India’s declining foreign direct investment (FDI) has become a pressing concern, amid a global slowdown in investment flows driven by economic instability, geopolitical conflicts, and increasing borrowing costs, as highlighted in the Economic Survey 2024-25.

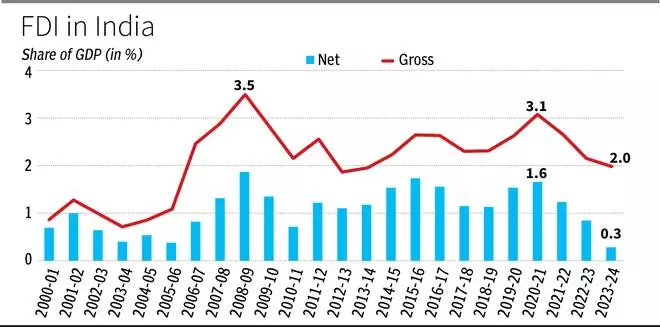

Against this backdrop, a detailed examination of India’s FDI trends, both in gross and net terms, remains essential. While the former measures the total inflow of direct capital, net FDI adjusts for outflows like repatriation/disinvestment and tells how much of that investment is retained. From the standpoint of external financing, it is net FDI inflow that matters.

The chart shows that from FY21, both gross and net FDI, as a share of GDP, not only slipped below their historical levels but continued to weaken. For example, gross FDI fell 1.1 percentage points after the pandemic and now remains around 2 per cent; net FDI fell more than five times to 0.3 per cent last year, the lowest in two-and-a-half decades. While the latest Economic Survey indicates a recovery in gross FDI, growing at 17.9 per cent during April-November FY25, the net FDI declined.

This recent improvement in gross FDI offers some optimism. However, the decrease in net FDI signals an uptick in foreign capital exiting India. Repatriation of foreign investment — when foreign investors sell their stakes and transfer profits back home — has been increasing over the years and grew roughly by 52 per cent in FY24. During April-November FY25, repatriation and disinvestment grew by 33 per cent over the same period last year.

The Economic Survey attributed this to the strength of India’s capital markets, which offered attractive exit options for investors.

While some repatriation is normal — especially as an economy matures — very high volumes may signal heightened vulnerabilities, especially when much of the capital originates from private equity with shorter investment horizons than traditional, longer-term FDI typically seen in sectors like infrastructure. Private equity and venture capital (VC) exits from Indian stock markets amounted to $19.5 billion between January and September 2024, exceeding the $18.3 billion recorded during the same period in the previous year.

The timing of such exits can inopportunely coincide with portfolio capital outflows and an enlarged trade deficit to pressurise the currency and external stability. Besides obvious implications for external balances, these may also send a negative signal if investors see India as a market for short-term profit-making rather than long-term growth, undermining India’s ability to attract the stable, growth-oriented foreign capital it needs.

Impact on real economy

Falling FDI inflow also has implications for the real economy: slower growth, fewer employment opportunities, reduced technological gains and operational efficiencies, and limited knowledge spillovers.

That the declining trend is concurrent with some targeted initiatives to attract foreign direct investments into manufacturing is more worrisome — for example, the production-linked incentive (PLI) scheme, and corporate tax cuts for both domestic and foreign companies, amongst notable ones.

This conjunction points to the fact that these measures have yet to yield a significant boost in FDI inflows.

Then there is the issue of where FDI flows are headed in India. Post-pandemic, the domination of the services sector has risen to 70 per cent of total FDI flows — up from 60 per cent a decade before (2014). This shift highlights India’s increasing role as a global hub for services and exports, which have been growth drivers.

Between 2020 and 2024, the FDI share of services like construction, electricity, mining, real estate, and financial services has risen rapidly, collectively more than doubling from 12 to 28 per cent. However, these are mostly non-tradable services, primarily geared towards local demand or the domestic market. Electricity and transportation (non-tradeables) have emerged as dominant FDI recipients, overall.

Most revenue generation is in domestic currency, while dividends, royalties, and profit repatriations are in foreign currency, pointing to enlarging outflows while goods’ exports fail to rise. Export-oriented services like communications and business services saw their share of FDI rise from 8 to 15 per cent between FY21 and FY22 but have stagnated at that level since then.

May miss crucial gains

Although both domestically focused and export-led services bring value, the current tilt suggests India may be missing out on crucial gains in foreign currency inflows and global market share. The decline in the share of FDI in manufacturing to total FDI over a decade (from 31 per cent to 25 per cent), should worry India, which relies on such investments to generate jobs and enhance its competitiveness.

Amid these challenges, the global manufacturing landscape is undergoing a shift. As rising labour costs erode China’s competitive edge, many multinational corporations are adopting a ‘China+1’ strategy, diversifying supply chains by establishing operations in countries like Vietnam, India, and Bangladesh. Vietnam, in particular, has succeeded in attracting such FDI inflows in recent years, while India has been unable to capitalise on the shifting dynamics.

India needs to address critical gaps to enhance its appeal for export-oriented FDI into large-scale manufacturing. How do we entice such capital to stay invested and expand rather than exit once returns materialise? Policymakers must think even more long-term than they have until now.

Bhapta and Garg are with Centre for Social and Economic Progress. Views expressed are personal