Bank of America Corp (NYSE:BAC) has just released its financial report for the first three months of 2023.

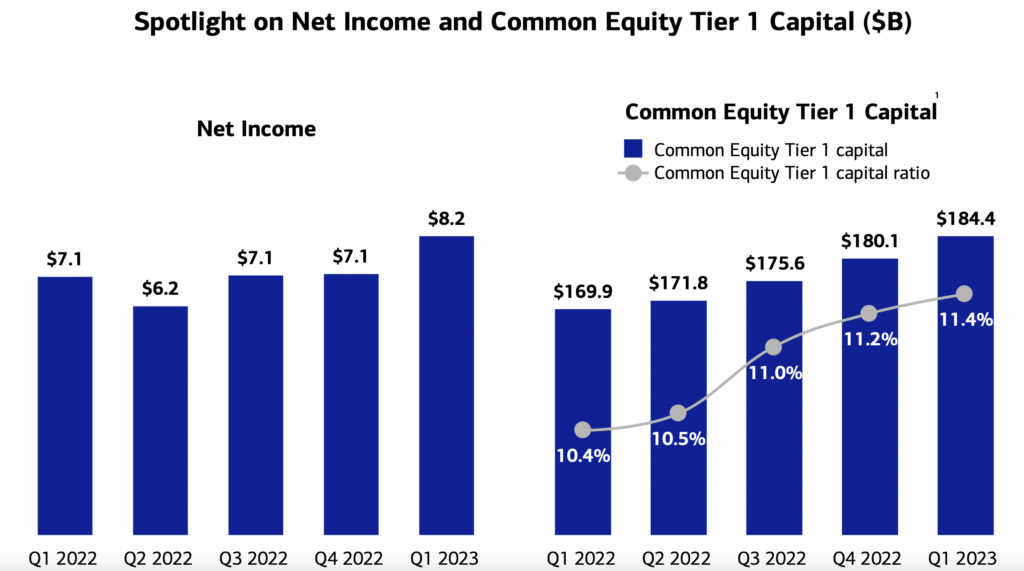

Across all segments, net income rose 15% to $8.2 billion, or $0.94 per diluted share, compared to $7.1 billion, or $0.80 per diluted share for Q1-22.

Pre-tax income increased 15% to $9.1 billion.

Revenue, net of interest expense, increased 13% from the year-ago quarter to $26.3 billion.

The Global Markets segment generated net income of $1.7 billion, an increase of $93 million, or 6% from the first quarter of 2022. Excluding net DVA, net income of $1.7 billion increased 9%.

The segment saw revenue of $5.6 billion, marking an increase 6%, driven primarily by higher sales and trading revenue, partially offset by lower investment banking fees.

Sales and trading revenue of the Global Markets segment amounted to $5.1 billion, up 7% from the year-ago quarter.

FICC revenue increased 27% to $3.4 billion, driven primarily by improved performance across mortgage, credit and municipal products, and increased secured financing activity for clients.

Equities revenue decreased 19% to $1.6 billion, due to weaker trading performance and lower client activity in derivatives and cash.

Chair and CEO Brian Moynihan commented:

“Every business segment performed well as we grew client relationships and accounts organically and at a strong pace. Led by 13% year-over-year revenue growth, we delivered our seventh straight quarter of operating leverage. We further strengthened our balance sheet and maintained strong liquidity. We delivered earnings of $0.94 per share, up 18% over Q1-22, in an economy with modestly slower GDP growth. Our results demonstrate how our company’s decade-long commitment to responsible growth helped to provide stability in changing economic environments.”