It might not be always possible for every lender to comprehensively evaluate the creditworthiness of a borrower. This is where credit rating agencies come in, employed to assign a credit rating. Though not a substitute for the lender’s own credit assessment, it is a credible document offering insights into the borrower’s financial strength. This is typically an annual exercise required to be carried out by companies with external borrowings, per the covenants agreed upon by the borrower and the lender.

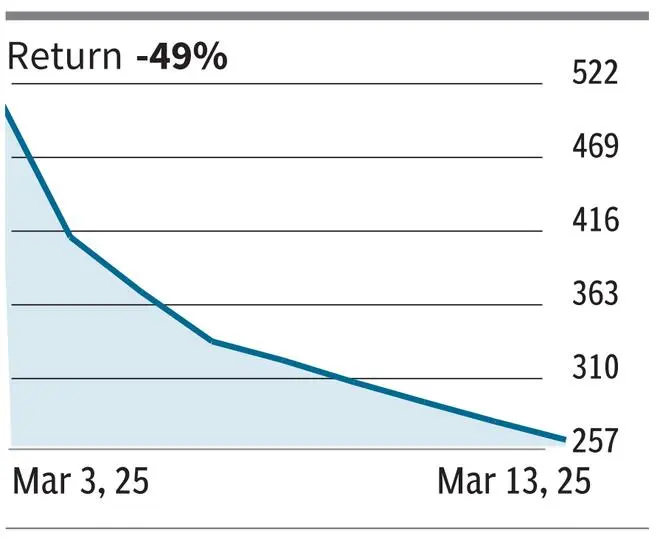

And it is this credit rating exercise that has sent the stock of Gensol Engineering (GEL) crashing by nearly 50 per cent in just 10 days!

The dreaded credit report

A solar EPC player turned EV lessor and manufacturer, GEL had a stellar story, coming up with its SME IPO in 2019 and later migrating to the mainboard in 2023.

The company’s revenue, EBITDA and PAT in FY24 are up 6x, 12x and 5x from that of FY22 and 9M FY25 performance has already beaten FY24 numbers. With an orderbook of around ₹7,000 crore and 8,300+ EVs leased as of December 2024, up 3x and 1.4x since March 2024 respectively, GEL seemed set for strong growth.

On March 4, 2025, GEL filed, with the stock exchanges, credit rating reports of the company, as assessed by CARE Ratings and ICRA, both downgrading the credit rating of the company to D from BB and BBB respectively. For better comprehension, a BB and BBB rating, per definition, means a moderate risk of default and a moderate degree of safety regarding timely servicing of financial obligations respectively, while a D rating is assigned to securities in default or expected to be in default soon.

The company’s stock understandably crashed 20 per cent the same day. The stock has corrected 49 per cent since March 4 and the week gone by saw it hit lower circuit every day. It is fair to say that the correction is still underway.

A key claim by ICRA in its credit report on the company is that certain documents shared by GEL with ICRA, on its debt servicing track record, were apparently falsified. Apart from concerns on its liquidity position, such a claim raises serious questions on the company’s corporate governance.

The company has been firefighting for the past week with a series of damage limitation measures.

On March 10, promoters converted existing warrants held into equity shares at a price of ₹871 per share, totaling to an equity infusion of around ₹29 crore. And on March 13, the company’s board approved fund-raising initiatives to the tune of around ₹600 crore, along with divestment plans to ease liquidity concerns. But the damage is done and it will be challenging to gain back investor confidence from here.

Soft signals

While such deterioration in liquidity is not sudden, let’s do a post-mortem of key soft signals, which now clearly seem like red flags, with the benefit of hindsight.

One, the company has been generating negative free cash flows for the past three FYs and operating cashflow has been negative in two out of the three. This coupled with a debt-equity ratio of 2.1 times as of September 2024 (down from 4.6 as of March 2024) is very often dangerous.

Two, promoter share pledge kept inching up and was at 85.5 per cent as of February 2025, up from 81.7 per cent in December 2024, which is quite risky and increases the probability of margin call. And simultaneously, the promoter holdings have also been dropping consistently since 71.2 per cent in March 2022 to 62.1 per cent as of February 19, 2025.

Three, the resignation of the CFO on March 6, just after the credit rating fiasco, citing the typical ‘personal reasons’ defence doesn’t help GEL’s case either. And the resignation of an independent director also followed, on March 13.

GEL has hit a trough, with both its liquidity position and investor confidence in tatters.

Incidents such as these teach one to stay grounded with basic checks on the state of leverage, free cashflow generated and corporate governance, and not just be carried away with the growth numbers reported and projected. So, as always investors beware.