The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, and national competent authorities (NCAs) completed an analysis of the cross-border provision of investment services during 2022.

The data collected and analysed across 29 jurisdictions allows ESMA and NCAs to shed light on various aspects of the market for retail investors that receive investment services by credit institutions and investment firms established in other Member States.

Key findings of the data collection include:

- A total of around 380 firms provided services to retail clients on a cross-border basis in 2022. The majority of them (59%) are investment firms, while 41% are credit institutions.

- Approximately 7.6 million clients in the EU/EEA received investment services from firms located in other EU/EEA Member States in 2022.

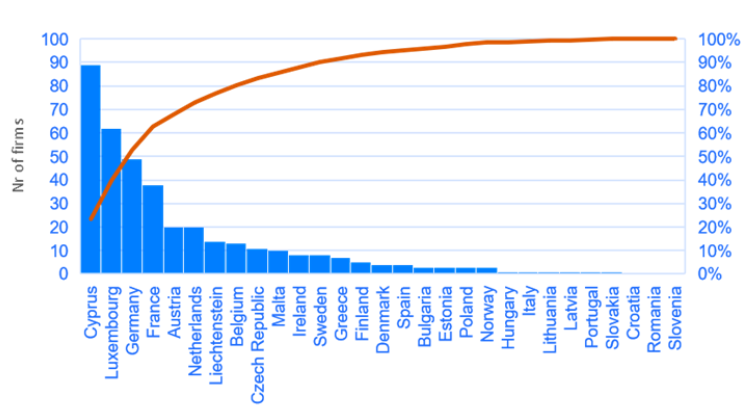

- In terms of number of firms, Cyprus is the primary location for firms providing cross-border investment services in the EU/EEA, accounting for 23% of the total firms passporting investment services. Luxembourg and Germany follow with 16% and 13% of all firms, respectively.

- Looking at the number of EU/EEA retail clients receiving cross-border investment services, more than 75% are served by firms based in three jurisdictions: Cyprus, Germany, and Sweden. Cyprus-based firms reported activity to around 2.5 million cross-border retail clients, German-based firms to around 2 million retail clients and Sweden-based firms to more than 1 million retail clients. All other firms in the scope of the exercise reported a total of around 1.8 million cross-border retail clients, accounting for about a quarter of the total number of retail clients.

- The average number of cross-border retail clients per firm varied from 189 (for the only firm in Italy) to about 140,000 retail clients (for the 8 firms based in Sweden). Overall, the average number of retail clients per firm was about 19,000.

- As host Member States, Germany, Spain, France and Italy are the most significant destinations (in terms of number of retail clients) for investment firms providing services cross-border in other Member States.

Approximately 5,700 complaints were recorded by firms relating to the provision of cross-border investment services to retail clients in 2022. The number of complaints received is proportional to the number of clients served by firms providing cross-border investment services.

The data analysis highlighted that clients of cross-border investment services primarily lodged complaints about “terms of contract/fees/charges” and about “issues pertaining to general admin/customer services”. Fewer complaints were reported on the topics of “investment products not appropriate/suitable for the client” and “market event related”.

ESMA aims to continue performing the data collection exercise on annual basis and endeavours to publish a Report on the findings at the next iteration of the exercise in 2024.