As an investment vehicle dedicated towards saving for retirement, the national pension system (NPS) has been an attractive option, especially for those in the private sector and for self-employed persons.

While the investment phase and the options available are discussed extensively, the critical aspect of the withdrawal or exit part will need to be carefully thought through and the options examined closely.

With the recent Budget increasing the threshold for taxation sharply, you can juggle with the NPS investment smartly to a tax-free pension.

At the end of the accumulation phase, there are two components in your corpus – the annuity part and the lumpsum portion.

Now, in the normal course, you will have to buy an annuity policy from an insurance firm with 40 per cent of your accumulated corpus. The remaining 60 per cent can be withdrawn as a lumpsum at 60.

However, the NPS offers several other exit options. You could defer the annuity portion and withdraw the lump-sum part. Or you could defer the lump-sum withdrawal and take the annuity immediately. You can also consider taking the annuity immediately and opt for the systematic lump-sum withdrawal (SLW) scheme to draw your money at periodic intervals, even as the amount remains invested.

Another option is the continuation of both the annuity and lump-sum, while maintaining regular contributions.

Of course, the NPS is available only up to the time you turn 75, for all options.

Now, the primary idea of the retirement corpus is to generate a steady pension, preferably one that at least keeps pace with inflation.

We will examine the key options from the above choices and explain them in detail for you to make the most of your retirement corpus to generate a healthy pension. Specifically, we will lay greater emphasis on two options – taking the annuity part and lumpsum simultaneously as well as withdrawing the annuity portion and opting for an SLW.

Additionally, the suitability of each options for specific categories of investors would be highlighted.

In all the options, we assume a normal retirement age of 60, which is when you tap into the NPS investment.

Splitting the retirement corpus

One of the earliest options provided in the NPS regulations was the combination of procurement of annuity with one portion of the accumulated corpus and withdrawal of the lump-sum corpus in one go.

So, with 40 per cent of the accumulated corpus, you should take an immediate annuity. The 60 per cent can be withdrawn as a tax-free lump-sum.

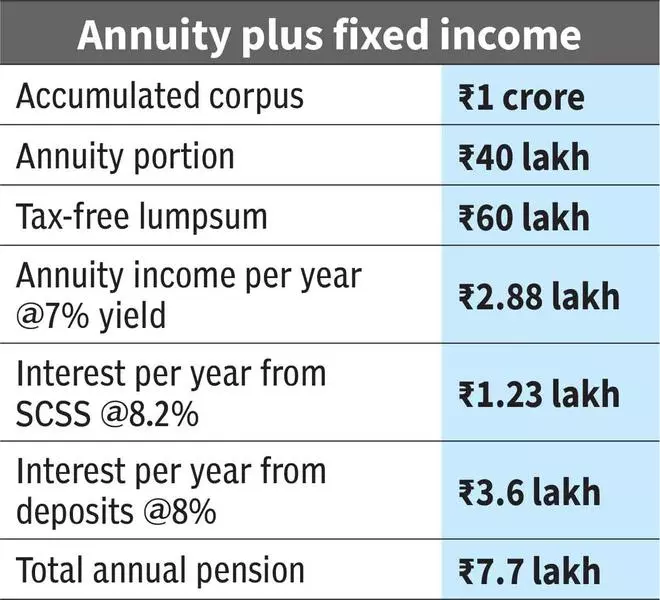

Let’s take an example. If you have ₹1 crore as your accumulated corpus at retirement in the NPS, you must take an annuity for ₹40 lakh. The balance is withdrawn as a lump-sum.

These two components must be deployed to generate a pension.

The compulsory annuity part for ₹40 lakh would generate an income at a frequency of your choice (monthly, annually etc.).

Currently, the best of insurance companies offer a little over 7 per cent yield on immediate annuity (single annuity with return of purchase price). Thus, you will get a sum of about ₹2.88 lakh annually or ₹24,000 a month.

Since this amount is fixed – and possibly inadequate – and does not change with increased inflation rates, you will need to make the balance ₹60 lakh work for you in a manner that it bolsters your overall income, beats inflation and yet remains a relatively-safe investment.

So, you may consider deploying ₹15 lakh (maximum allowed) in the senior citizen savings scheme (SCSS), which gives 8.2 per cent interest currently. You will receive ₹30,750 every quarter or a total of ₹1.23 lakh a year.

All deposits available with top banks and highly-rated NBFCs offer lower interest rates – 7.5-8 per cent at best. For the remaining ₹45 lakh, you would be able to get around ₹3.6 lakh annual interest.

In all, you will get close to ₹7.7 lakh as annual income if you choose only annuity and fixed deposits for your investments.

This mode of investing the NPS corpus would suit investors wanting the safest of avenues, even if returns are relatively moderate. More so, for those depending exclusively on the NPS corpus alone for their retirement income.

Even those with very large NPS corpuses (say, ₹2 crore or more) can minimise risk by just taking the above options.

Smarter deployment of lumpsum portion

For retirees who wish to beat inflation over the long term and want reasonably inflation-beating returns (more than debt and less than equity), adding equities to the portfolio is inevitable. However, the risk levels must not be too much as retirees depend on the corpus for regular income.

