I have bought one lot of Adani Enterprises 2400-strike call for ₹57.25. What is the outlook for this?

Anish Das

Adani Enterprises (₹2,152.65): The stock has been in a bearish trend since June last year. The attempts to recover over the last few months failed as the 20 and 50-day moving averages acted as resistance, preventing a rally beyond these averages.

With this background, the stock was largely charting a sideways trend since early February. But this sideways movement took the stock back to the 20 and 50-DMAs, which have again triggered a fall.

The stock saw a considerable sell-off over the last couple of sessions, which has dragged it below a support at ₹2,250. This has opened the door for another leg of decline. While the nearest support is at ₹2,000, given the current momentum, the downtrend might go well beyond this level.

Even if there is a recovery from ₹2,000, the stock surpassing your strike price of ₹2,400 is highly unlikely. Hence, given the current chart set-up, we suggest exiting the call option long.

As the trend is bearish, you may consider buying puts. If you decide to do so, our recommendation would be to buy a March expiry contract.

I am holding February 27 expiry Nifty Bank call option. Should I hold the same or should I book loss as I am facing 300 points loss?

Avinash

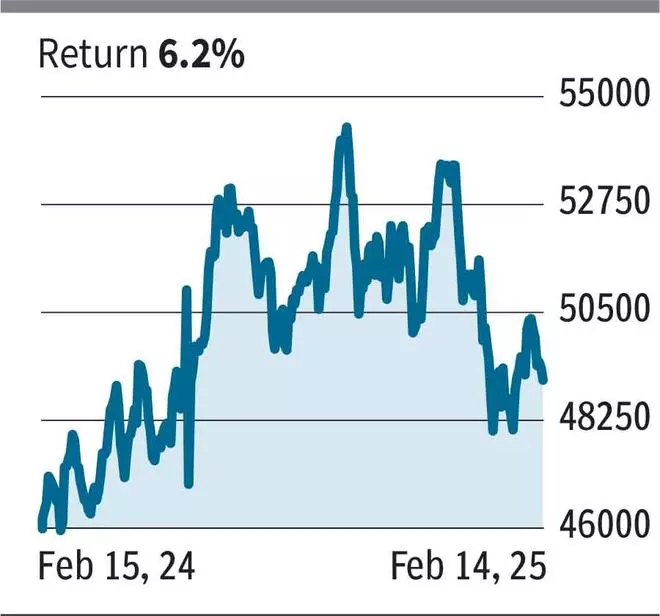

Nifty Bank (49,099): The index, which confirmed a double bottom chart pattern in the first week of this month, could not extend the rally and depreciated. Although there is a support at 48,800; it should rally past 50,000 to turn the outlook bullish.

Refer to the F&O Tracker section for more analysis on Nifty Bank futures and options.

Simply put, the prevailing price action does not provide a definite direction on the next trend. Hence, you may exit the call option for now. From next time on, please provide us details like strike price and purchase price.

Send your queries to derivatives@thehindu.co.in