More money has been lost by trying to invest in ‘The next HDFC Bank’ than in doing nothing and allowing inflation to erode it away. Any doubts, check with the long-term investors in bank IPOs over the last decade..

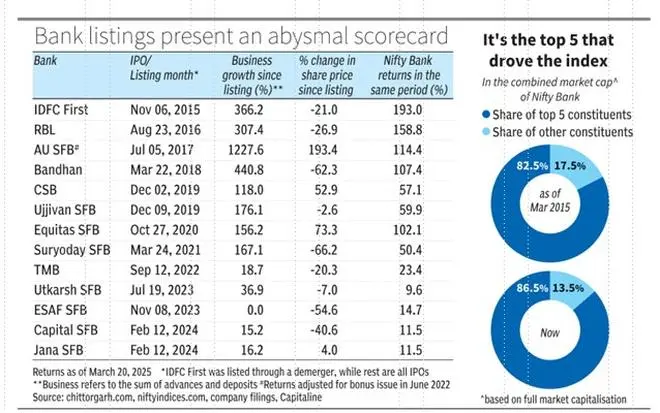

The abysmal long-term performance of many banking stocks is back in focus after markets witnessed shares of IndusInd Bank plummet over the last couple of weeks. Nearly every private bank that listed in the last decade – the likes of IDFC First Bank, Bandhan Bank, RBL Bank and the even smaller ones – the small finance banks (SFBs) have underwhelmed. Their underperformance against the index is telling (see infographic). The sentiment has often been bullish around these banks, given the financialization theme, the headroom for growth and the niche spaces they operated in. SFBs were even seen in the light of getting promoted to the status of a universal bank in the future. The irony here is that while business growth has been good for such banks, their share prices have failed to replicate the same for various reasons.

Further after mind-blowing returns given by the likes of HDFC Bank and Kotak Mahindra Bank in the last decade, many investors were hoping to find the next small or mid-cap bank that could repeat their performance. But unfortunately, any attempt to buy and hold the emerging banks has boomeranged badly.

Fortune favours scale

Of all the bank IPOs in the last decade, only AU SFB, CSB Bank, Equitas SFB and Jana SFB have managed to post positive returns since IPO (current price vs IPO issue price). None of them managed to beat the index though, except for one – AU SFB. In numerical terms, the failure rate has been a grand 92 per cent (12 out of 13 stocks)!

This suggests one must be as good a stock picker to have identified AU SFB as a winner and to have ignored the rest, in order to beat the index. Outside of this universe (private banks that listed in the last decade), among Federal Bank, Yes Bank, South Indian Bank, Karnataka Bank, Karur Vysya Bank, City Union Bank and DCB Bank, only Federal Bank has managed to keep pace with Nifty Bank over the last decade, with a CAGR of 10 per cent.

HDFC Bank, SBI, ICICI Bank, Axis Bank and Kotak Mahindra Bank are the top five constituents of the index. These five alone accounted for 82.5 per cent of the combined market capitalisation of all Nifty Bank constituents as of March 2015. Today they account for a higher 86.5 per cent. The contribution from the rest of the constituents has waned from 17.5 per cent to 13.5 per cent. This is enough evidence that it is the top 5 that have driven the index’s 10 per cent CAGR.

It is said fortune favours the brave, but when it comes to banking stocks looks like fortune favours scale.

This seems to be the case globally too. For example in the US, as witnessed during the 2023 banking crisis. While the smaller Silicon Valley Bank, Signature Bank and Silvergate Bank failed, many such on a decline, the larger ones such as JP Morgan Chase and Bank of America managed to get through unscathed and have given decent returns.

So, for investors not sure how to pick stocks in the sector, it is better to follow what the legendary John Bogle once said – ‘Don’t look for needle in the haystack. Just buy the haystack.’ While near term returns are uncertain, most long-term investors are better of buying the index rather than risking their fortunes on ‘The next HDFC Bank.’ That’s decadal lesson learnt!