Aquis Exchange PLC (LON:AQX) today announced its audited results for the year ended 31 December 2022.

During 2022 net revenue increased by 24% to £20.1 million, with significant increases in technology licensing revenue, whilst AQSE generated a profit ahead of schedule. Pan-European secondary market trading was strengthened through the launch of AMP, Aquis’s new dark pool activity.

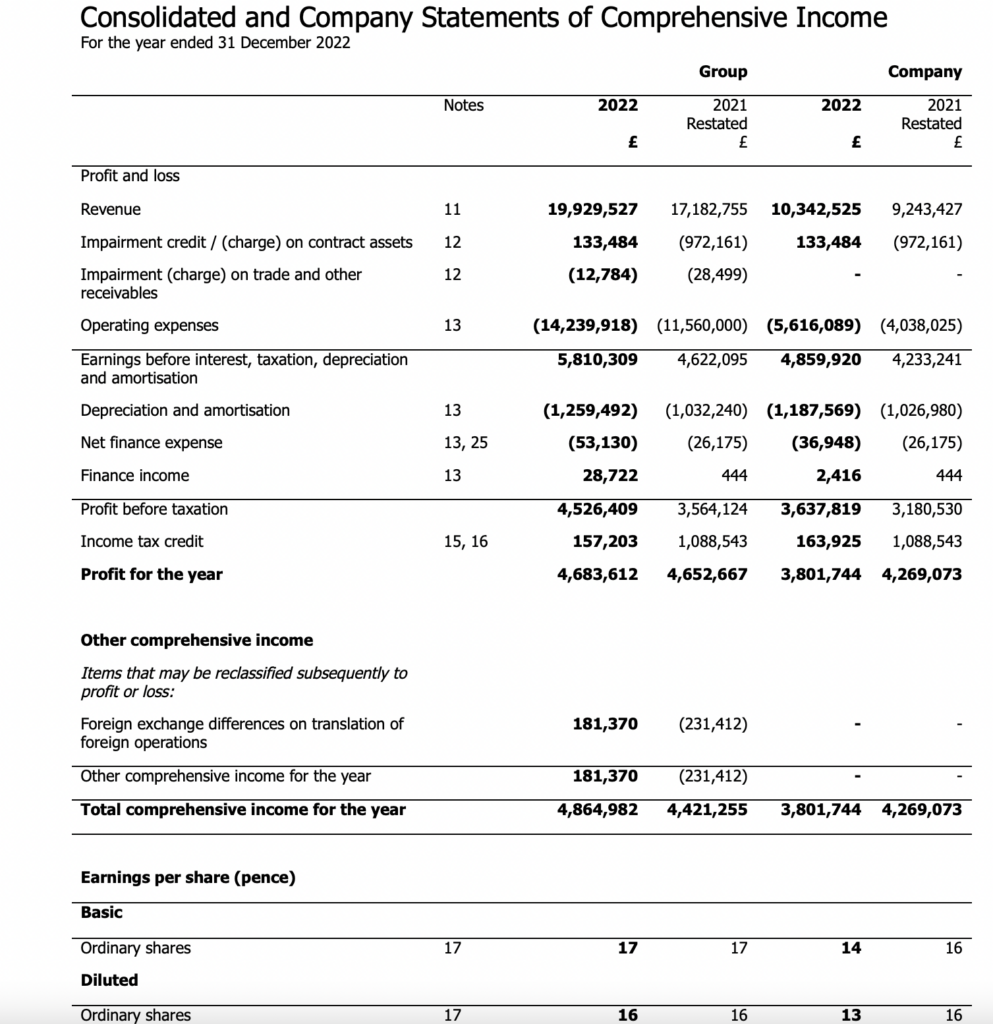

The Group generated a profit before taxation for the year of £4.5m compared to £3.6m in the previous year. The continued growth in profits during 2022 is primarily attributable to increased exchange revenue through the launch of AMP and as members’ subscriptions have risen as a result of increased trading levels, as well as increased revenue from data, technology licensing and issuer fees.

The trade receivables resulting from revenue from licensing technology contracts attract an IFRS 9 (Expected Credit Loss on the trade receivables arising from contract assets). This year the application of IFRS 9 has resulted in a net impairment provision release during the year of £133k (2021: charge (£972k)).

The Group’s cash and cash equivalents as at 31 December 2022 were £14.2m (2021: £14.0m) maintaining the Group’s strong cash conversion rate which allowed the continued investments. Over the year the Group deployed £1.95m of cash to purchase treasury shares used to service the various employee share schemes.

Alasdair Haynes, Chief Executive Officer of Aquis, commented:

“I am very pleased to be reporting another year of significant growth for Aquis, with net revenue up 24% and underlying profit increased by 41% from FY21. The Group profited from significant growth in the technologies division, along with strong performances in pan-European secondary market trading, the primary market activities of Aquis Stock Exchange and data revenue.

From the fledgling pan-European secondary market equities trading platform that we launched a decade ago, it is edifying to see Aquis transform into a profitable and growing Group that creates and facilitates next-generation financial markets. In 2022, we saw milestones reached in each division with the launch and growth of the Aquis Matching Pool (AMP); significant interest in Aquis Technologies’ pioneering exchange technology and particularly its cloud-native and 24/7 functionality, and an impressive 22 new listings on the Aquis Stock Exchange – the most of any growth exchange in the UK.

Amidst changing market dynamics in the UK and abroad, there are significant opportunities for Aquis across all divisions, and we are looking forward to continuing our growth strategy. Trading so far has been in line with market expectations.”