A pioneering investment vehicle — Equity Linked Savings Schemes (ELSS) — was ushered into existence with the debut of the Magnum Taxgain Scheme (now called SBI Long Term Equity) in 1992-93.

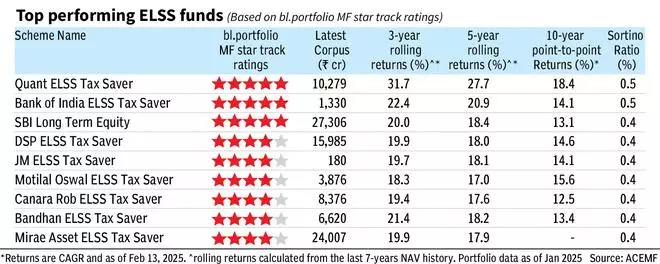

Boasting an impressive Assets Under Management (AUM) of ₹2.3 lakh crore and a robust base of 1.7 crore investor accounts, the ELSS category reigns supreme among the equity-oriented mutual fund segments. ELSS has been a proven category under Indian mutual funds that not only helped the investors to attain the tax benefits but also to generate wealth over time.

However, with the introduction of the optional new tax regime, the draw of ELSS as a tax-saving instrument seems reduced among investors. While other equity categories attracted considerable net-inflows of more than ₹50,000 crore in the last two years, ELSS category garnered only ₹4,663 crore during the same period.

With a majority of taxpayers now embracing the new tax regime, can ELSS continue to thrive in this evolving landscape?

ELSS has been a preferred instrument given its dual benefits of tax benefit and better returns. Under the old tax regime, investments in ELSS funds qualified for a tax deduction of up to ₹1.5 lakh under Section 80C. However, under the new tax regime, this benefit is no longer available.

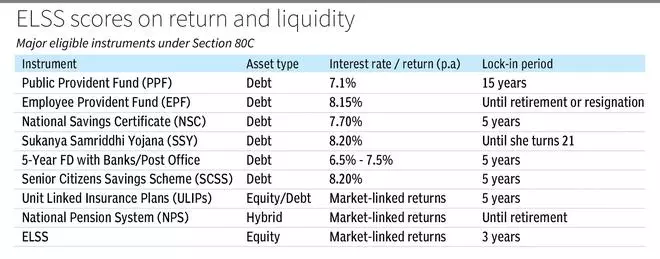

Many taxpayers, especially those in lower tax brackets, found the new regime more attractive due to lower tax rates, reducing the appeal of investing in ELSS for tax saving purpose. With the new tax regime offering lower rates, taxpayers began exploring other investment options that do not rely on Section 80C deductions. Instruments such as National Pension System (NPS) gain popularity as they offer equity-linked returns and tax benefits under different sections of the Income Tax Act.

Opting for ELSS

Even without the Section 80C tax benefit under the new tax regime, ELSS remains a compelling investment option due to their potential for high returns, tax efficiency on gains, and flexibility. They are particularly suitable for investors with a long-term horizon and a willingness to take on market risk for wealth creation. However, it is essential to align your investment decision with your financial goals, risk tolerance, and overall portfolio strategy.

Here is why

First, about, equity linked returns: ELSS schemes invest primarily in equities, which have historically delivered higher returns compared to traditional fixed-income instruments like PPF, NSC, or FDs over the long term. Equity markets tend to outperform inflation, making ELSS a good option for wealth creation.

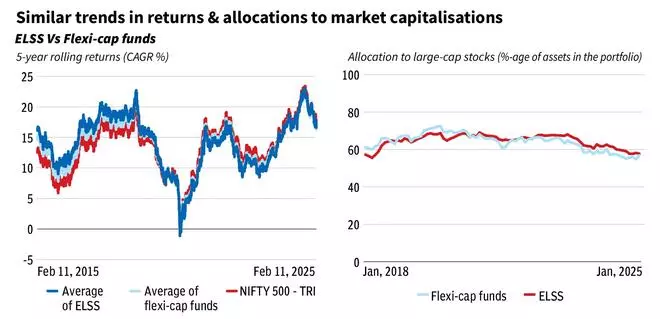

Second, ELSS is one of the better performing equity categories in mutual funds. Given its asset allocation pattern that are tilted more towards large-caps, ELSS can be compared with flexi-cap category. Both ELSS and flexi-cap category have delivered almost similar returns over the long run. For instance, the five-year rolling returns calculated from the last 15 years NAV history show that the ELSS category delivered compounded annualised return of 14 per cent while the flexi-cap category generated 13.9 per cent. Meanwhile, the Nifty 500 TRI gave 13.5 per cent. Regarding the market capitalisation allocation of ELSS schemes, approximately 90 per cent of the schemes in this category allocated more than 60 per cent of their investments to large-cap stocks over the last five years.

One of the benefits for ELSS fund managers is the flexibility to adopt a buy-and-hold investment strategy, thanks to the mandatory 3-year lock-in period. Many schemes in the category follow the buy and hold approach leading to lower churning ratio.

Thirdly, it has the shortest lock-in period among the crowded 80C basket. ELSS schemes have a 3-year lock-in period, which is the shortest among all Section 80C investment options whereas other instruments such as Public Provident Fund (PPF) and National Savings Certificate (NSE) have lock-ins of 15-years and 5 years respectively. This makes ELSS relatively more liquid compared to other long-term tax-saving instruments.

And finally, its tax efficiency on capital gains: While the Section 80C deduction is not available under the new tax regime, ELSS still enjoys favourable tax treatment on returns. Long-term gains from equity-oriented mutual funds including ELSS held for more than 12 months are taxed at 12.5 per cent on gains exceeding ₹1.25 lakh annually. This is still more tax-efficient than many other investment options, such as fixed deposits, where interest is fully taxable.

Better performing equity category in mutual funds

Shortest lock-in period among the crowded 80C basket

Tax efficiency on capital gains

ELSS funds are ideal for long-term financial goals such as retirement planning, children’s education, or buying a house. They are particularly suitable for investors with a long-term horizon and willingness to take on market risk for wealth creation. However, it is essential to align your investment decision with your financial goals, risk tolerance, and time horizon. Keep in mind that asset allocation should be in place while making your investments decisions.