International funds offered by domestic mutual funds have delivered impressive returns in recent years, effectively diversifying portfolios for Indian investors. However, regulatory constraints on foreign stock investments by these funds present significant obstacles for investors.

Among the 74 dedicated international funds, only some are open for subscriptions at any given point in time, based on available regulatory headroom. Often investors find funds open at market highs but closed when they want to capitalise on a decline. The recent six-month correction in Indian markets has lowered valuations in segments such as large-cap stocks to more reasonable levels in India.

Some sector indices have retreated by up to 30 per cent, while the Nifty 50 has declined 10 per cent from its September 2024 peak, bringing its P/E ratio down from 24.3 to 20. The domestically-driven and politically stable Indian economy also seems a safer bet than the US, in these times of high uncertainty.

For investors seeking international exposure from India, prospects for the US have turned more cloudy due to trade policy uncertainty, expectations of a slowdown, and a reassessment of prospects for the still-expensive tech sector. Chinese equities have become more attractive with policy support and economic stabilisation, while European markets benefit from cooling inflation, potential ECB rate cuts, and resilient growth.

All this calls for a shift in strategy for Indian investors seeking global diversification. Rather than bet on Nasdaq or US-focused funds at this juncture, funds which combine 65 per cent domestic equities with upto 35 per cent international stocks seem a safer bet.

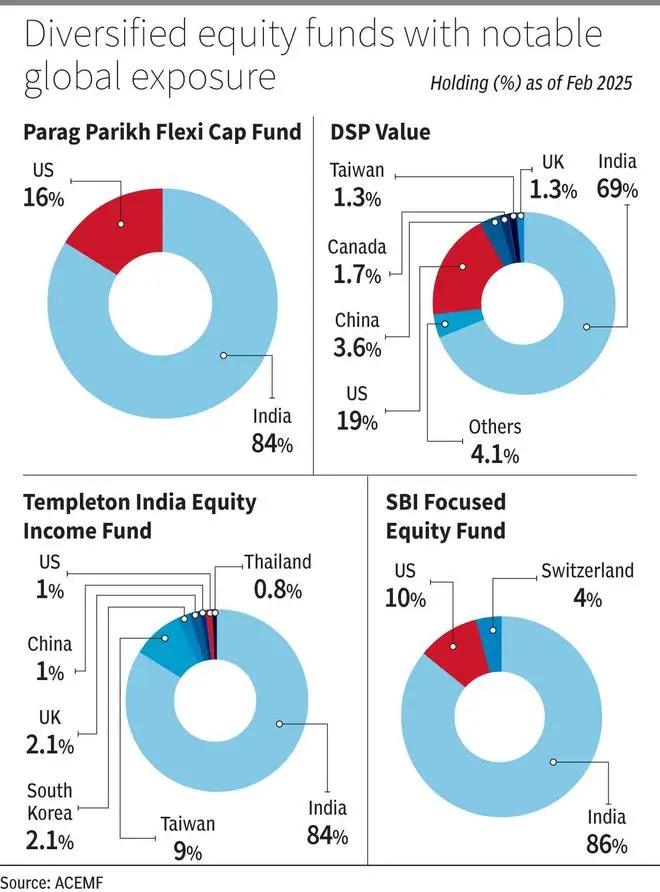

Currently there are 47 funds that allocate at least 65 per cent to Indian equities while diversifying a portion of their assets internationally.

These funds strategically maintain a minimum 65 per cent allocation to domestic equities for a favourable tax treatment compared to dedicated international funds.

We cherry-picked the following four funds which adopt value and quality investment approaches while diversifying across global markets, styles which could work well in a risk-averse market. Funds following the value style perform well during market corrections by investing in fundamentally strong yet undervalued stocks and quality funds tend to focus on companies with solid balance sheets and strong cash flows.

Parag Parikh Flexi Cap Fund

This fund has distinguished itself in the flexicap category by delivering consistent long-term returns. Its value investment approach, strategic international allocation and well-timed cash positions have made it a category leader. Historically, up to 30 per cent of its portfolio was invested internationally, though this allocation varies based on market conditions and regulations. Over the past five years, its international exposure has grown dramatically from ₹568 crore to ₹11,352 crore as of February 2025. The fund primarily invests in prominent US technology companies including Alphabet, Amazon, Facebook, and Microsoft. However, its international stock allocation has decreased from 30 per cent to 12 per cent over the past three years. The fund’s five-year annual return of 29 per cent has outperformed the category average of 23 per cent.

Templeton India Equity Income Fund

It targets companies offering attractive dividend yields between 3-5 per cent annually, selecting opportunities from both domestic and international markets. High-dividend-yield stocks are often from stable, well-established companies, making them less volatile and more resilient during market downturns. Its international exposure has fluctuated between 12-19 per cent over five years (currently 13 per cent), though it can invest up to 50 per cent internationally. The fund invests mainly on emerging markets like China, Korea, and Taiwan. Its top three international holdings are MediaTek, Novatek Microelectronics Corp, and Hon Hai Precision Industry. Over five years, it has delivered an annual return of 31 per cent, surpassing the category average of 28 per cent.

DSP Value Fund

Launched in December 2020, it employs a strategic allocation of two-thirds Indian equities and one-third international investments. The fund adheres to a value-focused philosophy that prioritises quality companies at attractive valuations across all markets. Its international portfolio maintains broad diversification across multiple sectors including technology, healthcare, industrials, and energy, as well as regions including the US, Europe, China, Taiwan, and Canada. Current top international holdings include Berkshire Hathaway, Microsoft, Alibaba, Tencent, and Brookfield Corporation. Over three years, it has delivered an annual return of 15 per cent, slightly underperforming its category average of 16 per cent.

SBI Focused Equity Fund

The fund has consistently maintained international equity exposure between 5 and 15 per cent over the last five years. Its current overseas portfolio, representing about 13 per cent of total assets, is concentrated in three key holdings: Alphabet Inc A, EPAM Systems Inc, and Lonza Group AG. The management strategically increases international allocation when these markets offer more attractive valuation and liquidity profiles compared to domestic opportunities. Though recent performance has lagged somewhat due to its growth and quality-focused approach within a large-cap mandate, the fund’s long-term track record remains impressive, delivering a 10-year annualised return of 13 per cent that surpasses the category average of 12 per cent.