State Street Corporation (NYSE:STT) reported its second-quarter 2023 financial results today.

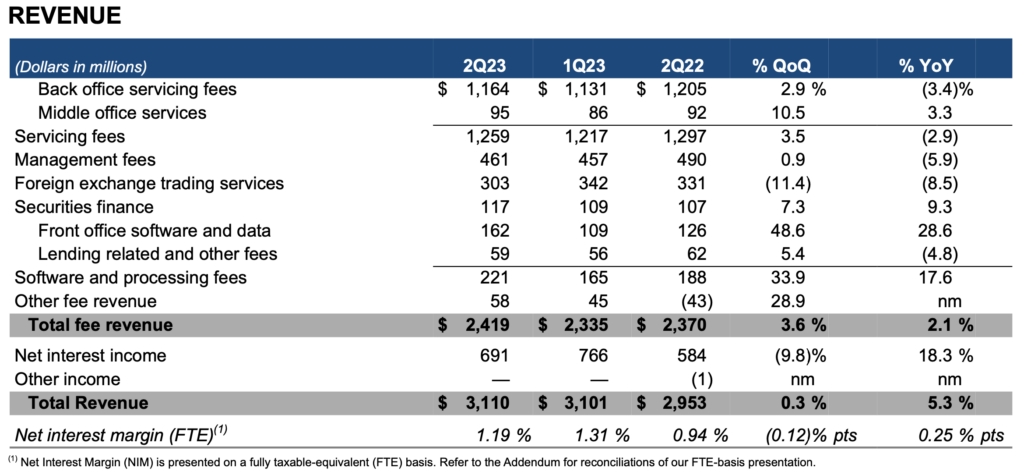

Foreign exchange trading services decreased 8% and 11% compared to 2Q22 and 1Q23, respectively, primarily reflecting lower client FX volumes and FX volatility. The result for the second quarter of 2023 was $303 million.

Total revenue increased by 5%, driven by NII growth of 18% and Fee revenue growth of 2%, reflecting stronger Front office software and data revenue, Securities lending revenue, and Other fee revenue, partially offset by lower Back office servicing fees, Management fees, and FX trading services revenue.

Net interest income (NII) increased 18% compared to 2Q22, primarily due to higher short-term market rates from global central bank hikes, an increase in long-term interest rates and balance sheet positioning, partially offset by lower average deposits. Compared to 1Q23, NII decreased 10%, primarily driven by lower average non-interest bearing deposit balances, partially offset by higher short-term market rates from international central bank hikes.

Ron O’Hanley, Chairman and Chief Executive Officer, commented:

“Our second-quarter results reflect the strength of our business model year-over-year as strong net interest income growth, a significant expansion in front office solutions and higher securities finance revenue contributed to improved EPS and ROE. Quarter-over-quarter we saw good fee momentum across a number of our businesses, helped by accelerated onboarding of our to- be-installed AUC/A pipeline, while we continued to invest and serve our clients.”