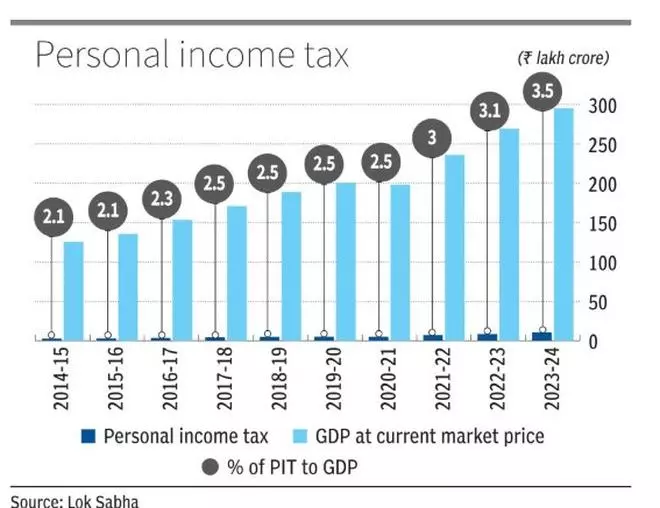

Collection from personal income tax (PIT) as a share of GDP (Gross Domestic Products) surged 140 basis points in Fiscal Year 2023-24 against 2.1 per cent in Fiscal Year 2014-15, Finance Ministry informed the Lok Sabha on Monday.

Figures under PIT include taxes paid by an individual, Hindu Undivided Family, Firms, associations of persons, body of individuals, local authorities and artificial juridical person. However, government has replaced the term ‘personal income tax’ with ‘non-corporate tax.’

Data in a written reply by Minister of State in the Finance Ministry, Pankaj Chaudhary showed that percentage of PIT to GDP at current market price was 2.1 per cent in FY15 which rose to 3.5 per cent in FY24. Similarly, the collection in FY15 was around ₹2.66 lakh crore which jumped to over ₹10.4 lakh crore, showring an increase of 293 per cent.

“The PIT collections are governed by multiple factors including growth of the economy, tax rates, taxpayer base and extent of tax compliance. Therefore, additional funds earned by the government on account of change in any one factor cannot be estimated in isolation,” Chaudhary said when asked about the estimated additional funds earned by the government after changes in PIT system during the last 10 years.

On new regime

Further, he said that the new income tax regime introduced by the Finance Act, 2021 has been the most significant change made in the PIT system during the last 10 years. Under the new income tax regime, introduced as per section 115BAC of the Income-tax Act,1961 w.e.f. Assessment Year 2021-22 (Financial Year 2020-21), an individual taxpayer or Hindu Undivided Family is being given an option for taxation either under the old tax regime or the new tax regime.

This new tax regime was subsequently made applicable to associations of persons, body of individuals and artificial juridical person from Assessment Year 2024-25. In the old tax regime, various deductions and exemptions are allowed to taxpayers, whereas, in the new tax regime, only limited deductions and exemptions are allowed, he said.

In response to another question about New Income Tax Bill, he said that while the exercise of simplification carried out through new Bill might not have a direct or immediate effect on revenue collection per se, all amendments proposed up to Finance Bill 2025 have been duly incorporated in the new Income Tax Bill 2025. Therefore, “the Bill stands updated from a policy perspective,” he said.

Further, the simplification exercise aims to create a statute of taxation that is accessible to and comprehended by not just tax professionals but informed citizens as well. Ease of paying taxes is an important pillar of ease of doing business. The approach of using clear and lucid language, increased use of tabular format for representation of information and mathematical formulas for easier understanding aims to increase tax certainty, improve ease of paying taxes and enhance ease of doing business.

“The existing technological reforms undertaken by the department including initiatives like pre-filled ITRs, Annual Information Statement, faceless proceedings, e-filing of various forms etc. are all retained in the Bill,” Chaudhary said.