Every week, several key economic indicators are released to help provide insight into the overall health and state of the U.S. economy. Last week’s data shed light on various aspects of the labor market, including payroll numbers, unemployment data, job openings and labor turnover, and business activity in different sectors of the labor market. All these indicators are closely watched by policymakers and advisors trying to understand the direction of interest rates because the data can have a significant impact on business decisions and financial markets. In the week ending on April 6, the SPDR S&P 500 ETF Trust (SPY) rose 1.36% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 0.39%.

Employment Report

The March employment report confirmed indications of a stabilizing labor market, revealing that only 236,000 jobs were added in March, slightly lower than the anticipated 239,000. While job growth in March remained historically strong, it marked the smallest monthly gain in over two years. Additionally, the report indicated an increase in the labor force participation rate to 62.6%, the highest level since March 2020, suggesting that workers are gradually returning to the labor market. Despite the rise in labor force participation, the unemployment rate decreased to 3.5%, outperforming expectations of 3.6%. Overall, the jobs report was strong and represents a steady step towards balancing out the labor market.

Job Openings and Labor Turnover (JOLTS)

The February JOLTS report revealed a significant decline in job openings, with the number of vacancies falling to a 21-month low and dropping below 10 million for the first time since May 2021. Despite expectations of a decline, the decrease of 632,000 job openings from January to 9.9 million in February still came as a surprise to economists, who had predicted 10.4 million vacancies. Other key data points from the report showed that hiring had inched down to 6.2 million, layoffs had fallen to 1.5 million, and quits had increased to 4.0 million. The JOLTS data helps gauge labor demand, and the latest report indicated a continuing cooldown of the labor market. Nevertheless, there are still 1.67 jobs available for every unemployed worker, and job openings are still well above pre-pandemic levels.

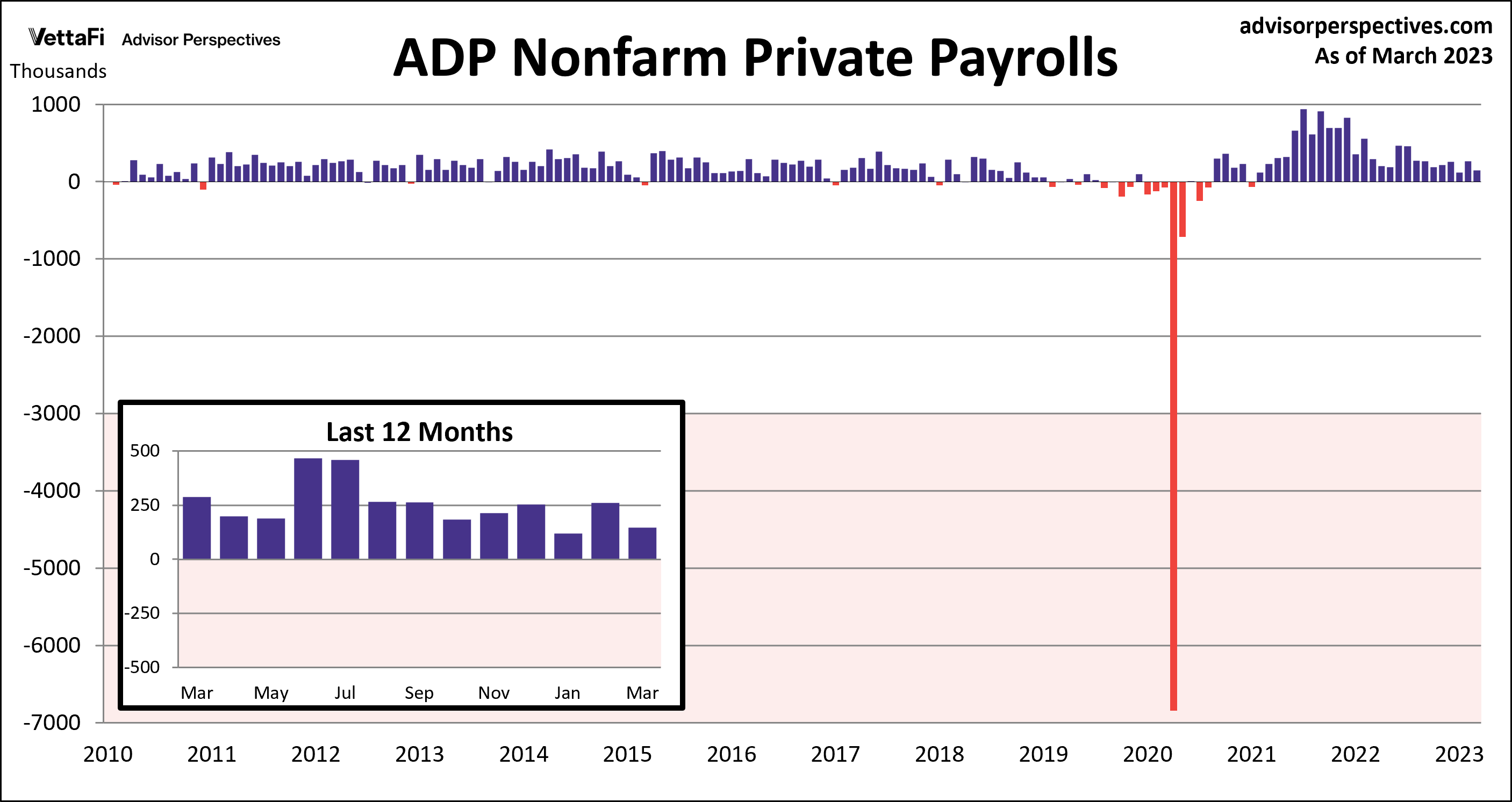

ADP Employment Report

Private employment has been declining since the end of 2021 and has recently returned to pre-pandemic levels. The March ADP employment report was consistent with the trend, revealing that 145,000 private jobs were added last month. This is a significant decline from the 261,000 added in February and well below the expected 200,000, a continued indication of a slowing economy. The report also revealed a very narrow margin between goods-producing industries and service-providing industries, which is an uncommon occurrence, as the U.S. is predominantly a services economy and typically shows stronger job growth in that sector.

Keep an eye out for important economic indicators this week, starting with Tuesday’s release of the Consumer Price Index (CPI), Wednesday’s release of the Producer Price Index (PPI), and Friday’s release of the latest retail sales data. These reports will provide more insight into whether U.S. inflation is continuing to cool and whether consumer spending has continued to subside. While the year-over-year headline CPI is expected to decrease to 5.2% this month, core CPI is expected to rise for the first time in six months to 5.6%. Additionally, the month-over-month headline and core PPI are both expected to increase from February to 0.1% and 0.3%, respectively. The retail sales data, which is expected to show a decrease of 0.4% in headline sales and 0.3% in the core sales (excluding auto) from February, will have an impact on the interest in the SPDR S&P Retail ETF (XRT).

For more news, information, and analysis, visit the Portfolio Strategies Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.