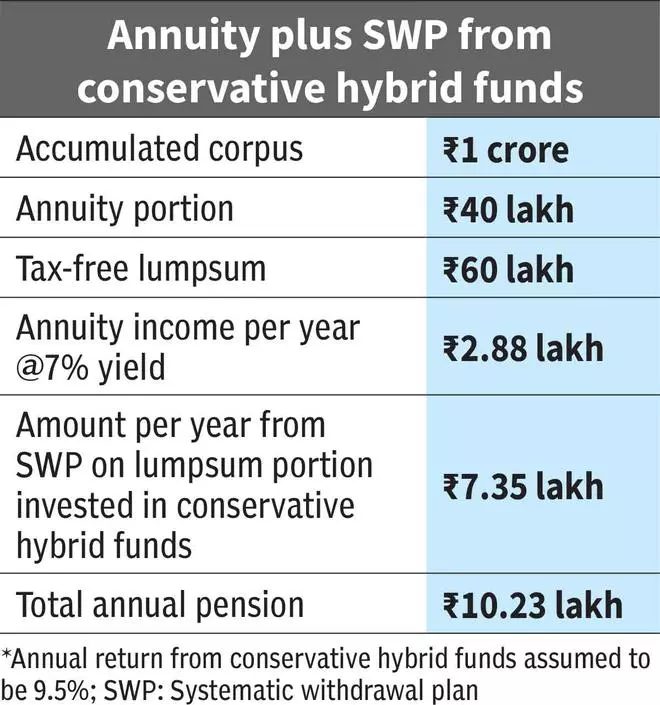

In such a scenario, conservative hybrid funds are ideal for deploying the 60 per cent lump sum. Why conservative hybrid funds?

This category of mutual funds deploys only 10-25 per cent of their corpus in equities and investments are usually in large-cap names. The remaining portion is invested in fixed income instruments such as bonds and debentures with high credit rating.

Conservative hybrid funds that you purchase now will be treated as debt schemes for tax purposes and all the gains (short- and long-term) are taxed at your slab.

Since the Budget has allowed up to ₹12 lakh as tax-free income, you can generate regular income via systematic withdrawal plans (SWPs) from these funds. Thus, for SWP amounts of up to ₹12 lakh, you will pay no tax.

Other hybrid categories such as balanced advantage or multi-asset are usually equity oriented and gains are taxed separately at different rates and not added to regular income for taxation purposes.

On a one-year and three-year rolling returns basis over the past 10 years, quality conservative hybrid funds have generated 9.5-10.5 per cent returns per annum comfortably.

In the above example, if the ₹60-lakh lump-sum is deployed in a conservative hybrid fund that generates even 9.5 per cent, you will be able to generate close to ₹61,250 every month or ₹7.35 lakh annually for a period of 15 years. This is almost as much as the entire ₹1 crore earned in the previous example. So, the ₹2.88-lakh additional annuity income in this case can be kept for future use by investing in deposits.

Parag Parikh Conservative Hybrid, ICICI Prudential Regular Savings, SBI Conservative Hybrid, Kotak Debt Hybrid and HDFC Hybrid Debt are good fund options to consider for your SWP.

Taking the SLW option

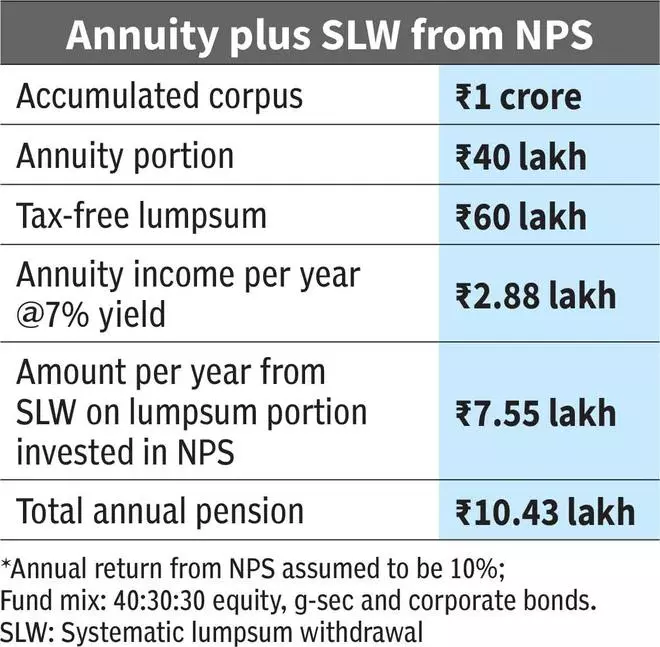

The NPS also gives an interesting SLW option. This is applicable only to the 60 per cent tax-free portion of your total corpus.

Now, in case you do not want to take the lump-sum in one go, especially if you are unsure where to deploy it or if the returns elsewhere aren’t satisfactory, you can withdraw in phases periodically (monthly etc.) even as the corpus continues to earn returns.

In a total of ₹1-crore corpus, only ₹60 lakh can be used for exercising the SLW option.

