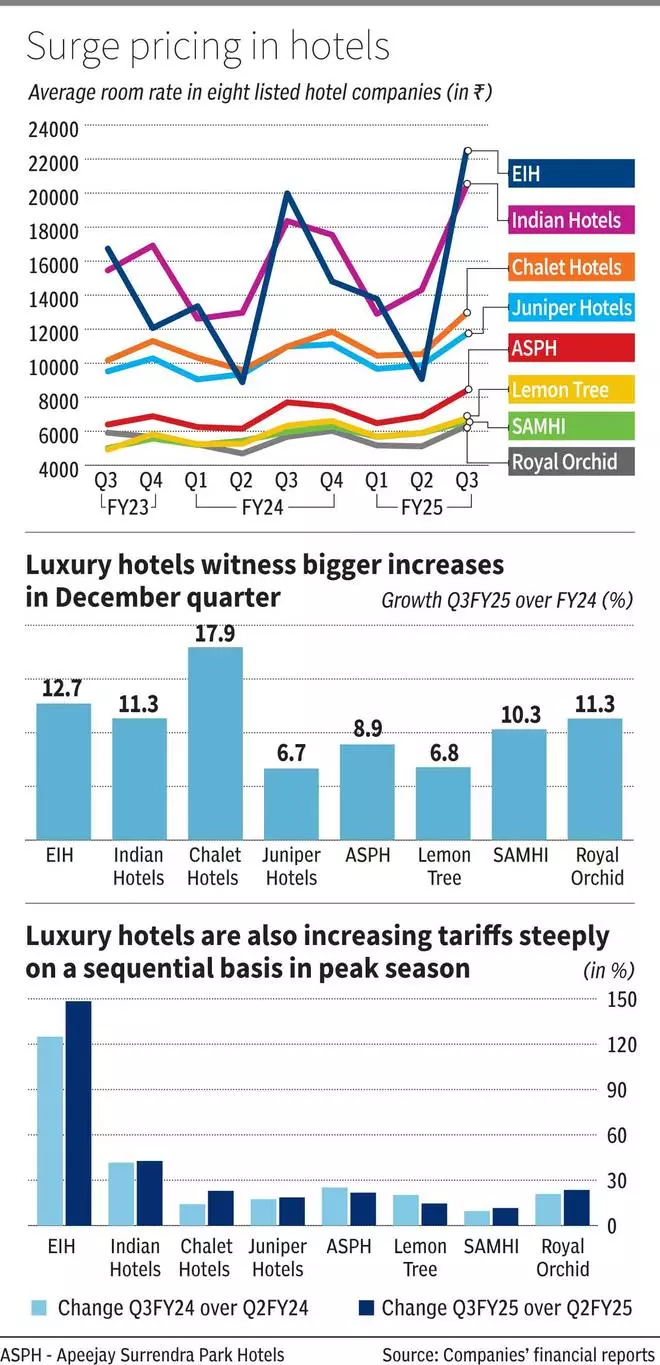

The strong growth in domestic tourism has resulted in the highest-ever average room rate (ARR) in the December quarter of 2024. A businessline analysis of eight of the largest hotel stocks shows that the luxury hotels have recorded a higher increase in the third quarter of this fiscal year, compared to the year-ago period. They also have the pricing power to hike prices sharply on a sequential basis.

EIH Associated Hotels Limited, Indian Hotels Company and Chalet Hotels have seen the highest year-on-year increase in ARR. EIH recorded an ARR of ₹19,985 in Q3 FY24, which increased to ₹22,526 in Q3 FY25 – up 12.7 per cent. Indian Hotels’ ARR rose 11.3 per cent while that of Chalet Hotels’ increased 17.9 per cent.

EIH and India Hotels are also hiking their room rates steeply in the December quarter – the peak tourist season. While EIH’s ARR went up 148 per cent sequentially in the December quarter of FY25, Indian Hotels’ ARR was up 42.7 per cent sequentially. Other large hotels hiked their ARR between 11 and 24 per cent on a sequential basis.

Driving factors

Atul Thakkar, Director – Investment Banker at Anand Rathi Advisors, pointed out that luxury hotels like EIH and Indian Hotels are at the top because of their strategic expansion, brand strength, prime locations, diversified offerings, asset-light models and financial prudence that pushed them to perform better.

The hospitality sector, luxury hotels in particular, is witnessing an uptick in demand across most operational parameters due to factors like rising domestic travel, events, banquet-related earnings, and other contributing elements.

Vikas Anand, Associate Director, India Ratings & Research explained, “All these companies generally cater to the upmarket segments, where there has been negligible supply over the last 4-5 years, especially during and after Covid. Given the demand resurgence, the existing hotels have benefitted from this. Foreign tourist demand has still not reached pre-Covid levels. This is further expected to boost demand for these hotels.”

Unbranded segment

“A lot of the budget hotels are in the unbranded segment, which is much larger but harder to track. It includes small boutique hotels, family-run guesthouses, and even Airbnbs. While these cater to a big chunk of travellers, they operate in a highly fragmented market, making it tough to get consistent data or metrics,” Thakkar added.

According to data from ICRA’s January 2025 report, ‘The Indian Hospitality Industry: Riding High, but What’s Next?,’ the projected ARR for FY25 is expected to range between ₹7,800 and ₹8,000, while the occupancy percentage is estimated to remain between 70 per cent and 72 per cent – the highest since FY11 when the ARR was ₹6,900 with a 61 per cent occupancy rate. Cities like Mumbai, Goa, and Jaipur are expected to record high ARR in FY25, ranging between ₹9,000 and ₹10,000, with occupancy rates in the 70-85 per cent range.