The bl.portfolio Star Track Mutual Fund Ratings serves as a valuable tool for investors navigating the complex and vast mutual fund landscape. By assigning star ratings from 1 to 5 (with 5 being the best), this framework helps identify funds that consistently perform well over time, rather than those that perform better only in short periods. The ratings are based on a thorough analysis of a fund’s historical performance, considering both returns and risk. Returns are measured using rolling returns, while risk is assessed using the Sortino ratio. This dual approach ensures a balanced assessment, helping investors identify schemes that not only deliver better returns but also manage risk effectively.

No mutual fund can remain a top performer indefinitely. Therefore, investors are better off looking for funds that have consistently earned high ratings. Here, we identify such funds which have consistently aced our ratings.

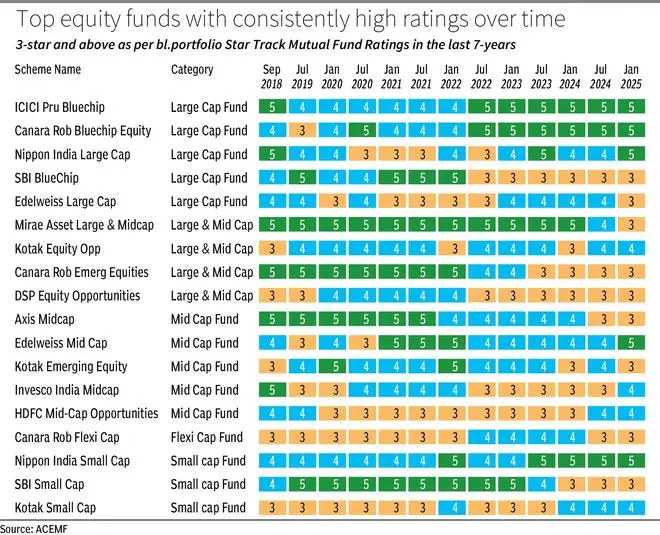

Review of historical ratings

The bl.portfolio Star Track Mutual Fund Ratings was introduced in October 2018 and is updated twice a year, using data from the end of June and December. As a result, 13 sets of historical ratings have been compiled so far. Analysing this historical ratings data tells us which funds are consistent in maintaining their performance versus peers.

As of December 2024, 450 funds were considered for the rating process, an increase from 254 funds in September 2018. (Click here for the detailed methodology and exclusion criteria for the rating process). Here, the audit has been done with 254 funds with 13 sets of historical data.

Key findings

The analysis reveals that no fund achieved a five-star rating across all 13 periods. However, two funds — ICICI Pru All Seasons Bond and Aditya Birla SL Money Manager — secured five stars in 12 out of 13 periods.

In the equity funds category, only ICICI Pru Bluechip and Nippon India Small Cap consistently earned four or five stars across all periods, highlighting their ability to deliver strong, consistent returns over time. In the hybrid category, ICICI Pru Equity & Debt and ICICI Pru Regular Savings achieved similar ratings.

In the debt funds category, there were many such candidates. 10 funds — Aditya Birla SL Money Manager, ICICI Pru All Seasons Bond, SBI Magnum Gilt, SBI Magnum Income, HDFC Short Term Debt, ICICI Pru Credit Risk, Aditya Birla SL Corp Bond, Kotak Banking and PSU Debt, Axis Treasury Advantage and ICICI Pru Bond Fund — consistently secured either a five-star or four-star rating across all evaluated periods.

Expanding the analysis to include funds with three stars or higher, 96 funds (38 per cent of the 254 funds) managed to earn either a three-star, four-star, or five-star rating. Many of these funds fluctuated between three and five stars, such as Mirae Asset Large & Mid Cap, SBI Small Cap, and Kotak Emerging Equity.

About two-thirds of the funds rated two stars or lower in most periods.

How to get the best out of the ratings

For investors who often find it hard to time the market, consistency is crucial. The ratings system highlights funds that have delivered steady outperformance over time, helping investors focus on building long-term wealth instead of chasing short-term performers.

The aforementioned findings confirm that no mutual fund can stay at the top forever. Funds naturally go through ups and downs, as a result of their styles or security selection. This makes it important to review your portfolio regularly, ideally once a year, to ensure you can retain performers and weed out consistent underperformers.

When choosing funds, go for those with five-star or four-star rating. The fund selection should be in line with your asset allocation strategy based on your risk profile, time horizon and goals. If a fund you have invested in sees a temporary dip but maintains above-average ratings, it’s better to stay invested rather than selling. However, if a fund’s rating drops to two stars or below, it may be time to reconsider your investment. This balanced approach helps investors weed out poor performers while staying focused on long-term success.