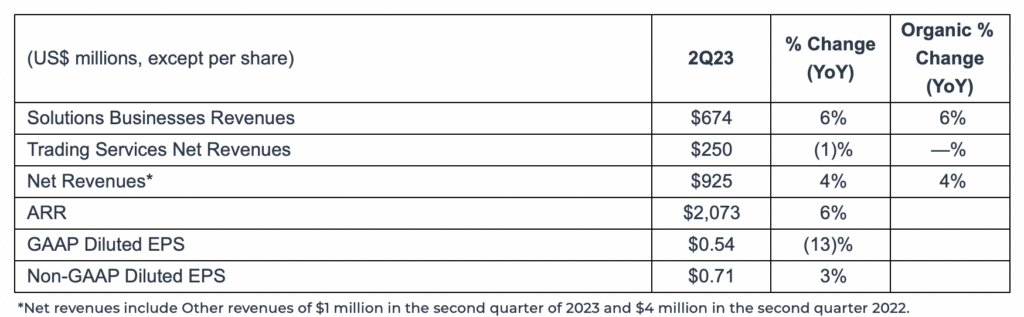

Second quarter 2023 net revenues were $925 million, an increase of $32 million, or 4%, from $893 million in the prior year period. Net revenues reflected a $36 million, or 4%, positive impact from organic growth, including positive contributions from all segments, partially offset by a $2 million decrease from the impact of changes in FX rates and a $2 million decrease from the net impact of an acquisition and divestiture.

Solutions Businesses revenues were $674 million in the second quarter of 2023, an increase of $37 million, or 6% with organic growth also of 6%. ARR, which reflects the majority of the Solutions Businesses revenues and excludes the AUM and transaction licensing components of Index, increased 6% from the prior year period.

Trading Services net revenues were $250 million in the second quarter of 2023, a decrease of $2 million, or 1%. The decrease reflects flat organic growth and a $2 million negative impact from changes in FX rates.

Second quarter 2023 GAAP operating expenses increased $62 million, or 13%, versus the prior year period. The increase primarily reflects higher merger and strategic initiatives expense related to the Adenza acquisition, higher restructuring expenses associated with the launch of Nasdaq’s divisional alignment program in the fourth quarter of 2022, and higher employee compensation costs, partially offset by lower general and administrative expense.

The company did not repurchase any of its common stock during the second quarter of 2023. As of June 30, 2023, there was $491 million remaining under the board authorized share repurchase program.

Ann Dennison, Executive Vice President and CFO said:

“Our solid financial performance in the second quarter reflects the durability and recurring nature of our business and the resilient demand for our diversified set of client solutions.

In June, we secured $5 billion in bond financing for the Adenza acquisition at favorable rates and saw exceptional demand for our multi-currency global debt offerings. Our consistent cash flow generation makes Nasdaq well positioned to execute our deleveraging plan while making focused, organic investments that advance our strategy, while executing our dividend growth and share repurchase strategies.”