Is real estate the next shoe to drop, or can the well-publicized risks be hedged? The trickle-down could have significant effects on inflation and how we run through the inevitable recession. The bottom line: can, or should, the government reset the rules for real estate debt, so it holds Humpy Dumpty together?

In the ETF Think Tank we often hear from advisors that they place real estate, a multi-trillion-dollar asset class, in their alternatives bucket. Real estate may be an alternative to fixed income and straight-up equities, but we believe it should be viewed as its own sector or asset category, not managed in the alternatives. Moreover, those investors who are overweighted in personal real estate should be especially wary of gaining additional exposure. Risks associated with higher interest rates, less institutional interest reflected by investor “gates,” and the need to reset leverage in a concentrated set of regional bank books may make this category especially vulnerable, in our judgement. Those who missed it should check out the December 2022 Get Think Tanked Armada Discussion with various real estate experts, including Phil Bak, David Auerbach, John Guinee, and Chris Volk.

[wce_code id=192]

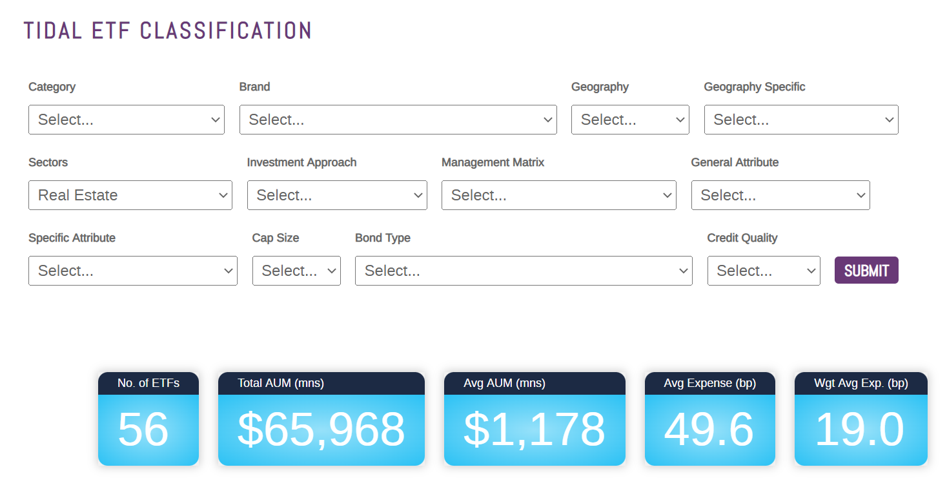

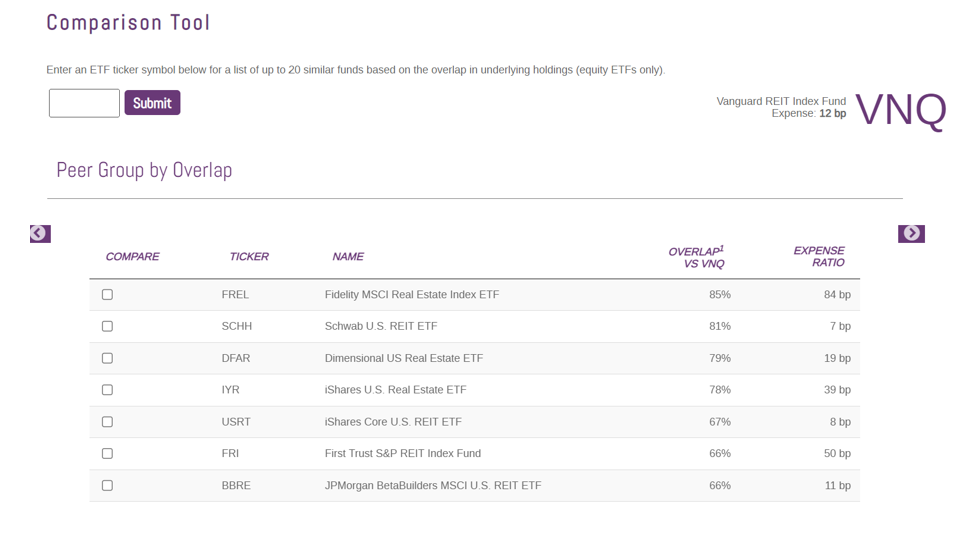

There are 56 ETFs with about $66.968 billion in broad exposure that includes real estate service companies, REITS, and development companies. The largest real estate ETF is the Vanguard Real Estate ETF (VNQ), with almost $31 billion in assets. The fund returned a negative 26.21% as of (See Vanguard 12-31-22 Factsheet). In 2022, the Direxion Daily Bear 3x Real Estate ETF (DRV) was the best performing fund in the category, up 68.50% (as of Comparison 12-31-22 Factsheet). This, of course, directionally parallels the Direxion Daily Bull 3x Real Estate ETF (DRN) – the worst performing fund, which was down 67.24% (as of Fact Sheet 12-31-22 ). Given the structure of 3x leverage, daily resetting, and the fact that returns are not likely to be linear in nature, the returns almost never inversely match. To learn more, investors are especially encouraged to read the prospectus and check out Direxion University. Leveraged Funds are geared to be traded, and not right for every investor.

