Across segments in the real estate space and more so in the upmarket category, residential developers have found excellent traction in the last three-four years. The post-Covid phenomenon of demand for larger houses (especially for hybrid working) and increasing affordability have resulted in big developers operating in large markets experiencing robust growth in bookings and collections.

The demand continues to be especially strong in the premium and luxury residential segments.

In this regard, Godrej Properties, one of the country’s leading developers with strong presence in the Mumbai Metropolitan Region (MMR), Pune, Bengaluru and the National Capital Region (NCR), among a few other cities, has been a key beneficiary as it operates mainly in the above-mentioned spaces.

After rising strongly over the past few years, the stock is down over 40 per cent from its peak in mid-2024, thanks to the selling across the broader markets.

At ₹1,960, the stock trades at 26 times its per share earnings for FY26, making it an attractive bet for investors with a three-year perspective. The company’s own forward PE multiples have generally been north of 40 times. The BSE Realty index trades at a PE multiple of over 45 times. The valuations are at comfortable levels.

Investors can buy a good portion of their intended quantities now, while accumulating further on any declines linked to the broader markets, especially in the current volatile environment.

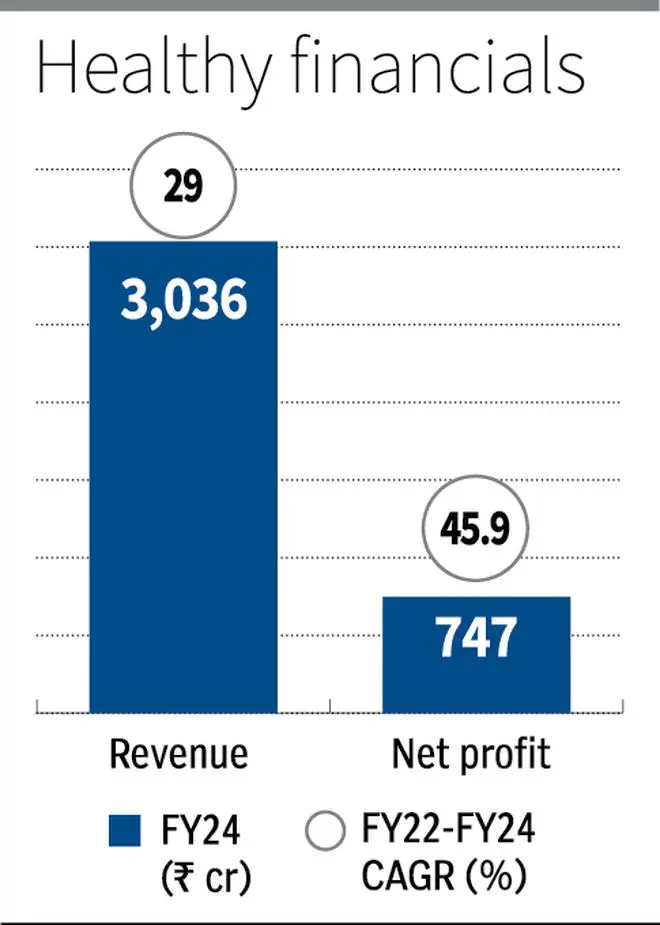

Over FY22-24, Godrej Properties’ revenue from operations grew at nearly 29 per cent compounded annually to ₹3,036 crore, while net profits rose at a rate of 45.9 per cent to ₹747 crore in FY24.

FY25 has been exceptionally strong for the company. In 9MFY25, revenues increased 74 per cent year on year to ₹2,801.1 crore, while net profits rose by a whopping 274 per cent to ₹1,010 crore in the same period.

Other key metrics from 9MFY25 suggest continuing strong traction. The booking value for the period was ₹19,281 crore, a rise of 71 per cent year on year. Collections during the same period came in at ₹10,086 crore, representing a 67 per cent increase.

Upmarket segments

Godrej Properties has a track record as a developer for close to 40 years. While the MMR, Pune, Bengaluru and the NCR are cities where it has deep presence, the company is also expanding footprint in Hyderabad, Ahmedabad and Kolkata. In all, Godrej Properties has a presence in 11 cities.

In FY25, the company is well on its way to achieve its plan of achieving 21.9-million-sq-ft launch, with expected value of ₹30,000 crore. It has already achieved 79 per cent of that value by 9MFY25.

Although the company has presence across segments in the residential realty space, it caters primarily to the upmarket and luxury categories.

It is focused on houses that are priced well over ₹1 crore, going up to homes valued at ₹5 crore.

A report from Anarock for CY24 states that the high-end segment (₹80 lakh-₹1.5 crore) in Hyderabad and Bengaluru accounts for 39 per cent each of the overall launches in those cities. The luxury segment (₹1.5-2.5 crore) has considerable traction in Bengaluru at 24 per cent and Hyderabad at 17 per cent. NCR leads the pack with a whopping 59 per cent launches in the ultra-luxury segment (greater than ₹2.5 crore).

The company enjoys premium pricing power in the markets it operates in due to the strong brand presence and timely execution.

As of the third quarter of FY25, the blended realisation for Godrej Properties is fairly high, at over ₹13,000 per sq ft.

The company follows a mix of outright execution of projects and joint development for higher revenue share.

Godrej Properties has a large land bank as well, with the legacy of its parent company. It has a development management agreement with Godrej & Boyce for its largest landholding in Vikhroli.

The company is also increasing its commercial real estate portfolio with presence in the key cities of its operations. A large portion of these properties is already leased or in the process of being done.

Its Taj Trees project in Mumbai, managed in partnership with the Tata Group, has high occupancy of 75 per cent and an average room rent of ₹12,660, among the best in the industry.

Robust financials

Godrej Properties’ balance sheet is fairly string. The company raised ₹6,000 crore via the QIP (qualified institutional placement) route. Consequently, the net debt-to-equity ratio of only 0.23 as of December 2024, from over 0.7 levels earlier. Despite the relatively elevated interest rate environment, the company’s cost of debt has always remained sub-8 per cent (7.8-7.9 per cent), which is quite moderate.

In 9MFY25, Godrej Properties added 12 new projects with an estimated saleable area of 16.9 million sq ft. The booking value potential of ₹23,450 crore is already higher than the full-year FY25’s guidance.

Thus, there is considerable revenue visibility for the company.