The dominance of foreign venture capitalists in the Indian start-up ecosystem may be coming to an end as India-domiciled VC firms lead deal tables in 2024.

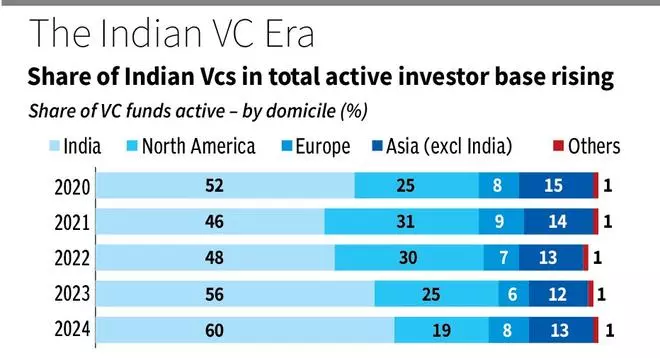

Indian VC firms held a 60 per cent share in the total active funds that made investments in start-ups during 2024, compared to a 52 per cent share in 2020. In the same year, American VC firms, who have long been key backers of Indian start-ups, held just 19 per cent share, compared to their 25 per cent share in total ecosystem deals in 2020. The data is sourced from research firm Venture Intelligence. The share of European VC firms has remained flat at around 8 per cent in the entire period from 2020 to 2024.

India domiciled refers to VC firms both set up in India and with investment teams based here.

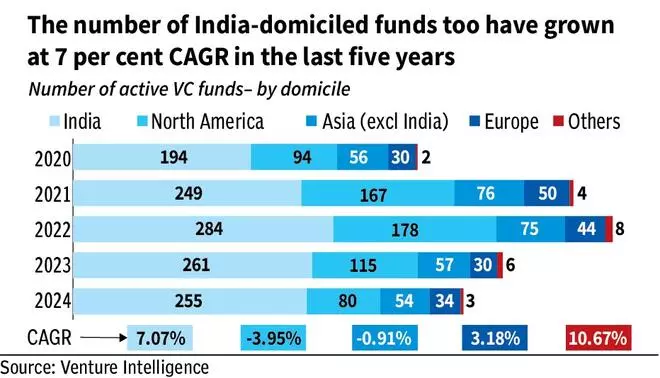

In absolute terms, too, there were 255 active India-domiciled VC funds in 2024, a 7 per cent CAGR growth from 2020. In comparison, there were only 80 North American VC firms who made investments in 2024 , a 3.9 per cent decline in CAGR terms from 2020.

The ranking

Start-up investments in 2024 were largely led by homegrown VCs. Blume Ventures emerged as the most active investor sealing 27 investment deals. DeVC (short for Decentralised VC), a pre-seed firm, emerged at second spot with 24 deals. Peak XV Partners, Z Nation Lab and Zerodha’s Rainmatter Capital rounded off the top five, with no US-based VC in the list. This is a change from pre-Covid times when roughly three out of five used to be American VCs.

Higher availability of domestic capital via the SIDBI Fund of Funds and more Family offices and Ultra HNIs investing in this asset class is supporting the trend, analysts say.

Siddarth Pai, Founding Partner, 3one4 Capital, says that fund managers prefer to domicile in places like GIFT IFSC, as opposed to Mauritius or Singapore due to the certainty offered by Indian regulations for AIFs. “As the ecosystem matures, many founders and investors are starting their own funds and develop their investment theses in India,” he added.

Arun Natarajan, founder and MD, Venture Intelligence says Indian units of various international firms such as Sequoia, Matrix Partners and others are also re-branding/spinning-out from parent firms to start standalone firms based in India.