Indian equity markets defied logic following Trump’s tariff announcements on April 3, but fell in line with global trends the next day. While the headline index braced the impact, the mid-cap and small-cap indices bore the brunt. Pharma faced mixed fortunes with a marginal relief rally followed by a meltdown. Other sectors that were impacted include gems, auto components and even IT Services. With European and US markets continuing to tumble after Indian market close on Friday, Trump’s tariffs may have a longer and bloodier tail.

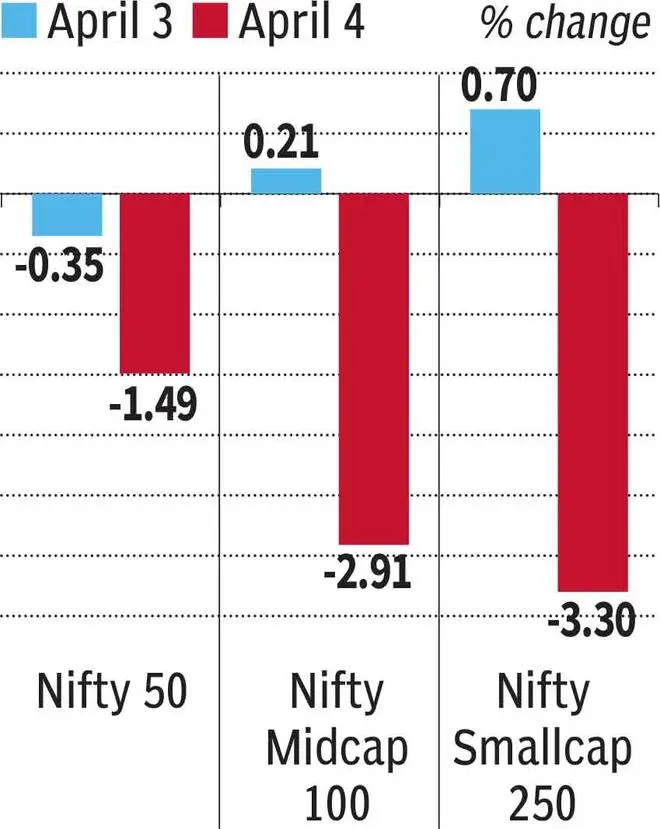

Broader indices

The initial sober reaction gave way to strong correction on Friday as Pharma joined the list of sectors facing possible tariffs. The decline is still muted compared with global peers decline of 5-8 per cent, which could be attributed to lower US exposure in the broader economy.

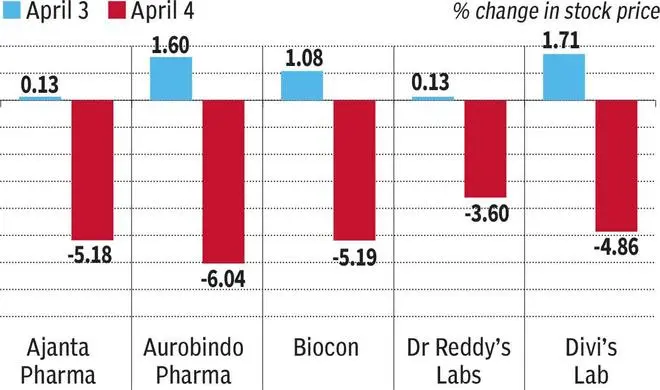

Pharma not spared

Pharma initially rode the relief rally as it was exempted from tariffs. The following day, Trump announced ‘higher than seen before tariffs’ for pharma, which more than eroded the previous day’s gains. However, domestic-focussed companies gained on both days.

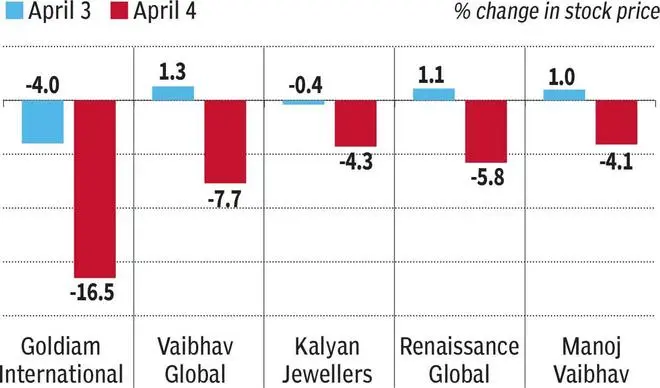

Jewellers hit hard

The gems and jewellery industry facing 26 per cent tariff will be at a disadvantage to competitors from Turkiye and the UAE, which are facing 10 per cent. Even stocks like Kalyan Jewellers, which do not have a significant US exposure, have been hit.

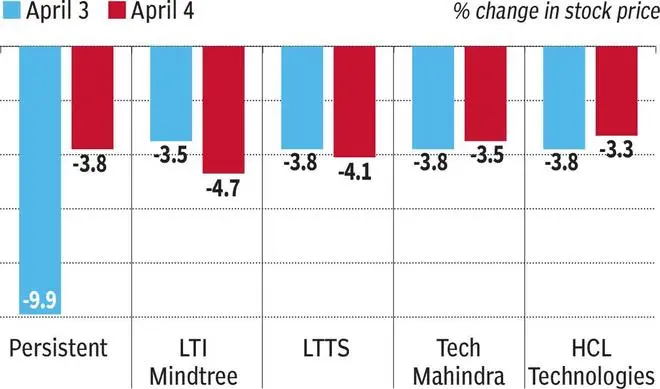

IT took a surprise hit

IT services was out of discussion on goods tariffs, but came squarely into limelight. The risk of slowing economic activity in the US and Europe, the sector’s two large markets, impacted it.

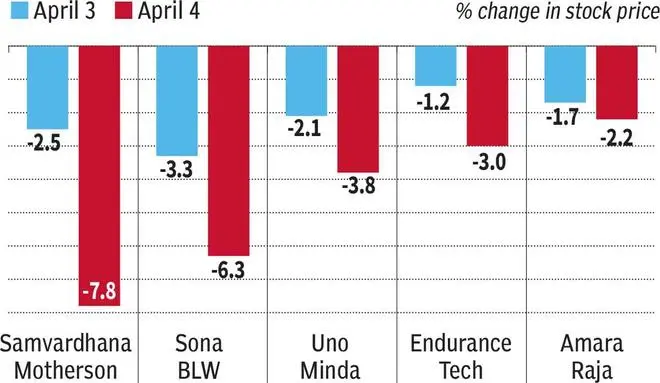

Auto components continue to fall

Auto OEMs’ low exposure to the US shielded them but auto component players were caught in the cross fire, as they have a sizeable global exposure in their revenue, including the US.

Published on April 5, 2025