Factor investing, which combines the prowess of active and passive investing into one, is gaining popularity in India. Also called smart beta or strategy-based investing, it aims to get higher returns than traditional market capitalisation-based indices.

The popular factors used in India are quality, value, alpha, low volatility, momentum and equal weight. NSE has launched about 45 factor-based indices (either single or multi-factor based). These indices are culled from conventional indices such as Nifty 50 and Nifty midcap 150 using a variety of fundamental, technical, and other filters.

Currently, 85 factor-based mutual funds are available in the market, currently. Not only mutual fund managers but also many PMS, AIFs, and large investors prefer building portfolios based on factor-based models.

Methodology

For instance, The Nifty 100 Low Volatility 30 index tracks the performance of 30 stocks in Nifty 100 with the lowest volatility in the last year. Standard Deviation is used to shortlist the stocks.

Similarly, the value factor aims to pick stocks with a lower stock price than their intrinsic value, , such as a PE ratio, while the quality factor aims to invest in stocks with strong fundamentals and profitability characteristics.

The momentum factor considers strong past performance in the last six months, whereas the alpha strategy captures stocks that have performed well recently and are expected to continue to outperform in the short to medium term.

Cyclical nature

The performance of smart beta funds is cyclical; they perform well at times and underperform at other times. For instance, the value strategy works well, particularly during recovery phases.

Low volatility stands to gain during uncertainties, while quality performs well during volatile or bear market cycles. Momentum gains its spot during a strongly trending bull market.

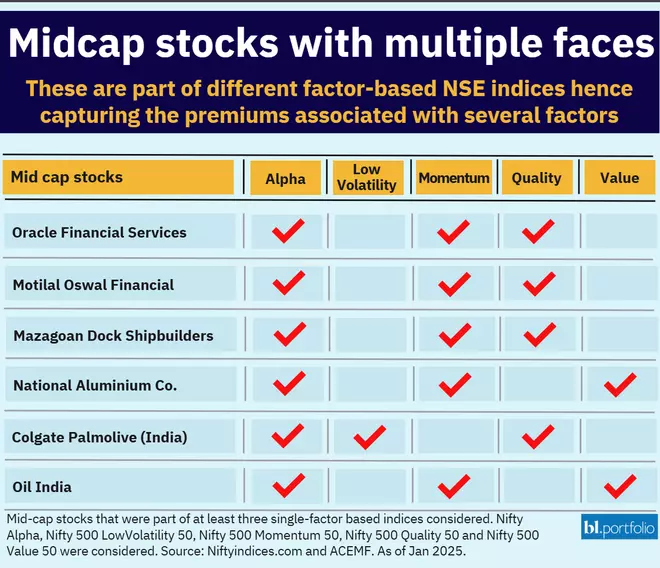

Given the different filtering processes, it is not common to see the same mid-cap stocks make their way into three different factor-based indices. However, six stocks have managed to do that.

Oracle Financial Services Software, Motilal Oswal Financial Services, Mazagoan Dock Shipbuilders, National Aluminium Co., Colgate Palmolive (India) and Oil India are the six midcap stocks that are part of at least three of the different single-factor-based NSE indices.

Midcap stocks that part of various factor-based indices

The indices considered for the study are Nifty Alpha, Nifty 500 LowVolatility 50, Nifty 500 Momentum 50, Nifty 500 Quality 50 and Nifty 500 Value 50. Data as of January 31, 2025. Source: Niftyindices.com and ACEMF.