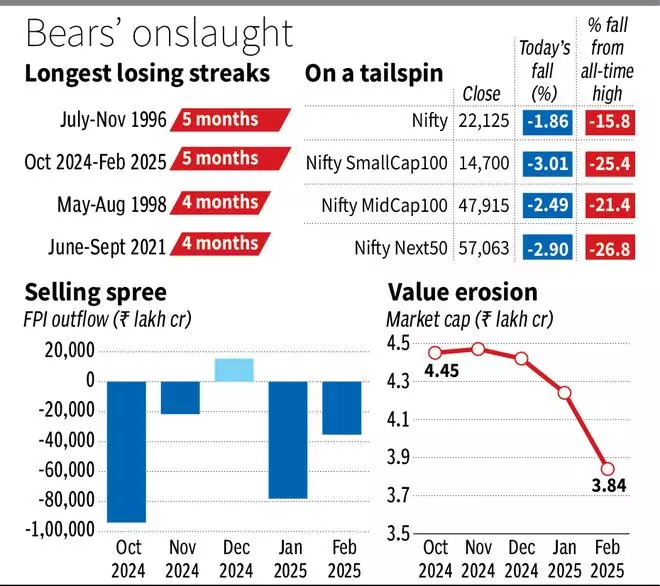

Nearly ₹9 lakh crore worth of market capitalisation was wiped out on Friday, with the stock markets recording their biggest weekly fall in 2025 as IT, autos, media, metals, FMCG and PSB stocks were hammered by the bears.

In the Sensex, all stocks fell barring HDFC Bank, while in the Nifty50, only 5 stocks gained. IndusInd Bank, Tech Mahindra, Wipro, Bharti Airtel, M&M and Tata Motors were the biggest fallers in the indices.

Market slump

On Friday, the Nifty50 ended at 22,124.70 points and the Sensex at 73,198.10 pointsboth down 1.9 per cent. They have declined 6 per cent in the month, over continuing concerns over the imposition of tariffs by the US, the prospect of weak corporate earnings, and the relentless selling by foreign portfolio investors.

“This trend may continue in the coming weeks too, but with persistent sell off the market correction is close to its saturation levels,” said Joseph Thomas, Head of Research, Emkay Wealth Management

The Nifty50 is down 15.6 per cent from its 52-week high. The Nifty Midcap 150, SmallCap 250 and Microcap 250 have fallen 21-26 per cent from their highs. The fall in the broader market indicated the bearish sentiments, analysts said. Small and microcap stocks have slid 5-6 per cent during the week.

“With the index slipping below its 20-month exponential moving average, the bearish trajectory has been further cemented,” said derivatives analyst Dhupesh Dhameja of Samco Securities. He pointed out that every minor rebound was being met with aggressive selling that prevented any sustained recovery.

Tariff threat

The market sell-off that began in the last quarter of 2024 has intensified this year with US President Donald Trump threatening reciprocal tariff rates on imports. He announced 25 per cent tariffs on imports from the European Union and affirmed that duties imposed on Mexico and Canada would take effect from March 4. An additional 10 per cent tariff was declared on Chinese imports.

Weak US jobs data contributed to the fall in the IT stocks, that have crashed over 4 per cent to a 7-month low. Over 60 per cent of the software sector’s revenues are from the US.