On April 14, 2023 at 09:44:47 ET an unusually large

$2,953.47K block of Put contracts in Snowflake

(SNOW) was sold,

with a strike price of $140.00 / share, expiring in 98 day(s) (on July 21, 2023).

Fintel tracks all large options trades, and the premium spent on this trade was 1.87 sigmas above the mean, placing it in the 86.25th percentile of all recent large trades made in SNOW options.

This trade was first picked up on Fintel’s real time Unusual Option Trades

tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

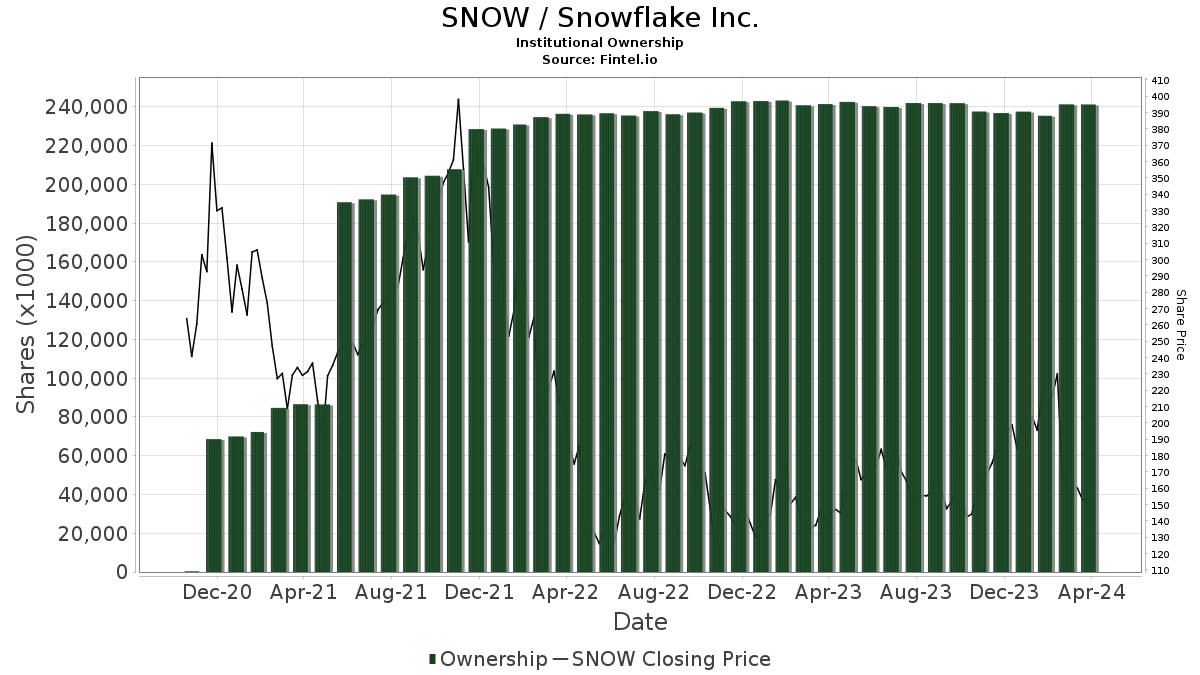

There are 1504 funds or institutions reporting positions in Snowflake.

This is a decrease

of

21

owner(s) or 1.38% in the last quarter.

Average portfolio weight of all funds dedicated to SNOW is 0.70%,

a decrease

of 18.57%.

Total shares owned by institutions decreased

in the last three months by 1.12% to 240,451K shares.

The put/call ratio of SNOW is 0.92, indicating a

bullish

outlook.

Analyst Price Forecast Suggests 30.34% Upside

As of April 6, 2023,

the average one-year price target for Snowflake is $184.28.

The forecasts range from a low of $106.05 to a high of $525.00.

The average price target represents an increase of 30.34% from its latest reported closing price of $141.38.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Snowflake

is $3,066MM, an increase of 48.43%.

The projected annual non-GAAP EPS

is $0.49.

What are Other Shareholders Doing?

FBCG – Fidelity Blue Chip Growth ETF

holds 3K shares

representing 0.00% ownership of the company.

In it’s prior filing, the firm reported owning 2K shares, representing

an increase

of 15.25%.

The firm

decreased

its portfolio allocation in SNOW by 9.49% over the last quarter.

Sumitomo Mitsui Trust Holdings

holds 657K shares

representing 0.20% ownership of the company.

In it’s prior filing, the firm reported owning 662K shares, representing

a decrease

of 0.87%.

The firm

decreased

its portfolio allocation in SNOW by 99.92% over the last quarter.

Beaird Harris Wealth Management

holds 0K shares

representing 0.00% ownership of the company.

In it’s prior filing, the firm reported owning 0K shares, representing

an increase

of 100.00%.

Hartline Investment

holds 52K shares

representing 0.02% ownership of the company.

In it’s prior filing, the firm reported owning 0K shares, representing

an increase

of 100.00%.

ALVOX – Alger Capital Appreciation Portfolio Class S

holds 25K shares

representing 0.01% ownership of the company.

In it’s prior filing, the firm reported owning 16K shares, representing

an increase

of 35.81%.

The firm

increased

its portfolio allocation in SNOW by 77.69% over the last quarter.

Snowflake Background Information

(This description is provided by the company.)

Snowflake Inc. is a cloud computing-based data warehousing company based in San Mateo, California. It was founded in July 2012 and was publicly launched in October 2014 after two years in stealth mode. The company’s name was chosen as a tribute to the founders’ love of winter sports.

See all Snowflake regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.