In January 2024, we recommended investors subscribe to the IPO of Medi Assist, which is the country’s largest TPA (Third party administrator) provider. In the ensuing period, the stock has given flattish returns after declining nearly 30 per cent from its peak in September 2024. We now recommend investors accumulate the stock on dips. The company’s progress in industry consolidation and technology tailwinds are supporting the strong growth outlook for the company. But the volatile macro environment may present further buying opportunities till calmer ‘trade winds’ prevail. The stock trades at 34 times its one-year forward earnings, which is a minor discount to its average.

Consolidation spree

Medi Assist has shown a degree of success in acquisition and integration. The TPA industry is fragmented. At the time of IPO, there were 16 TPAs vying for market share and only half of the premiums under management (PUM) were available for TPA with the rest administered inhouse by insurance companies. Considering that TPAs are administrators that benefit from scaled operations, consolidation was bound to happen. Some of its major acquisitions include Raksha and Medvantage in 2023, and Mayfair in 2022. These entities are fully integrated and have not diluted the margins. When fully-scaled operations resume at the acquired entities, the margins should bounce back.

Medi Assist has also agreed to acquire Paramount TPA and the acquisition is under the regulatory review process. The ₹312-crore acquisition should further enhance the scale of operations. This acquisition is expected to be reflected in the consolidated accounts shortly. On a proforma basis, Paramount’s revenues are at ₹153 crore in FY24 is 25 per cent of Medi Assist’s revenues. Paramounts EBITDA margins at 9 per cent in FY24 compared to 22 per cent at Medi Assist presents a strong case for expansion going by Medi Assist’s track record with other acquisitions in the past.

Technology tailwinds

TPA services can be done in-house too. While group policies, which are low-margin products, are largely outsourced (close to 70-75 per cent outsourced), retail health policies which are high-margin and have a lower frequency of claims are largely serviced inhouse (30-35 per cent outsourced).

The recent burst in high-tech driven data-handling capabilities (read AI or ML) supports outsourcing of TPA services. TPAs act as the facilitator between three parties – policyholder getting the benefits, insurer providing the payment and the hospitals providing the services. Primarily, TPAs prove their worth by reducing frauds and turnaround time and controlling medical inflation. Data, which is the crucial differentiator in all learning based technology models, are more likely to congregate at TPAs rather than individual insurance companies or even smaller TPAs. The network effect of being the largest should support Medi Assist in cementing its place.

There is also the regulatory push in the form of faster insurance processing at the time of discharge. This should also favour adoption of external TPAs, which have built relations with network hospitals. Medi Assist also engages in AI-based prediction for a cashless and quick discharge. Medical inflation hovers around 14-15 per cent in India. Medi Assist has reiterated its ability to reign it at 4-5 per cent from the time of its IPO to now.

Financials, valuation

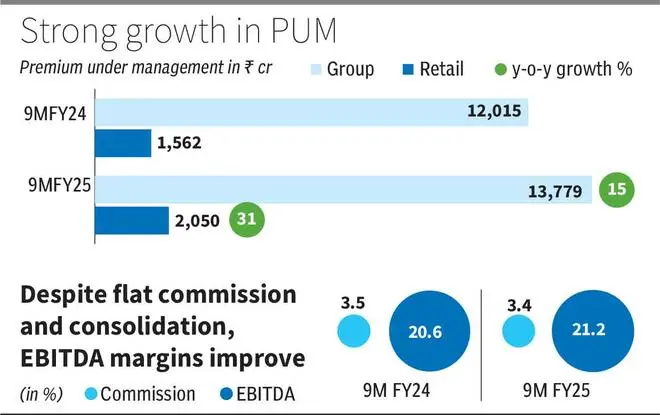

The PUM has grown 17 per cent year on year in 9MFY25. This includes Raksha and Medvantage consolidation and will be further boosted by Paramount acquisition, which is soon expected. The company insists on organic growth complementing inorganic growth; the industry, being fragmented, provides scope for inorganic route and the increasing scope for TPA services provides scope for organic growth. The growth of the insurance industry, which is the end- user, is also facing decent growth prospects of low double-digit growth.

In 9MFY25, the commission that the company charges has stayed flat at 3.4 per cent compared with last year. As the scale of business grows, Medi Assist can trade off lower commission charges for higher volumes. The overall revenue growth was at 14 per cent year on year in 9MFY25.

Despite consolidation and synergy yet to be fully reflected, the EBITDA margins in 9MFY25 at 21.2 per cent have expanded 60 bps from last year. The company can target an organic EBITDA margin range of 23-24 per cent on a higher base as synergies from acquisitions play out.

The company is trading at 34 times one-year forward earnings, which is a 12 per cent discount to last one-year average. The stock has corrected 30 per cent from peak reached in September 2024 owing to wider market correction. The long-term scope of TPAs, the leading presence of Medi Assist in the industry, the scope for further inorganic growth all support accumulating the stock on dips. The impending Paramount consolidation will also support the stock in the short term. The company has a net cash of ₹266 crore on December 31, 2024. This healthy balance sheet should enable the company to pursue meaningful consolidation as well.

Published on April 5, 2025