Most investors and advisors are by now very familiar with how strong fixed income has been so far this year. Fixed income ETFs have added $52 billion to start 2023, a big part of the overall $80 billion ETFs have taken in. With so many different types of fixed income offerings, active, all-term bond ETFs present an intriguing opportunity. They are able to invest across the duration spectrum and as such, inviting investors and advisors to consider the top ETFs in that category so far in 2023.

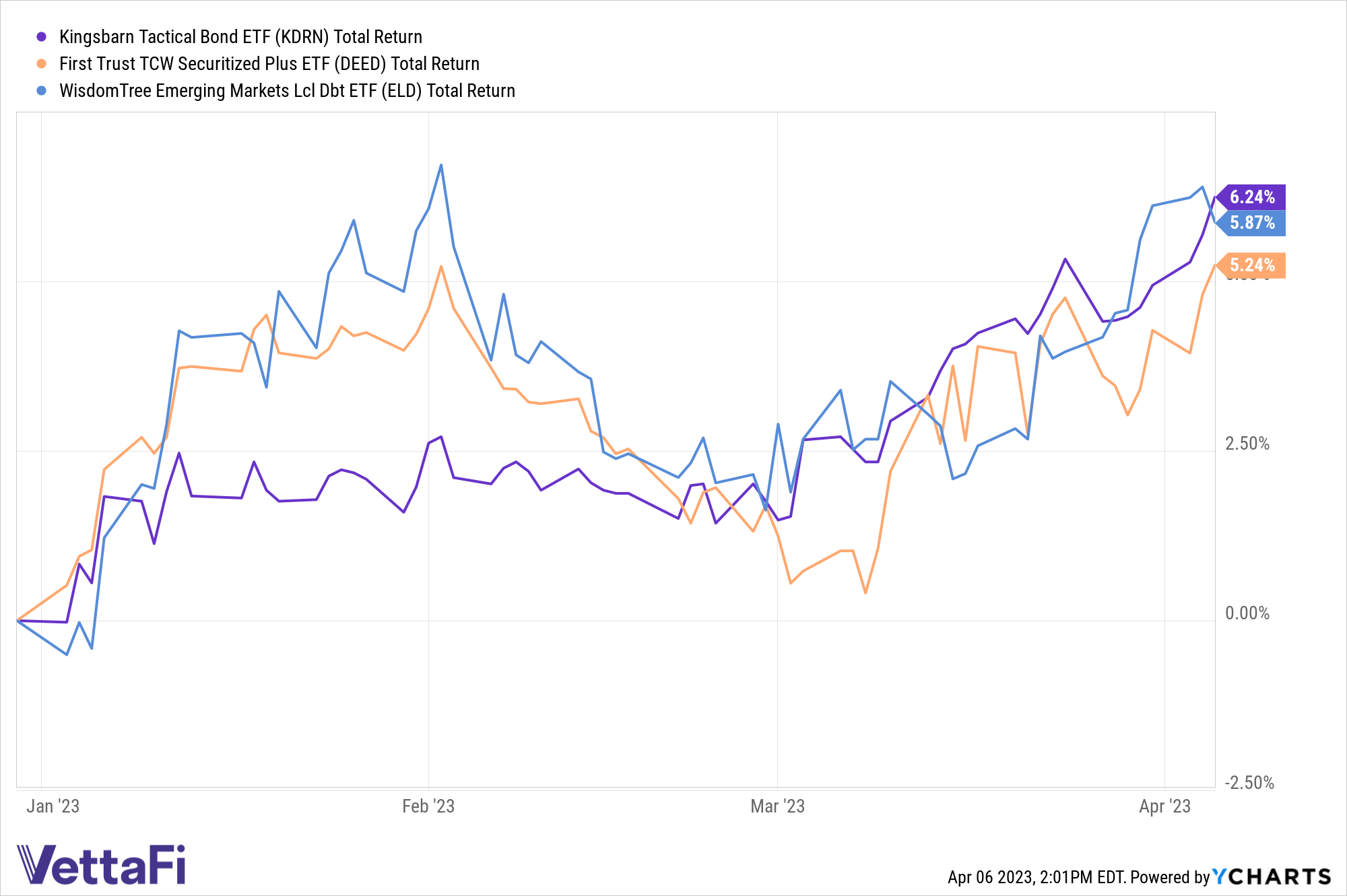

To start, the Kingsbarn Tactical Bond ETF (KDRN) is the most expensive of the three charging 117 basis points. KDRN is a fund of funds ETF that actively invests across credit and duration risk in global bond ETFs as well as U.S. Treasury futures, holding around eight to 12 underlying strategies. KDRN has led the way among active all-term bond ETFs YTD in performance, returning 624 bps YTD.

See more: “The ABCs of FRNs: Get Floating Rate Note Yields in USFR”

The First Trust TCW Securitized Plus ETF (DEED) is next, charging 75 bps. Whereas KDRN is a year or so away from hitting its three-year milestone, DEED is on track to reach its three-year mark later this month. DEED actively invests in U.S. securitized debt with broad maturities, like residential and commercial mortgage-backed securities, including CLOs. Half of the portfolio includes U.S. government securities, with the rest for privately-issued mortgage and agency-backed securities.

DEED has returned 524 bps YTD, and despite its higher fee, it has trailed the WisdomTree Emerging Markets Local Debt ETF (ELD), which has outperformed YTD with a return of 587 bps. ELD actively invests in emerging market debts, diversifying worldwide and across maturities. ELD charges the least of the three ETFs at just 55 bps and aims to use EM local currency debt to help hedge against the dollar and boost current returns.

ELD has added $13.2 million over the last month in net inflows and offers appealing returns for its cost among the top three active all-term bond ETFs so far this year. With the U.S. facing ongoing Fed-related drama, looking abroad in an ETF like ELD could be an appealing option in the weeks and months to come.

For more news, information, and analysis, visit the Modern Alpha Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.