In an environment where many export-oriented segments are facing the heat due to uncertain global economic growth scenarios, US trade tariffs and central bank actions, some domestic sectors are doing well with healthy cashflow visibility.

The leasing of domestic offices and hospitality spaces is witnessing robust traction in key metropolitan markets such as Bengaluru, Mumbai and a few other cities.

As a key player in commercial leasing space, Embassy Office Parks REIT (Real Estate Investment Trust) has benefitted from the heightened traction in GCCs (global capability centres) and technology offices in the last few years. It is among the top REITs in the country.

A diversified client base, strong occupancies in its office portfolio, ability to steadily increase rentals during lease renewals and a strong pipeline of commercial leases with occupants already booked are positives for the REIT.

At ₹366, the Embassy Office Parks REIT trades at 0.88 times its September 2024 NAV (net asset value). The dividend per unit of ₹22.75 (expected in FY25) gives a dividend yield of over 6.2 per cent. It has already distributed ₹17.33 for 9MFY25. Given the prospect of double-digit (early to mid-teen percentage) growth in payouts for the next couple of years, the dividend yield for FY26 is likely to be close to 7 per cent. And almost 90 per cent of this payout is tax efficient. The yield is higher than the 10-year G-Sec yield and, as mentioned earlier, suffers very low taxes as payouts are of the nature of dividend and debt repayments.

The prospect of robust dividend yield and the scope for capital appreciation, given that the REIT trades below the NAV, make it an attractive investment prospect for investors.

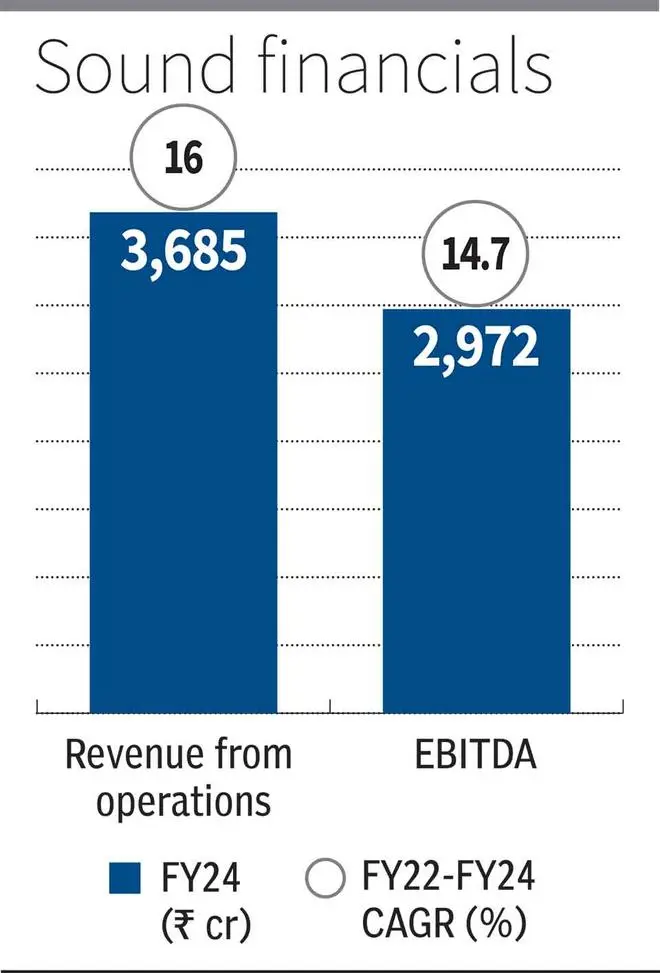

Over the FY21-24 period, the REIT’s net revenue from operations grew at a CAGR of 16 per cent to ₹3,685.2 crore, while its EBITDA grew at 14.7 per cent over the same period to ₹2,972.4 crore. In 9MFY25, the REITs net revenue grew 7.8 per cent year on year to ₹2,943 crore, while EBITDA rose 6 per cent to ₹2,346 crore.

Leasing power

Embassy Office Parks REIT has a portfolio of 51.1 million sq ft in commercial space. It has 14 office spaces from which it derives rents from 263 companies, including many from the Fortune 500 list. About 38.9 million sq ft of Grade-A office assets are complete and another 12.2 million sq ft are under development. Some of the top occupants of Embassy’s office spaces include IBM, JP Morgan, ANSR, WeWork, ANZ, Google, Eli Lilly, AstraZeneca, Volvo, CISCO, Fidelity and Google, among many others.

As of December 2024, about 29 per cent of occupants are from technology sector, 25 per cent from financial services, 9 per cent from research, consulting and analytics, and 7 per cent each from healthcare and co-working segments. Retail and telecom are some of the other sectors from which occupants lease office space from Embassy.

The client mix is thus well-diversified and caters to a wide range of industries. Importantly, the fast-growing GCCs and technology clients make up more than 70 per cent of the total occupant base.

Bengaluru is the leading market for Embassy with 75 per cent of the REIT’s total gross asset value (GAV) coming from the city. And for good reason.

According to a report from CBRE, in CY24, among the top 7 cities in terms of office absorption (74.4 million sq ft in all), Bengaluru leads others with a 29 per cent share. Sustained demand from GCCs and steady rental increases are key reasons.

Office spaces in Bengaluru (91 per cent), Mumbai (100 per cent) and Noida (78 per cent) have seen occupancies rise 3-6 percentage points for the REIT in December 2024, compared to the same period in the previous year.

Embassy’s overall occupancy by GAV was at 87 per cent in December 2024, up from 84 per cent in the previous year. By leased area, the overall occupancy is 90 per cent, up from 86 per cent in December 2023. The occupancy rates are among the best in the industry and quite healthy.

Rental growth is also healthy for Embassy Office Parks REIT. For FY25, the REIT has derived a 13 per cent contracted increase in rentals for 7 million sq ft. The same rise is expected in FY26 as well for 7.8 million sq ft.

The pipeline for leases also looks robust. In FY26, there are office spaces of area 4.6 million sq ft scheduled for development and 68 per cent of that is already pre-leased to clients. In some cases, 100 per cent is pre-leased already.

Overall, the REIT would suit those looking for fixed income returns or a bit more, without undue volatility.