NPS tier-1 funds have done well over the years. Their equity funds (E) invest only in the Sensex, Nifty 50 and Nifty 100 baskets. The debt portion is deployed in government securities and high-rated corporate bonds, so credit risk is minimal.

In the last 10-plus years, whether we take XIRR or point-to-point returns, many of the funds have given 12 per cent annual returns (for a 50:50 equity-debt mix) comfortably. For the sake of reducing risk in the case of retirees, if we bring down the equity part to 40 per cent and the debt to 60 per cent, around 11-11.5 per cent returns were generated by funds.

Conservatively, if we assume even 10 per cent annual returns, taking the SLW route would give you ₹62,903 a month as income or ₹7.55 lakh annually for a period of 15 years, before exhausting your corpus. If your returns are higher, you could even be left with a surplus at the end of 15 years after your regular SLW plan comes to an end.

During the SLW phase, you can change your investment mix or the fund manager itself.

So, you can increase the debt component (G-Sec, corporate bonds) and reduce the equity portion, or vice-versa if you have an appetite for risk and also have alternative income sources.

ICICI Prudential and HDFC have been among the best NPS fund managers over the years.

You can change the frequency of payment and also decide to terminate the SLW plan if you want.

Deferment and continuation

Some subscribers of NPS may choose to work as consultants or take up part-time work for a few years even after retirement at 60. They would be receiving a regular income and may therefore not need the NPS pay-outs.

A few others may have a large interest income via deposits that could easily last for several years into their retirement.

From another perspective, since we are at the start of a declining interest rate cycle, annuity yields may trend down over the next couple of years. Either you may want to lock into current yields, or wait for the next rising interest rate cycle for better annuity returns.

For such subscribers, there are two options – deferment and continuation of the NPS corpus.

Three types of deferment can be opted for.

First is deferring the annuity portion, but withdrawing the lumpsum part. However, the annuity portion can be deferred only for three years – till you turn 63. At 63, you will be expected to buy an immediate annuity product.

Second, you could take the annuity part immediately, but defer the lumpsum portion.

The third option is the deferment of both annuity and the lumpsum portion.

You will not be able to make any fresh investments in any of the deferment options.

The continuation option involves continuing both the annuity and lump-sum portions. If you take this option, you will have to make fresh investments of at least ₹1,000 yearly to keep your account active.

When we consider the deferment options, you could get substantially higher incomes by pushing withdrawals just a few years down the line.

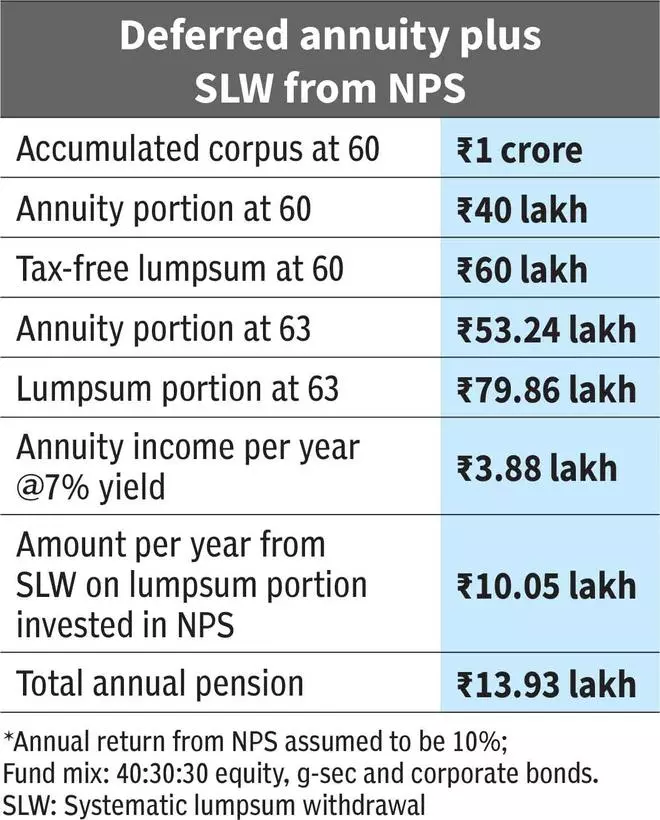

We discuss the deferment option with an example where the annuity portion is withdrawn after three years and an SLW is done with the lump-sum portion.

If the NPS corpus was ₹1 crore at 60, assuming 10 per cent returns, the accumulated amount in the annuity portion (40 per cent) would be ₹53.24 lakh at 63. The lump-sum portion would have grown from ₹60 lakh to ₹79.86 lakh.

At 63, you would be able to get ₹3.88 lakh as annuity amount annually from insurers — a good ₹1 lakh more than what you would have got at 60. And the SLW portion would enable you to withdraw ₹10.05 lakh a year till you turn 75, a good ₹2.5 lakh more than the income possible three years ago.

In all, you would be making ₹13.93 lakh, or ₹3.5 lakh more than what you would get by starting your annuities and SLWs at 60.

Weigh each option according to your life situation using the above guidelines. For retirees, beating inflation, keeping risks low and earning a reasonable income are the three most critical factors.