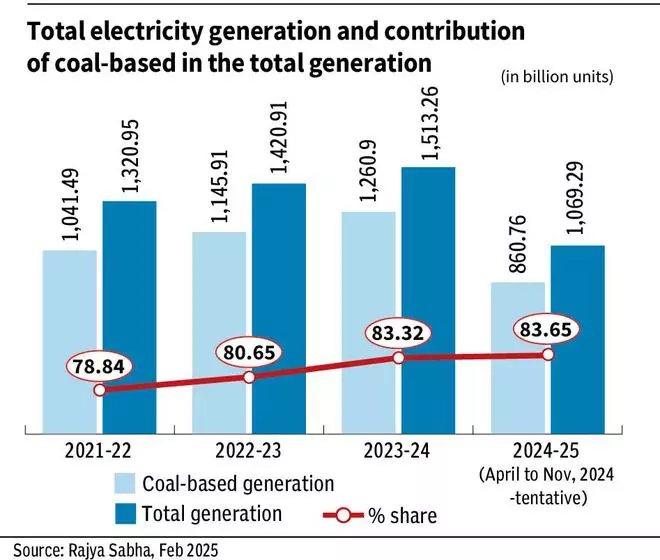

With the fifth-largest coal reserves globally and ranking as the second-largest consumer, coal remains a critical energy source in India. Approximately 74 per cent of India’s power generation depends on Thermal Power Plants (TPPs), predominantly fuelled by coal, underscoring the necessity for a robust and sustainable coal industry.

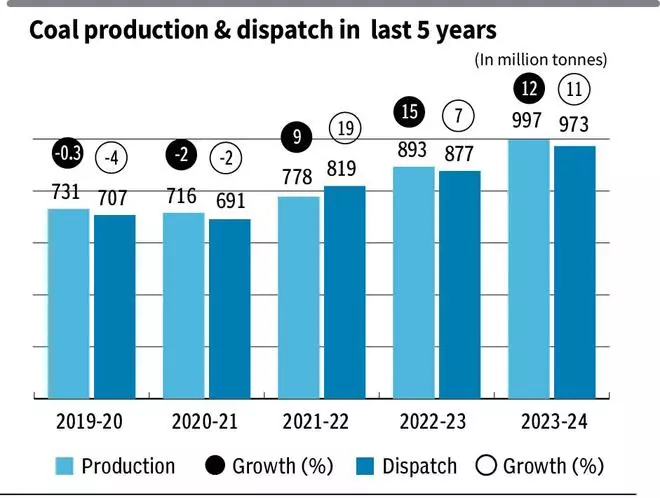

While domestic production has shown good traction in recent years, there is a need to further improve output to reduce reliance on imports.

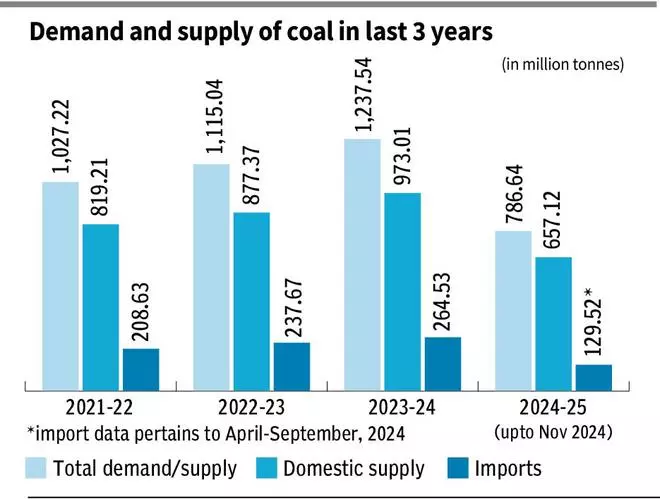

The demand-supply picture

India’s coal demand has witnessed a significant surge over the past three years, growing more than 20 per cent, from 1,027.22 million tonnes (mt) in 2021-22 to 1,237.54 mt in 2023-24, per the latest data by the Ministry of Coal and Mines. The current fiscal year, 2024-25, has already recorded 786.64 mt of coal demand till November 2024, accounting for 63.5 per cent of the previous year’s total. The consistent rise in coal demand has been matched by a steady increase in domestic supply but still, the dependency on imports remain a cause for concern.

In 2021-22, India produced 819.21 mt of coal, which grew by 7.1 per cent to 877.37 mt in 2022-23 and further increased by 10.9 per cent to 973.01 mt in 2023-24. This represents an overall rise of 18.8 per cent over the three years. In the current fiscal year, domestic coal supply has already reached 657.12 mt by November, which is 67.5 per cent of last year’s total, indicating a good pace of production that could surpass previous records by the end of the fiscal year.

