Online trading company Plus500 Ltd (LON:PLUS) today provided a trading update for the three months ended 31 March 2023.

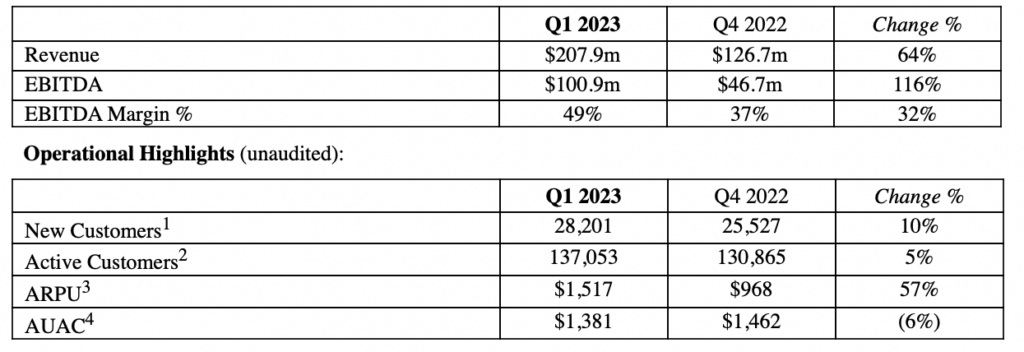

Revenue in Q1 2023 was $207.9 million (Q4 2022: $126.7m). Customer Income, a key measure of the Group’s underlying performance, remained consistently strong at $157.8m in Q1 2023 (Q4 2022: $150.4m). Customer Trading Performance6 during Q1 2023 stood at $50.1m, (Q4 2022: ($23.7m)).

The company continues to expect that the contribution from Customer Trading Performance will be broadly neutral over time.

EBITDA in Q1 2023 was $100.9 million (Q4 2022: $46.7m) with an EBITDA margin of 49% (Q4 2022: 37%).

Plus500 onboarded 28,201 New Customers in Q1 2023 (Q4 2022: 25,527) and the number of Active Customers reached 137,053 (Q4 2022: 130,865).

The Group’s marketing initiatives included the second phase of its major bespoke global advertising campaign, featuring actor Kiefer Sutherland, to build brand awareness in key strategic markets. This second phase, international, multi-channel advertising campaign commenced in Q1 2023 and focused on the launch of ‘+Insights’, Plus500’s proprietary big-data, analytical tool designed to provide OTC customers with access to real-time and historical trends, based on Plus500’s registered customer base of more than 24 million registered customers.

ARPU increased significantly in Q1 2023 to a level of $1,517 (Q4 2022: $968), and Active Customer levels remained consistent with previous periods.

Average user acquisition cost (AUAC) in Q1 2023 was $1,381 (Q4 2022: $1,462). The Group continues to expect that AUAC will rise steadily over time, as the Group’s customer profile further shifts to higher value, long term customers.

The Company repurchased 2,264,910 shares in Q1 2023, at an average price of £18.11, for a total cash consideration of $49.6m, as part of its most recent share buyback programme to purchase up to $70.0m of the Company’s shares, and its previous share buyback programme, announced at the Company’s interim results on 17 August 2022 and completed on 27 February 2023, to purchase up to $60.2m of the Company’s shares.

Plus500 continued to make headway against its strategic roadmap in Q1 2023, with the objective of further developing its position as a diversified, global multi-asset fintech group.

The Group continued to optimise its growing position in the substantial futures market in the US, supported by Plus500’s best-in-class technology, its robust financial position and on-going operational investment.

During Q1 2023, Plus500 made progress in developing its B2B line of business and strategic position as a market infrastructure provider, delivering brokerage-execution and clearing services for institutional clients, driven by the Group’s operational capabilities, proprietary technology and well-established financial position.

Following the launch of ‘TradeSniper’ in Q3 2022, Plus500’s B2C proprietary trading platform, specifically tailored for the sizeable US futures retail trading market, the Company subsequently launched in Q1 2023, ‘Plus500 Futures’, a new proprietary trading platform for the US futures retail trading market. ‘Plus500 Futures’ and ‘TradeSniper’ uniquely offer US customers a fully holistic solution of onboarding, depositing and trading on futures contracts, and will continue to be developed by Plus500 to ensure a consistent best-in-class experience is delivered for customers.

As part of the Board’s strategy to further diversify its geographical footprint, the Group continues to target a number of new potential markets to expand its existing OTC product offering. In February 2023, the Group obtained a licence in the United Arab Emirates, granted by the Dubai Financial Services Authority (DFSA), offering a major potential growth opportunity for Plus500. The Group’s operation in the UAE is already fully functioning and the Group has made rapid progress in developing its market position and offering for customers in this significant and high growth market.

For FY 2023, the Board continues to expect that Plus500’s performance will be in line with current market expectations, with the Group expected to deliver sustainable growth over the medium to long term.

David Zruia, Chief Executive Officer of Plus500, commented:

“Plus500 produced another strong performance in Q1 2023, again driven by our unique proprietary technology stack proposition, which attracts and retains higher value customers over the long term. We have a range of extremely exciting strategic growth opportunities ahead of us, particularly in the US futures market, enabling us to accelerate our development as a diversified, global multi-asset fintech group with a highly valuable customer base and market leading capabilities.

Supported by further organic investments and targeted acquisitions, we remain confident that Plus500 is well-positioned to deliver sustainable growth and strong, consistent returns over the medium to long-term.”