Retail investors threw their weight behind AI-related stocks in Q2 while also flocking to Manchester Utd in anticipation of the long-awaited sale of the club, according to the latest quarterly stocks data from trading and investing platform eToro.

Retail investors also continued to reap the rewards for their sustained loyalty to big tech, with the sector recovering further ground in Q2.

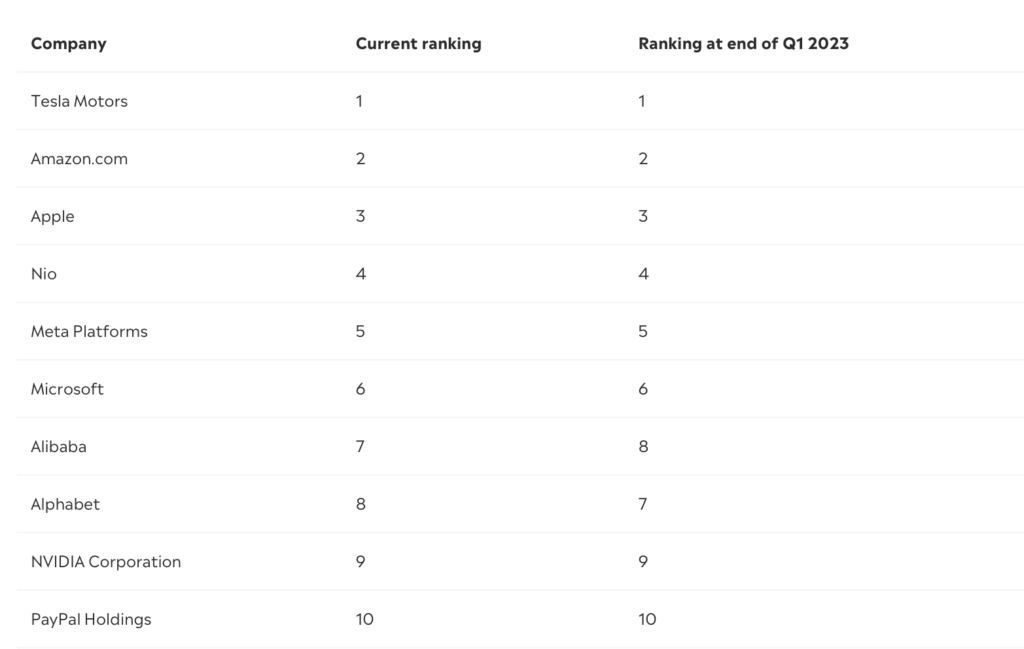

eToro looked at which companies saw the biggest proportionate change in holders at the end of Q2 versus the end of Q1, while also looking at the 10 most widely held stocks on the platform.

The list of most widely held stocks was led by Tesla, Amazon and Apple, all of which have seen huge share price improvements this year, with Tesla’s share price up 131% year-to-date. Others in this list include NVIDIA (+193% share price ytd), Meta (+76% share price ytd).

Amongst the 10 ‘biggest risers’, several companies relating to AI make the list, as retail investors have looked to benefit from the explosion of this sector. The number of global eToro users holding C3.ai jumped 96% quarter-on-quarter, whilst Koninklijke Philips saw a 69% increase in holders, after launching new AI-powered software in May.

Another stock which saw a significant jump in holders in Q2 was Manchester United, up 21%, with retail investors clearly hoping to benefit from the club’s expected sale. Meanwhile investors also looked to buy the dip on a number of stocks that suffered share price falls this year including Nikola, Enphase and CVS.

Commenting on the data, eToro’s Global Market Strategist Ben Laidler, said:

“Retail investors have been in pole position for the dramatic big tech rally this year, and ahead frankly of most institutional investors. The so-called ‘magnificent seven’ tech stocks are all amongst the top ten most widely held on the platform.”

At the other end of the spectrum, it was a fairly mixed bag in terms of the stocks that lost popularity. EA came second on the fallers list, losing 14% of holders on the eToro platform in Q2, whilst Royal Caribbean Cruises lost 11%, possibly a result of retail investors cashing in following significant share price gains from this stock.

Laidler adds:

“China’s Meituan topping the list of stocks losing holders last quarter is symptomatic of the disappointment in the local economy’s reopening rebound, with China’s stock market one of the worst performers last quarter, sitting out the global rally. We also see investors being proactive within their continued love affair with tech, by trimming back on heavyweights Meta and Netflix”