At the same time, imports rose from 208.63 mt in 2021-22 to 237.67 mt in 2022-23, marking a 13.9 per cent increase, and further climbed to 264.53 mt in 2023-24, a growth of 11.3 per cent. However, the current fiscal year reflects a potential shift in this trend. As of November 2024, coal imports stood at 129.52 mt, just under 50 per cent of the previous year’s total.

The contribution of domestic coal to the overall supply mix has been increasing steadily. In 2021-22, domestic production accounted for 79.7 per cent of total coal supply, while imports made up 20.3 per cent. This ratio remained fairly stable over the next two years, with domestic coal comprising 78.7 per cent and 78.6 per cent of the total supply in 2022-23 and 2023-24, respectively. However, in 2024-25 (up to November), the share of domestic coal has risen to 83.6 per cent, while imports have declined to 16.4 per cent.

Despite the steady growth in domestic supply, the increase in coal demand raises concerns about the environmental impact, especially as India pushes towards its renewable energy targets. Notwithstanding the promotion of renewable energy, the rapid growth in electricity demand ensures thermal power will remain a crucial component of India’s energy mix, with its share projected to be 55 per cent by 2030 and 27 per cent by 2047. Comprehensive studies estimate that coal demand will rise to approximately 1,462 mt by 2030 and further increase to 1,755 mt by 2047.

Balancing the need for coal with commitments to sustainability remains a significant challenge. The data shows that the share of coal-based electricity generation is more than 80 per cent in the last three years.

Critical energy source

To meet these goals, the central government is setting targets. Data presented by the Ministry of Coal in Rajya Sabha this month revealed coal production targets for the next five years — categorised into Coal India Limited (CIL), Singareni Collieries Company Limited (SCCL), and Captive and other sources. The targets revealed a steady increase from 2024-25 to 2029-30. The total production target rises from 1080 mt in 2024-25 to 1533.04 mt in 2029-30, reflecting a 41.9 per cent increase over five years.

CIL dominates with a contribution of 6013 mt, comprising approximately 75.7 per cent of the total target. Its annual production target grows consistently, starting at 838 mt in 2024-25 and reaching 1131 mt by 2029-30. SCCL’s contribution is minimal, with a total of 470 mt over five years, increasing slightly from 72 mt to 82 mt. In contrast, Captive and other sources demonstrate significant growth, contributing 1462.12 mt (18.4 per cent of the total), with their target nearly doubling from 170 MT in 2024-25 to 320.04 MT in 2029-30.

This data indicates an increasing reliance on Captive and other sources, reflecting policy initiatives to decentralise coal production and enhance private participation. While CIL remains the primary contributor, its growth rate is lower compared to Captive and other sources, signalling a gradual shift in India’s coal production strategy.

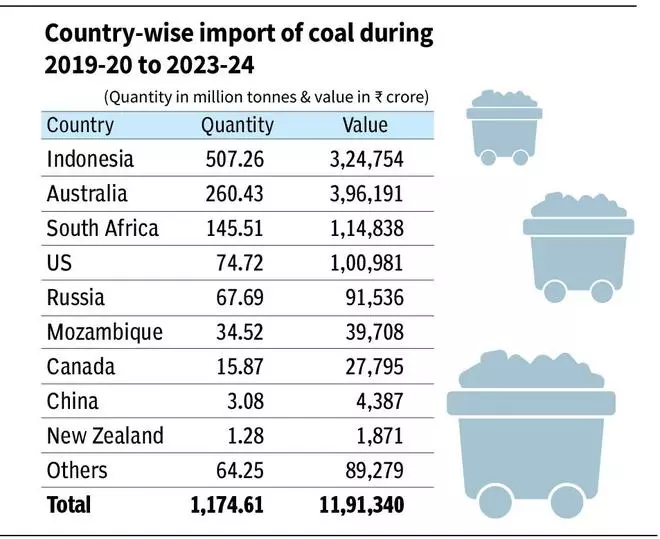

Import substitution

An Inter-Ministerial Committee (IMC) has been constituted in the Ministry of Coal in 2020 for coal import substitution. On the directions of the IMC, an Import Data System has been developed by the Ministry of Coal to enable the Ministry to track coal imports. Efforts are taken to ensure more domestic supplies of coal.

To ramp up domestic coal production to achieve self-reliance and reduce coal import, the government has taken initiatives including Single Window Clearance, amendment of Mines and Minerals (Development and Regulation) Act, 1957, to allow captive mines to sell up to 50 per cent of their annual production after meeting the requirement of the end-use plants, production through MDO mode, increasing use of mass production technologies, new projects and expansion of existing projects and auction of coal blocks to private companies/PSUs for commercial mining. Also, 100 per cent Foreign Direct Investment (FDI) has also been allowed for commercial mining.