Free Money has Consequences on $1.5 Trillion

Investors concerned about the regional bank model should be aware that in an effort to reach yield and lock in with long duration bonds, certain regional banks became over exposed to commercial real estate loans. According to Bank of America, US regional banks account for 68% of commercial real estate loans. There is nearly $450 billion in commercial real estate loans maturing in 2023, and this is just the beginning. In fact, Scott Rechler points out during a CNBC interview that $1.5 trillion of commercial loans need to be refinanced over the next 3 years, which will require restructuring the economics, and more equity. Those on Twitter should check out Scott’s feed discussing the problem. All this leads us to ask: what is the solution to the 40-year treasury bubble storm that is building on the weaknesses of a multi-trillion-dollar asset class? Could there be a need for the government to create a next generation Resolution Trust Corporation (RTC) agency? Institutional ownership, including pensions and charitable foundations, are overexposed to this very long-term “alternative” asset class. Most importantly, the fall-out in the banking space would be monumental. An RTC solution would be unwanted as a political solution, but controlling the process with a defined entity and mandate would help build confidence. Bottom line, ignoring this ticking time bomb cannot be the answer.

The Government Owns the Problem

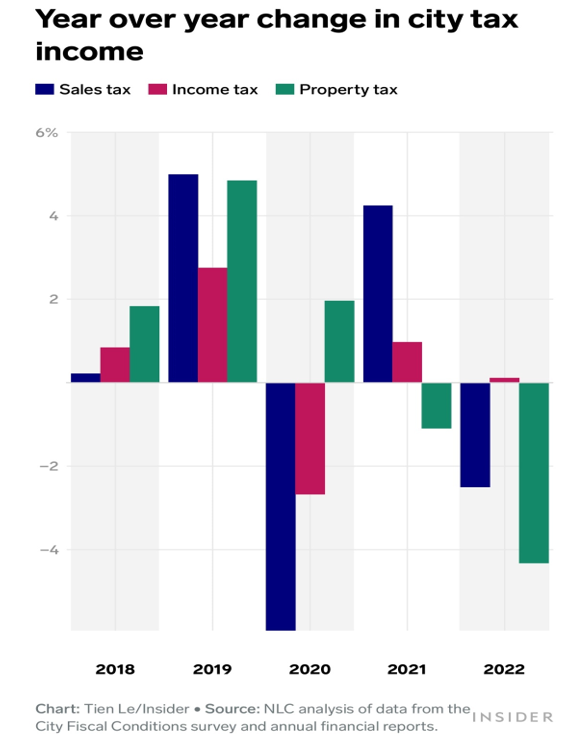

An article written by Emil Skandul highlights how commercial real estate may never come back to the 95% occupancy levels that it once enjoyed. It was at 47%, as of December 2022 (see article The Office Apocalypse Is Upon Us). The article highlights that a lower occupancy level has a domino effect on local businesses, with lower revenues for cities that are dependent on tax dollars received from sales, income, and property taxes. Skeptics may argue that plugging a hole in the dam by socializing our financial system further rewards those who took risks by capitalizing the opportunity of free money and is not solving the long-term problem. “Too big to fail” never sells well in politics! However, as this article points out, the trickle-down effect may just be too large to ignore. In a twist of irony, this is an optimistic rationale for why investors with an overly bearish outlook may be proven wrong. Sure, substantially lower valuations will lead to the repricing of real estate property, and thus new equity may replace, dilute, or even wipe out original optimistic investors. That does not mean that the debt is not good money. Alternatively, we could do as some say – “Extend and Pretend.” Arguably, this is why a new RTC enterprise could be impactful. We need to acknowledge the problem with a formal solution – an enterprise with a clear mandate.

As ETF investors looking at the 56 funds in the real estate space, we would highlight the following.

First, bigger is not necessarily better. Let’s face it – investing in REITS right now is a credit decision, and market cap weighting, at this point in the cycle, is only going to be buying the most obvious opportunities and hoping “too big to fail” works out. We would also recommend monitoring the impacts from outflows in the bigger funds. These ETFs have high ownership concentration in the top 10 names, and certain stocks like Office Properties Income Trust (OPI) are overowned by ETFs.

Second, niche opportunities may offer additional upside and yield.

Third, under the current environment, bond funds focused on the area could offer a more relatively stable investment and should be monitored in terms of widening credit spreads. BondBloxx has an interesting suite of ETFs, and even a targeted ETF to fill this role. https://bondbloxxetf.com/bondbloxx-usd-high-yield-bond-financial-and-reit-sector-etf/ Another interesting ETF to monitor closely is DWS’s Municipal Infrastructure Revenue Bond ETF (RVNU). Revenue bonds may be under pressure as a result of real estate occupancies being down, but protecting such credits will be of paramount importance!

Summary

We like to believe that as a Think Tank, we can encourage big ideas to solve big problems, even if they are controversial. Arguably, bringing back the Resolution Trust Company (RTC) as an agency is such an idea, but ignoring the problem is for sure worse. Trillions of dollars are at stake, and while politically controversial, it could be the first step to forming a good plan. We acknowledge that such an idea might be like kicking the can down the road and further socializing our banking system. Unfortunately, in the absence of a plan or even acknowledgement, we see further risk of a recession becoming extended or deep. Haven’t we taught our children that “extend and pretend” is a bad thing?

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalizedinvestment advice The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.